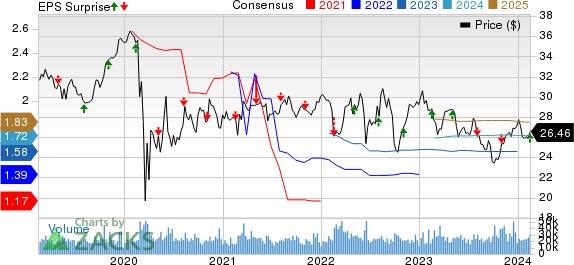

PPL Corporation has pulled off a financial coup with a remarkable performance in its fourth-quarter 2023 operating earnings. The company’s earnings per share (EPS) of 40 cents exceeded the Zacks Consensus Estimate of 38 cents by a remarkable 5.3%. Not only that, but this figure also shows a jaw-dropping 42.9% increase from the 2022 fourth-quarter result of 28 cents.

The exultation doesn’t end there. On a GAAP basis, PPL recorded EPS of 15 cents in the fourth quarter, a standout achievement compared to the 26 cents in the year-ago quarter. Furthermore, the 2023 adjusted EPS of $1.60 soared over the 2022 figure of $1.41, resting comfortably at the lofty top end of the guided range of $1.55-$1.60.

Revenues Mixed

The company, however, saw total revenues of $2.03 billion, which missed the Zacks Consensus Estimate of $2.08 billion by 2.4%. While this is a miss, it’s important to note that 2023 revenues of $8.3 billion were up 5.2% from $7.9 billion in 2022, heralding a generally positive trend.

Performance Highlights

One of the noteworthy developments in PPL’s Q4 performance is the remarkable decrease in total operating expenses which fell by 16%, amounting to $1.64 billion, significantly down from the year-ago quarter’s $1.95 billion. As a result, the operating income totaled $390 million, a substantial 16.1% surge from the year-ago quarter’s figure of $336 million.

Segmental Updates

Looking at the segmented performance, the Kentucky Regulated division registered adjusted EPS of 17 cents, marking a staggering 54.5% increase from the year-ago figure of 11 cents. Meanwhile, the Pennsylvania Regulated segment saw a similarly impressive growth in adjusted EPS, reaching 20 cents, a 25% jump from the year-ago level of 16 cents. Even the Rhode Island Regulated division experienced an impressive adjusted EPS of 5 cents per share, a notable 66.7% surge from the previous year.

Financial Position and Future Projections

As of Dec 31, 2023, PPL boasts cash and cash equivalents of $331 million. The company also increased its projection for capital expenditure to $14.3 billion for 2024 to 2027, a significant leap from the earlier suggestion of $11.9 billion for the 2023 to 2026 period. Moreover, PPL expects O&M savings of at least $175 million by 2026, with plans to deliver O&M savings in the range of $120-$130 million by the end of 2024.

Future Outlook and Market Insights

Although PPL has a Zacks Rank #4 (Sell), there seems to be a silver lining in its 2024 EPS guidance, which rests comfortably in the range of $1.63-$1.75. The company is also keeping an eye on the future, with a revamped projection for capital expenditure and O&M savings, indicating a zealous pursuit of growth and efficiency.

Investors are keeping a close watch on other players in the energy space. Three big names, Exelon Corporation, Ameren Corporation, and NRG Energy, Inc., are all gearing up to release their fourth-quarter results. As the stakes and expectations run high, the market is on the edge of its seat, eagerly waiting to see if these players can pull off a performance as splendid as PPL’s. With the energy sector heating up, it’s an electrifying time for investors indeed.

The exultation doesn’t end there. On a GAAP basis, PPL recorded EPS of 15 cents in the fourth quarter, a standout achievement compared to the 26 cents in the year-ago quarter. Furthermore, the 2023 adjusted EPS of $1.60 soared over the 2022 figure of $1.41, resting comfortably at the lofty top end of the guided range of $1.55-$1.60.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.