Bank of America Receives Optimistic Shift in Outlook from Phillip Securities

Fintel has reported that on October 18, 2024, Phillip Securities upgraded their outlook for Bank of America (NYSE:BAC) from Neutral to Accumulate.

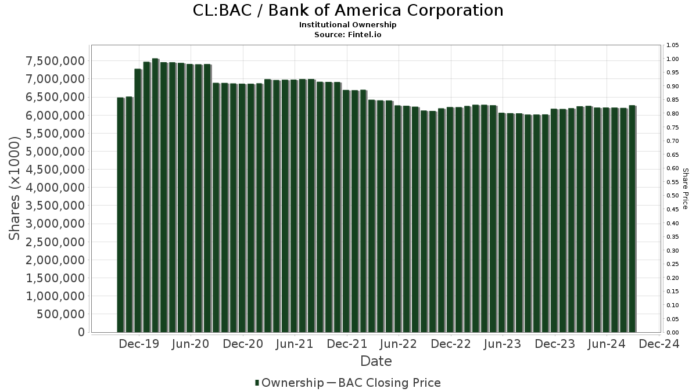

Understanding Fund Sentiment Towards BAC

Currently, 4,235 funds and institutions have reported their positions in Bank of America. This reflects an increase of 45 owners, or 1.07%, over the last quarter. The average portfolio weight dedicated to BAC by all funds has risen to 0.67%, which is up 2.51%. In total, institutional ownership has grown by 2.94% over the last three months, now amounting to 6,280,126K shares.

Berkshire Hathaway holds 1,032,852K shares, representing 13.43% ownership of Bank of America, with no change over the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) currently owns 209,897K shares, which is 2.73% of the company. This shows a slight drop from the previous quarter when they reported owning 210,263K shares, a decrease of 0.17%. However, they increased their allocation to BAC by 1.81% this past quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) holds 174,622K shares, constituting 2.27% ownership. They reported owning 173,507K shares previously, leading to a 0.64% increase. Their portfolio allocation in BAC, however, experienced a slight decrease of 0.08%.

JPMorgan Chase has increased its stake to 147,816K shares, or 1.92% ownership, from 146,885K shares, marking an increase of 0.63%. They, too, have raised their portfolio allocation in BAC by 2.49% over the last quarter.

Geode Capital Management also reported an increase, now holding 138,556K shares, which represents 1.80% ownership. This is up from 137,026K shares, a rise of 1.10%, while their portfolio allocation in BAC increased by 0.63%.

Fintel offers one of the most thorough investing research platforms available for individual investors, traders, financial advisors, and small hedge funds.

Our data encompasses a global range and includes fundamentals, analyst reports, ownership information, fund sentiment, insider trading, options flow, and more. Unique stock picks are generated using advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This article originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.