On October 18, 2024, Phillip Securities upgraded their outlook for Bank of America Corporation – Preferred Security (NYSE:BAC.PRQ) from Neutral to Accumulate.

Current Fund Sentiment

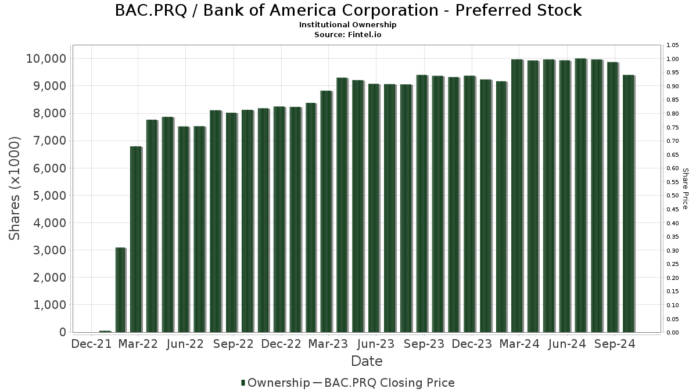

There are currently 28 funds or institutions holding positions in Bank of America Corporation – Preferred Security. This represents a decline of 3 owners, or 9.68%, compared to the previous quarter. The average portfolio weight dedicated to BAC.PRQ among these funds is 0.39%, which shows an increase of 13.33%. Over the last three months, the total shares owned by institutions decreased by 6.02%, totaling 9,405K shares.

PFF – iShares Preferred and Income Securities ETF holds 2,508K shares, down from 2,588K shares, indicating a decrease of 3.18%. Additionally, the firm reduced its portfolio allocation in BAC.PRQ by 4.78% last quarter.

PGX – Invesco Preferred ETF has 2,147K shares, which is a drop from 2,167K shares, marking a decrease of 0.91%. The portfolio allocation in BAC.PRQ was also cut by 1.81% over the same period.

CPXAX – Cohen & Steers Preferred Securities & Income Fund, Inc. maintains 1,647K shares, with no change noted in the last quarter.

PFFD – Global X U.S. Preferred ETF holds 900K shares, down from 925K shares, or a decrease of 2.89%. Their portfolio allocation in BAC.PRQ also fell by 3.65% last quarter.

FSDIX – Fidelity Strategic Dividend & Income Fund remains steady with 665K shares, showing no change in their holdings.

Fintel is a leading platform for investment research, catering to individual investors, traders, financial advisors, and small hedge funds.

Their extensive data encompasses fundamentals, analyst reports, ownership data, fund sentiment, insider trading, and more, all aimed at improving investment profits through advanced quantitative models.

Click to Learn More

This story initially appeared on Fintel.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views of Nasdaq, Inc.