The property and casualty (P&C) insurance industry has been thriving due to factors like global presence, solid underwriting, and improved pricing. Despite the impact of catastrophe losses, insurers show resilience in the face of challenges.

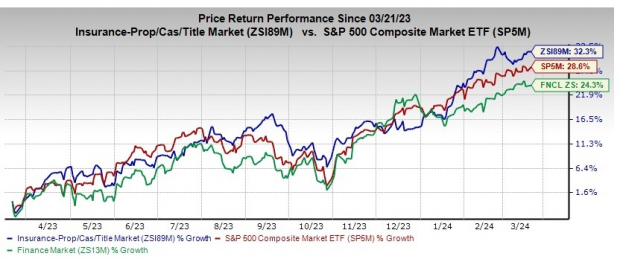

Over the past year, the P&C insurance industry has outperformed both the Zacks S&P 500 Composite and the Finance sector in terms of growth. This success has laid a strong foundation for insurers like Palomar Holdings, Inc. (PLMR) and Axis Capital Holdings Limited (AXS) to shine in the market.

Both companies, with a Zacks Rank #1 (Strong Buy), are making waves in the industry. Palomar Holdings, with a market capitalization of $2 billion, offers specialty property insurance, while Axis Capital, valued at $5.3 billion, provides a range of insurance and reinsurance products globally.

The commercial insurance landscape is evolving, with price hikes and steady growth projected for the future. This growth trajectory is fueled by factors like operational strength, renewal trends, and increasing gross premiums. Despite challenges like high inflation and weather-related losses, the industry is expected to see significant growth in the coming years.

With robust underwriting practices, strategic capital planning, and the ability to weather catastrophic events, P&C insurers remain on a steady course for success.

The Federal Reserve’s interest rate decisions have a direct impact on the insurance industry, fostering a more favorable rate environment for insurers. Additionally, the use of real-time data, automation, and digitization is enhancing operational efficiency and paving the way for growth.

As we delve deeper into the comparison between Palomar Holdings and Axis Capital, various metrics shed light on their positioning in the market.

Price Performance

Palomar Holdings has outshone Axis Capital in terms of stock performance, boasting a significant rise over the past year, signaling investor confidence in the company.

Return on Equity (ROE)

Palomar Holdings’ impressive 19.3% ROE surpasses both Axis Capital and the industry average, reflecting strong financial performance and management efficiency.

Valuation

When it comes to valuation, Axis Capital emerges as the more affordable option compared to Palomar Holdings. However, the P&B ratios reveal interesting insights into their financial standing.

Debt-to-Capital

Palomar Holdings maintains a lower debt-to-capital ratio than Axis Capital, signifying a more conservative approach to leverage and financial risk management.

Growth Projection

The growth projections for both companies highlight Palomar Holdings’ potential for significant increases in earnings compared to Axis Capital.

Combined Ratio

Palomar Holdings’ lower combined ratio indicates strong underwriting discipline and efficiency, setting them apart from Axis Capital in this aspect.

Revenue Estimates

Forecasts for revenue growth position Palomar Holdings ahead of Axis Capital, foreseeing a substantial increase in revenue for the former.

Concluding Thoughts

Considering multiple parameters, Palomar Holdings emerges as the front-runner when compared to Axis Capital in areas such as price, return on equity, leverage, growth potential, combined ratio, and revenue estimates. While Axis Capital may hold an advantage in terms of valuation, Palomar Holdings stands out as a robust choice for investors looking for strong performance and growth prospects in the P&C insurance sector.

The dynamics of the insurance industry, coupled with evolving market trends, set the stage for a compelling journey ahead for insurers like Palomar Holdings and Axis Capital.