Fintel reports that on October 15, 2024, Phillip Securities upgraded their outlook for Wells Fargo (WBAG:WFC) from Neutral to Accumulate.

Fund Sentiment Overview

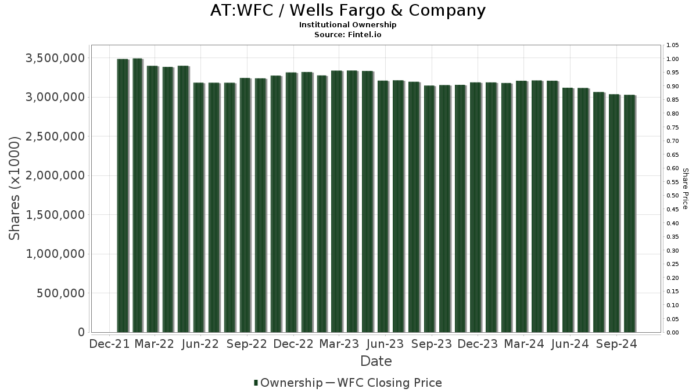

As of now, 3,405 funds or institutions report having stakes in Wells Fargo, reflecting an increase of 65 owners or 1.95% from the last quarter. The average portfolio weight dedicated to WFC has risen to 0.64%, marking a 5.57% increase. Over the past three months, total shares held by institutions decreased by 1.48%, totaling 3,028,868K shares.

JPMorgan Chase currently holds 115,540K shares, which represents a 3.45% ownership stake in Wells Fargo. This marks an increase from 113,849K shares in its previous filing, indicating a 1.46% rise in ownership. The firm has also boosted its portfolio allocation in WFC by 0.99% over the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) holds 110,073K shares, representing 3.29% ownership. This is a decrease from its previous stake of 112,415K shares, a 2.13% drop, as their WFC portfolio allocation fell by 2.43% in the last quarter.

Dodge & Cox has reduced its stake to 92,277K shares, translating to 2.76% ownership. Their prior holding of 115,176K shares shows a substantial decrease of 24.81%, with a 15.07% reduction in their WFC allocation over the past quarter.

The Vanguard 500 Index Fund (VFINX) currently holds 89,478K shares, or 2.67% ownership, down from 90,694K shares, reflecting a 1.36% loss. Their portfolio weight in WFC has dropped by 4.30% over the last quarter.

Wellington Management Group LLP has increased its holdings to 71,837K shares, accounting for 2.15% ownership, up from 60,176K shares previously, indicating a significant 16.23% boost. However, they decreased their allocation in WFC by a noteworthy 82.63% during the last quarter.

Fintel serves as a comprehensive investing research platform for individual investors, traders, financial advisors, and smaller hedge funds. Their data encompasses global fundamentals, analyst insights, ownership statistics, fund sentiment, insider trading, options flow, and more. Fintel’s unique stock selections are based on advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.