Understanding Annaly Capital Management: A Complex Investment Choice

Annaly Capital Management (NYSE: NLY) may appear to be a solid dividend stock at first glance, but its performance and strategy tell a different story. As investors evaluate the likelihood of further interest rate cuts by the Federal Reserve, it’s essential to understand what that means for Annaly.

Lower rates could benefit Annaly, particularly for those seeking total returns. However, for investors focused on consistent dividend income, it’s crucial to consider the potential pitfalls of including Annaly in their portfolio.

The Impact of Falling Rates on Annaly Capital

Annaly Capital operates as a mortgage real estate investment trust (REIT), meaning it invests in mortgages aggregated into securities that trade like bonds. The value of these mortgage-backed securities (MBS) can fluctuate with interest rate changes.

Typically, rising interest rates lead to falling bond prices as yields must be adjusted to match market rates. Conversely, when rates drop, bond prices tend to rise for the same reason.

Image source: Getty Images.

Factors beyond interest rates also affect MBS, such as the overall health of the housing market. A robust housing market can boost the availability of new mortgages, while a stagnant one may limit bond supply.

Additionally, as interest rates decrease, homeowners may refinance their mortgages, which can alter the pool of available bonds and impact the pricing of individual MBS. This complex environment can make it challenging for individual investors to monitor Annaly effectively.

Overall, lower rates are likely to benefit Annaly. Should these rate drops stimulate new housing demand, banks could return to the mortgage market, enhancing the potential for increased bond prices in Annaly’s portfolio.

Why Dividend Seekers Should Look Elsewhere

Despite boasting a considerable 13% dividend yield, Annaly may not be suitable for dividend-focused investors. The underlying reason is straightforward: the stability of Annaly’s dividend cannot be relied upon.

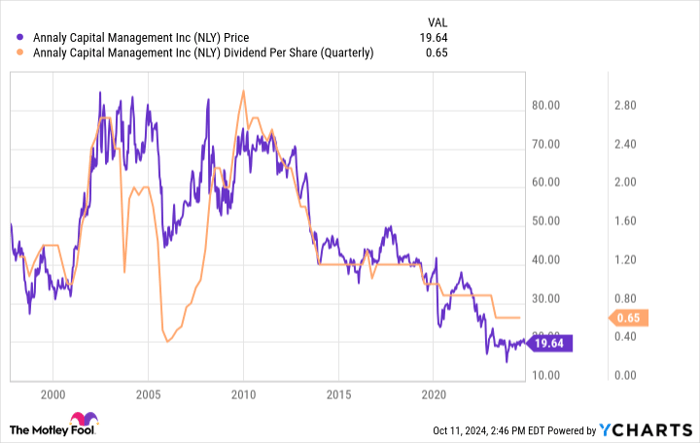

Take a look at the accompanying chart. The dividend trend, shown in orange, reveals volatility that aligns closely with the fluctuating stock price represented in purple. For investors relying on steady income, such variability is concerning.

NLY data by YCharts.

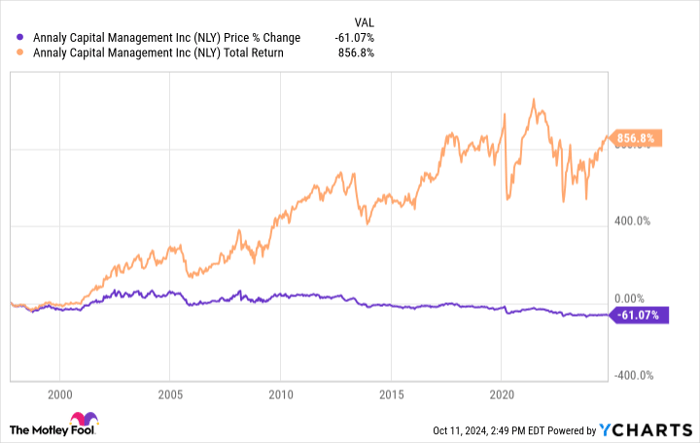

However, Annaly Capital is not inherently a poor investment. Rather, it functions as a total return investment that benefits more from reinvesting dividends. For those who can do so, the significant dividends may offset declines in stock price effectively.

The chart below highlights the robust total return of 850% compared to a stark 60% drop in stock price when factoring dividends as reinvestment.

NLY data by YCharts.

Investors interested in incorporating real estate into their portfolios may find Annaly appealing, particularly institutional investors such as pension funds. While the potential benefits from declining interest rates are enticing, the nature of Annaly’s business model limits its suitability for individual investors focused on dividend income.

Assessing an Investment in Annaly Capital Management

Before purchasing shares in Annaly Capital Management, potential investors should keep the following in mind:

The Motley Fool Stock Advisor analyst team has identified their belief in the 10 best stocks for current investment, with Annaly Capital Management not included. These selections are anticipated to yield substantial returns in the near future.

Consider this example: when Nvidia was recommended on April 15, 2005, a $1,000 investment would have grown to $806,459!

The Stock Advisor service provides investors with a clear roadmap for success, including portfolio building tips, regular analyst updates, and recommendations for new stock picks every month. Since 2002, it has delivered returns that more than quadruple the performance of the S&P 500.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024.

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.