Analysts Predict Upside for SPDR SPMD ETF Driven by Key Holdings

In an analysis of ETFs covered by ETF Channel, we’ve evaluated the trading prices of underlying holdings against analysts’ 12-month forward target prices. This led us to determine that the SPDR Portfolio S&P 400 Mid Cap ETF (Symbol: SPMD) has an implied target price of $60.70 per unit based on these holdings.

Potential Gains on SPDR SPMD ETF

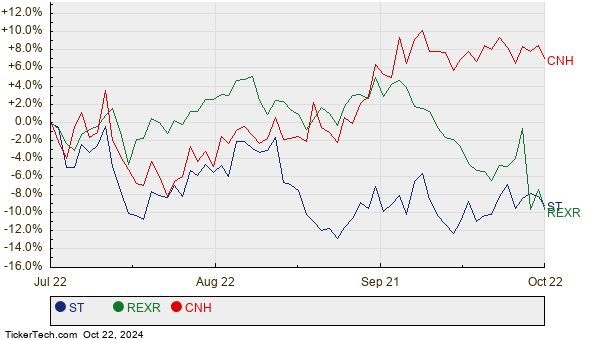

Currently, SPMD is trading around $55.40 per unit, indicating a potential increase of 9.56% based on analysts’ price targets. Within the fund, three notable companies stand out for their significant potential upside: Sensata Technologies Holding PLC (Symbol: ST), Rexford Industrial Realty Inc (Symbol: REXR), and CNH Industrial NV (Symbol: CNH). Sensata, trading recently at $35.45, has a target price averaging 23.65% higher at $43.83. Rexford shows similar promise, with a recent share price of $44.69 compared to a target of $55.20, suggesting a 23.52% increase. CNH’s price of $10.97 is also seen as undervalued, with analysts aiming for a target of $13.53, representing a 23.32% boost.

Analyst Targets Summary

Below, you will find a summary of the discussed companies and their respective analysts’ target prices:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| SPDR Portfolio S&P 400 Mid Cap ETF | SPMD | $55.40 | $60.70 | 9.56% |

| Sensata Technologies Holding PLC | ST | $35.45 | $43.83 | 23.65% |

| Rexford Industrial Realty Inc | REXR | $44.69 | $55.20 | 23.52% |

| CNH Industrial NV | CNH | $10.97 | $13.53 | 23.32% |

Validity of Analyst Predictions

Are the analysts’ predictions reasonable, or overly optimistic? Investors need to consider whether the justifications for these target prices are sound, especially in light of recent company and industry changes. While a high target relative to current trading prices might signal optimism, it could also lead to potential downgrades if bases for these targets become outdated. Thorough research remains essential for investors navigating these forecasts.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

CEZ Historical Stock Prices

BWX YTD Return

Top Ten Hedge Funds Holding IBTG

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.