Pinterest Faces Challenges Despite Impressive Growth Figures

Pinterest (NYSE: PINS) has experienced significant volatility, seeing a 23% increase in stock value over the past year, but it remains 30% below its previous high for the year. Although Pinterest has reported strong operational and financial performance, investor confidence appears to be wavering regarding its ability to maintain this growth.

This article will explore the factors affecting Pinterest’s future and assess where its stock might stand in a year.

Strong Financials Underpinning Pinterest’s Growth

Pinterest currently boasts 522 million monthly active users (MAUs), solidifying its presence as a top platform for brands and creators to share visual content. The site’s model, which encourages users to “pin” and share ideas, has found strong appeal particularly among women and younger audiences. Advertising remains the core of Pinterest’s business, leveraging diverse visual formats to help brands boost visibility and sales.

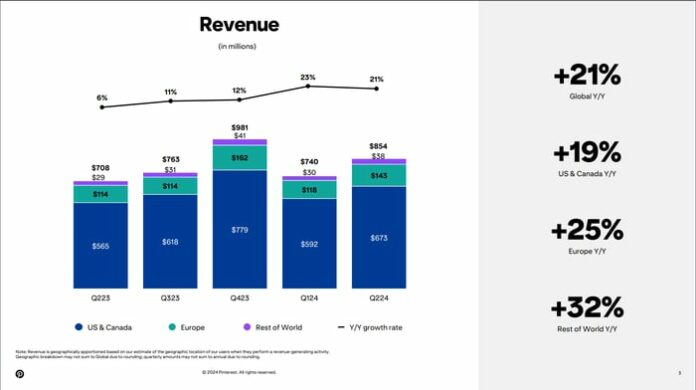

During its second quarter, which ended on June 30, Pinterest saw revenue surge by 21% compared to the previous year. This growth was paired with a 12% increase in global MAUs and an 8% rise in its average revenue per user (ARPU). The company attributes these positive results to its investments in artificial intelligence (AI), which have improved ad-targeting and user engagement. The adjusted earnings per share (EPS) rose a notable 38% to $0.29 from the same quarter last year.

While 2023 has started positively for Pinterest, concerns about softer company guidance may explain recent declines in stock prices. Ahead of the upcoming third-quarter earnings report, expected to be released on November 7, management has forecasted annual revenue growth of 16% to 18%. This outlook has underwhelmed investors, as market projections had anticipated growth above 18%.

Even though the market is on the lookout for signs of acceleration, this minor adjustment in the growth forecast does not overshadow what remains an impressive growth narrative.

International Expansion: A Key Opportunity for Pinterest

Pinterest’s appeal as an investment lies in its unique social media model, which continues to resonate with an expanding audience. Notably, the company has made significant strides internationally, where it is seeing its highest growth in both users and revenue. Currently, 81% of Pinterest’s MAUs come from outside the United States and Canada, yet this segment only accounts for 21% of the total revenue.

To put this into perspective, Pinterest generates $6.85 in ARPU from users in the U.S. and Canada, whereas Europe contributes only $1.03 per user, and ARPU drops to just $0.13 for the rest of the world. This disparity underscores the substantial opportunity for Pinterest to enhance monetization and continue its long-term growth.

source: Pinterest

Collaborations with major companies like Amazon, which allows users to shop directly from Pinterest ads, and integration with Alphabet‘s Google ads manager, are in early stages of extending the brand’s global footprint.

Analysts forecast that Pinterest will achieve $3.6 billion in revenue this year, marking a 19% increase from 2023, while EPS is estimated to reach $1.46, a 34% rise. Projections for 2025 suggest a continued positive trajectory, with expected revenue growth of 17% and a 22% increase in EPS next year.

Currently, shares seem undervalued following a steep decline from highs earlier this year. The stock is trading at a forward price-to-earnings ratio of 22, significantly lower than the peak ratio of over 30 in June. This valuation appears more favorable for investors looking to hold for the long term, with a projected one-year forward P/E ratio of 18.

PINS PE Ratio (Forward) data by YCharts

Forecast for Pinterest’s Stock

I assign a buy rating to Pinterest, believing there is a good chance that the stock price will increase over the next year. If the company’s international strategy continues to gain traction in the coming quarters, this could lead to earnings exceeding expectations and potentially push share prices higher. Pinterest can be a valuable component of a diversified investment portfolio.

Is Now a Good Time to Invest $1,000 in Pinterest?

Before deciding to buy Pinterest stock, consider this:

The Motley Fool Stock Advisor analyst team has highlighted what they believe are the 10 best stocks to invest in right now… and Pinterest did not make the list. The stocks recommended have the potential for significant returns in the future.

Take, for example, when Nvidia was recommended on April 15, 2005… if you invested $1,000 at that time, you’d have $867,372!*

Stock Advisor provides investors with a clear strategy for success, featuring guidance on portfolio building, regular analyst updates, and fresh stock picks each month. Since 2002, the Stock Advisor service has achieved more than quadrupled the return of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of October 21, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, and Pinterest. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.