NASDAQ Soars as ‘Magnificent 7’ Mega-Cap Tech Stocks Lead the Charge

Strong Performance for Amazon and Alphabet Supported by AI Innovations

The NASDAQ index has surged 24% year-to-date, nearing record highs after a summer slowdown. This recent rally has been significantly fueled by the ‘Magnificent 7’—a group of mega-cap tech stocks that have reached impressive valuations in recent years.

The ‘Magnificent 7’ comprises the six largest companies on Wall Street: Apple, Nvidia, Microsoft, Alphabet, Amazon, and Meta, along with Tesla, led by Elon Musk. Collectively, they have been at the forefront of innovation, particularly in the rapidly evolving AI sector.

Analyst Jeffrey Wlodarczak from Pivotal Research has analyzed the ‘Magnificent 7’ and is now providing updated insights on two key players: Amazon (NASDAQ:AMZN) and Alphabet (NASDAQ:GOOGL). Below, we explore why these companies stand out according to Wlodarczak.

Amazon: A Resilient E-Commerce Leader

Let’s first consider Amazon, a dominant force in online retail. The company started as an online bookstore and has transformed significantly, now offering everything from toys to pharmaceuticals. Amazon has navigated challenges since the tech bubble burst in the early 2000s, emerging as one of the world’s largest publicly traded firms.

Its extensive inventory is complemented by a sophisticated network of technologically advanced warehouses. Utilizing AI and robotic technology, Amazon efficiently fulfills orders globally, bolstering its position as the leading e-commerce platform with a nearly $2 trillion market cap—making it the fifth-largest public company worldwide.

Recently, Amazon has launched a ‘digital pharmacy’ service, enabling customers to order prescriptions online with licensed pharmacists. In addition, the company plans to open 20 new pharmacies, effectively doubling the cities with same-day delivery options.

On the services side, Amazon Web Services (AWS) has gained traction. Competing with Google Cloud and Microsoft’s Azure, AWS generated $26.3 billion of the company’s $148 billion total revenue for Q2 this year, accounting for almost 18% of the overall revenue and contributing to a 10% year-over-year growth.

Wlodarczak emphasizes Amazon’s strengths, noting its significant growth potential, driven largely by AWS and continued expansion in e-commerce and advertising. He believes that the company can potentially increase its revenue from AWS from 17% to about 35% over the next five years.

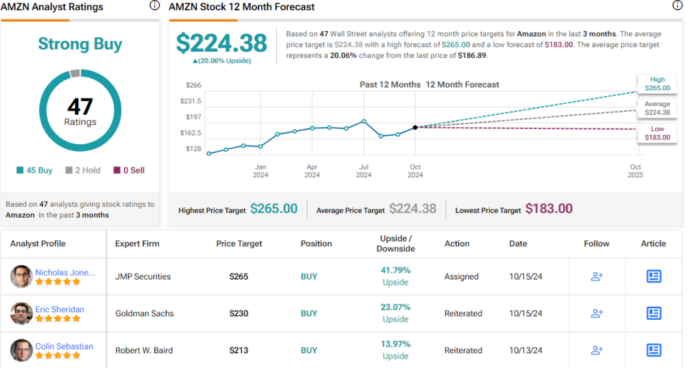

Regarding Amazon stock, Wlodarczak has a Buy rating, with a price target of $260. This suggests a possible upside of 39% in the next year. A strong consensus from analysts shows 45 buys and only 2 holds, with an average price target of $224.38, indicating a 20% upside from the current trading price of $186.89.

Alphabet: Dominance and Adaptation in the New AI Era

Next on our list is Alphabet, the parent company of Google, holding a market cap just over $2 trillion as the fourth-largest public company. Alphabet’s success relies on its leading position in global internet search and digital advertising through platforms like Google and YouTube.

The surge in AI technology has reshaped the tech landscape and Alphabet is actively integrating this technology to enhance its services. Its Gemini platform represents the company’s latest innovation, designed to process natural language across various media, offering a competitive edge against rivals such as Microsoft and emerging generative AI platforms.

Financially, Alphabet has also demonstrated strong performance, with revenues totaling $84.7 billion in Q2 2024—an increase of nearly 14% year-over-year and surpassing analysts’ expectations by more than $445 million. The company recorded a profit of $1.89 per share during this quarter.

Like Amazon, Alphabet benefits from continuous growth in a rapidly changing digital landscape, positioning itself for success as it navigates the challenges presented by AI advancements.

Analyst Predicts Strong Future for Alphabet Amid Promising Market Conditions

Revenues Set to Exceed Expectations This Quarter

Alphabet Inc. (GOOGL) is expected to report revenues of $86.23 billion for the third quarter, surpassing previous estimates by 5 cents per share. Analysts remain optimistic as the company continues to strengthen its position in the tech industry.

Strong Competitive Edge Backed by AI Investments

According to Pivotal analyst, Wlodarczak, Alphabet has a strong competitive edge due to its substantial share in the search engine market—approximately 90% outside of China. He emphasized, “If the status quo holds, GOOG appears to be in a very strong competitive position with a deep moat around their dominant core search business model.” Furthermore, he pointed out the potential of Alphabet’s global device presence to advance their consumer AI assistant capabilities.

The analyst also noted Alphabet’s solid standing in cloud computing as the third-largest player. Wlodarczak believes this area has significant growth potential, which can be enhanced by the company’s investments in AI. He explained that with strategic adjustments, Alphabet could lower its cost structure significantly, potentially streamlining its workforce of around 180,000 employees.

Positive Stock Forecasts Amid Analyst Support

Wlodarczak recommends GOOGL shares as a Buy, with a price target set at $215, indicating a potential upside of 30% over the next year. The general sentiment on Wall Street mirrors this optimism, showing a Strong Buy consensus. Out of 39 recent reviews, there were 30 Buys versus 9 Holds. Current shares are priced at $165.16, accompanied by an average target price of $201.57—suggesting a healthy gain of 22% in the coming year.

Disclaimer: The opinions expressed in this article belong to the analysts cited and are for informational purposes only. It is essential to conduct your own research before investing.

The views expressed here are that of the author and do not necessarily represent those of Nasdaq, Inc.