PPG Industries Prepares for Third-Quarter Results Amidst Mixed Demand Conditions

PPG Industries Inc. is slated to announce its third-quarter 2024 results after the bell on Oct. 16.

Stay current with quarterly earnings announcements: See Zacks Earnings Calendar.

Across the last four quarters, PPG Industries surpassed the Zacks Consensus Estimate for earnings in three instances and was aligned with estimates once, leading to an average surprise of approximately 2.2%. The company, known for its paint products, is anticipated to have gained from acquisitions, price adjustments, and cost savings strategies during the third quarter. However, it likely faced some challenge due to sluggish demand, particularly in Europe.

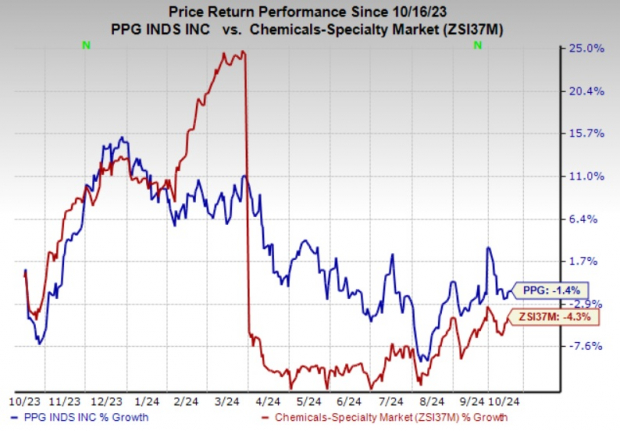

In the past year, PPG’s stock has decreased by 1.4%, while the overall industry has seen a 4.3% decline.

Image Source: Zacks Investment Research

Let’s take a closer look at what to expect from this announcement.

Sales Estimates for PPG

The Zacks Consensus Estimate for PPG’s sales this quarter stands at $4,652.7 million, indicating a slight increase of about 0.2% compared to last year.

Our estimation for net sales from the Industrial Coatings segment is $1,719.9 million, reflecting a year-over-year decline of 2.5%.

In contrast, net sales from the Performance Coatings segment is expected to reach $3,006.7 million, marking an increase of 4.4% from the previous year.

Key Factors Influencing PPG’s Stock Performance

PPG is likely to benefit from higher pricing, improved manufacturing efficiency, careful cost management, and growth through acquisitions during the upcoming quarter. The firm is actively cutting costs and restructuring its operations to enhance working capital efficiency. Expected savings of $8-10 million from these initiatives in Q3 will bolster its financial performance.

Catering to cost inflation, PPG has raised prices across various segments. In the second quarter, the company experienced an uptick in consolidated segment margin, marking the seventh consecutive quarter of growth. This trend is likely to continue impacting margins positively during the September quarter.

In addition, PPG is expanding through strategic acquisitions, which are expected to enhance the company’s revenues this quarter. Notable acquisitions such as Tikkurila, Worwag, and Cetelon are likely to contribute positively.

However, challenges persist due to soft demand in regions like Europe and China. Industrial production remains low, largely due to cautious consumer spending in Europe and a slow resurgence in China. Additionally, weakened demand in some U.S. markets has compounded these difficulties.

Particularly, sales for automotive refinish coatings within the U.S. have fallen. Geopolitical unrest linked to the Russia-Ukraine situation further undermines demand, with a noticable decline in volumes expected in Q3. While demand for PPG’s products has improved in China, overall demand in Europe remains weak. The industrial coatings market continues to face challenges due to sluggish global production, and automotive Original Equipment Manufacturer (OEM) coatings are also under pressure in both Europe and the U.S. due to reduced automotive production rates.

PPG Industries, Inc. Price and EPS Surprise

PPG Industries, Inc. price-eps-surprise | PPG Industries, Inc. Quote

Earnings Outlook for PPG

According to our model, it is uncertain whether PPG will achieve an earnings beat this quarter. A positive Earnings ESP and a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) are typically indicators of improved earnings potential; however, PPG does not meet these conditions.

Earnings ESP: PPG’s Earnings ESP stands at -1.33% for the quarter. The Zacks Consensus Estimate for earnings is currently set at $2.15. You can find promising stocks with our Earnings ESP Filter.

Zacks Rank: Presently, PPG holds a Zacks Rank of #4 (Sell).

Other Basic Materials Stocks to Consider

Here are a few other companies in the basic materials sector that might be worth your attention, as our model indicates they have the right elements to potentially beat earnings this quarter:

Agnico Eagle Mines Limited (AEM), set to report earnings on Oct. 30, boasts an Earnings ESP of +4.38% and a Zacks Rank of #1. The consensus estimate for AEM’s earnings is currently 96 cents.

CF Industries Holdings, Inc. (CF), also releasing earnings on Oct. 30, has an Earnings ESP of +10.58% and carries a Zacks Rank of #1.

The consensus estimate for CF’s third-quarter earnings is set at $1.04.

Kinross Gold Corporation (KGC) is expected to release third-quarter earnings on Nov. 5, with an Earnings ESP of +13.92% and a consensus estimate of 16 cents, and it currently has a Zacks Rank of #3.

Upcoming Infrastructure Stock Opportunities

A significant initiative to revamp the aging U.S. infrastructure is on the horizon. This movement is bipartisan, urgent, and certain. Trillions will be allocated, leading to immense financial opportunities.

The pressing question is: “Will you seize the moment to invest in the right stocks when their growth potential is at its peak?”

Zacks has published a free Special Report to assist you in this endeavor. Discover five companies positioned to reap the benefits of the extensive construction and repair of roads, bridges, and buildings, along with cargo movement and energy transformation on a grand scale.

Download FREE: How To Profit From Trillions on Infrastructure Spending >>

Stay updated with Zacks Investment Research’s latest recommendations, including 5 Stocks Set to Double. Get your free report now.

PPG Industries, Inc. (PPG): Free Stock Analysis Report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.