The Rise and Decline of Stitch Fix: A Case for Acquisition

As the COVID-19 pandemic transformed our lives, stock markets saw unusual fluctuations as people sought new forms of entertainment. One company that thrived during this time was Stitch Fix (NASDAQ: SFIX). However, after peaking at $106 per share, it now languishes at just $2.74—a decline of 97% from its highs. Here’s an examination of Stitch Fix’s journey and why it may become a target for acquisition.

Charting the Trends

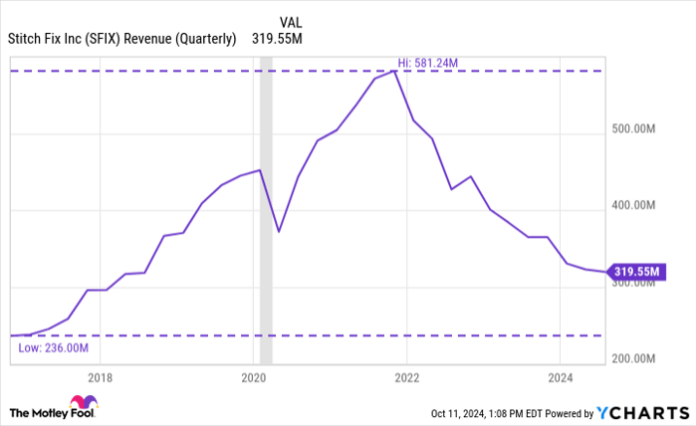

The chart below shows Stitch Fix’s quarterly revenue since becoming a public company. For the first few years, the company enjoyed steady growth, with a significant surge in 2020 aligning with the pandemic.

SFIX Revenue (Quarterly) data by YCharts.

The gray shaded area in the chart represents the brief recession during COVID-19. Initially, revenue dipped but soon rebounded, reaching record highs by the end of 2022. So, what’s caused its subsequent decline?

The Factors Behind the Decline

During the pandemic, Stitch Fix thrived due to its convenience. As physical stores closed, demand for online shopping skyrocketed. However, as life returned to normal, customers reverted to their old shopping behaviors.

Additionally, persistent inflation has pressured consumer spending. With rising costs, many prioritize necessities over discretionary purchases, putting companies like Stitch Fix at risk. This has led to a noticeable drop in their active client base over the years:

| Category | Aug. 1, 2020 | July 31, 2021 | July 30, 2022 | July 29, 2023 | Aug. 3, 2024 |

|---|---|---|---|---|---|

| Active Clients | 3.5 million | 4.2 million | 3.8 million | 3.1 million | 2.5 million |

Data source: Stitch Fix.

Potential Acquisition Candidates

Stitch Fix’s falling customer numbers correlate with declining revenue. A key misstep for management was its choice to heavily invest in artificial intelligence and data science to better understand consumer habits.

Here are two companies that might consider acquiring Stitch Fix:

1. Amazon: Known for its Prime subscription service that offers free shipping and exclusive access to products, Amazon could leverage Stitch Fix’s customer data to enhance its marketplace.

2. Urban Outfitters: With a portfolio that includes several brands focused on trendy apparel, Urban Outfitters could benefit from Stitch Fix. Their existing subscription-based rental service, Nuuly, could integrate well with Stitch Fix’s offerings.

Image source: Getty Images.

The Conclusion

Stitch Fix faces a challenging future. While it continues serving millions and gathers useful data, the company’s management appears unable to navigate the current landscape effectively. I believe a larger company like Amazon could better utilize Stitch Fix’s strengths, or Urban Outfitters could successfully broaden its online reach.

Is Stitch Fix a Worthy Investment Now?

Before investing in Stitch Fix, consider this:

The Motley Fool Stock Advisor recently highlighted their choice of the 10 best stocks to invest in, and Stitch Fix was not included. The listed stocks are projected to yield strong returns in the future.

For instance, investing $1,000 in Nvidia when it was recommended on April 15, 2005, would have grown to an astonishing $826,069!

Stock Advisor offers investors a straightforward strategy for successful investing, including portfolio guidance and bi-monthly stock picks. Historically, it has outperformed the S&P 500 by more than four times since its inception.

View the 10 stocks »

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco holds positions in Amazon. The Motley Fool has investments in and recommends Amazon. The Motley Fool advises against investing in Stitch Fix. The Motley Fool has a disclosure policy.

The views expressed in this article are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.