“`html

Upcoming 2024 Election: Investors Brace for Major Market Turmoil

“The enemy within”…

That’s how Donald Trump describes his political adversaries in the Democratic Party.

Kamala Harris has cautioned her supporters that a second term for Trump would pose a “huge risk for America.”

Each side views the other as more than just an unfortunate choice; they see one another as a real threat to American values.

If you expect this year’s election results to be finalized peacefully on November 5, think again.

I predict another fiercely contested election outcome—one that will linger even after the votes are cast.

Don’t just rely on my speculation.

Recently, billionaire investor Ray Dalio voiced his concerns during a panel in Singapore, underscoring the importance of a smooth transition of power.

Dalio suggested that, if Trump were to narrowly lose, the likelihood of him challenging the results is “almost an even probability.”

Should Harris experience a close defeat, the Democrats will likely not back down either, perceiving too much at stake.

Investors must remain vigilant.

The potential for market chaos looms large.

Bigger Market Movements Mean Bigger Gains

The impacts of a contested election will extend beyond political spheres and directly into Wall Street.

I anticipate that the volatility measure, known as the VIX, could potentially double or triple as the stock market reacts in the wake of the election.

This may seem daunting, particularly for novice investors.

However, for seasoned investors like myself, such times can present opportunities for significant financial gains.

Essentially, larger fluctuations in stock values create more chances for profit.

I am already preparing with a substantial investment of my own funds.

If you brace yourself for the upcoming volatility, not only can you sidestep potential losses, but you might also seize the rare occasion to significantly increase your investment in just weeks.

I will outline how to do this shortly.

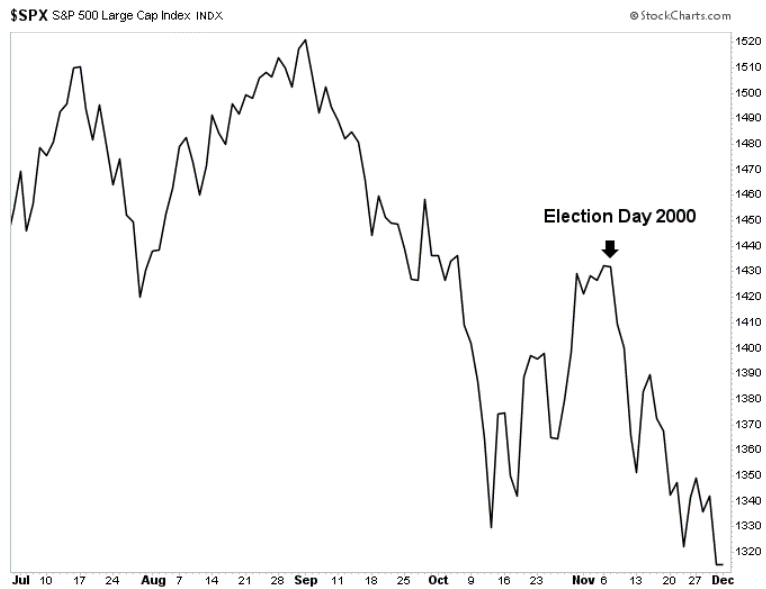

First, let’s revisit the stock market’s reaction during the last drawn-out legal battle following a tightly contested election—specifically, in 2000.

The 2000 Election: 35 Days of Uncertainty

In the 2000 presidential election, a mere 537 votes in Florida determined the outcome from over 100 million ballots cast.

If you were around back then, you likely remember the chaos.

Many voters utilized punch-card ballots, which sometimes left behind “hanging chads,” creating confusion about voter intent and resulting in disputes over ballot counts.

Ultimately, the results led to multiple recounts, debates, and legal battles, stretching the decision until the Supreme Court declared George W. Bush the winner after 35 days.

This turmoil affected millions of Americans and caused significant unrest among investors.

During election week in 2000, the S&P 500 fell by 4.3%—vastly steeper than its average weekly loss of about 0.5%.

Furthermore, when the Supreme Court made its ruling, the S&P 500 dropped another 4.9%.

You can observe the election chaos through the accompanying chart.

This election cycle appeared less contentious compared to the anticipated showdown between Trump and Harris.

I foresee the impending market turmoil in November 2024 overshadowing the disruptions we witnessed in 2000.

While you may believe it’s prudent to prepare for a repeat of past contested elections—be it 2000 or even 2020—

…I predict that this scenario will be unprecedented.

An additional factor that will amplify market instability is on the horizon—

A Perfect Storm for Increased Volatility

Coinciding with Election Day, the Federal Open Market Committee will convene in Washington to deliberate on interest rates.

Generally unnoticed, the Fed has recently made an unusual adjustment to its meeting calendar.

It decided to shift the start of next month’s two-day interest rate policy meeting from November 5 to November 6.

Could this be to avoid any political appearance?

Or perhaps allowing them to respond based on early election results?

I will let you interpret that for yourself.

Regardless, on November 7 at 2 p.m. Eastern Time, the Fed will announce its decision regarding whether to continue cutting key interest rates and the degree of the cut.

Currently, a quarter-point cut is expected.

However, there could be a larger half-point cut similar to what occurred in September, or rates may be held steady.

These uncertainties become three more market-moving elements come the day following the election.

Typically, Fed decisions are critical influencers in the markets.

However, during the aftermath of what could become the most contentious presidential election in modern history, with heightened national tension,

imagine the additional volatility it could add to the stock market.

But as I emphasized earlier, this is NOT a reason

“““html

Navigating Market Volatility: Strategies from a Seasoned Investor

The Importance of Systems During Uncertainty

In the world of finance, I’m known as a “quant” guy.

My strategy doesn’t rely on gut feelings about which stocks to buy or what direction the market will take.

Instead, I develop computer models designed to identify stocks with high growth potential and momentum.

This method has worked well for me, as it removes emotional decision-making from investing. I trust my models to guide me.

For over 40 years, I’ve used my proprietary quant system to discover growth stocks and market trends. This approach allowed me to outperform the S&P 500 by 3-to-1 for 23 consecutive years.

Throughout that period, I recognized early on investments in companies that later dominated their sectors. Notable examples include Microsoft Corp. (MSFT) at $0.38, Apple Inc. (AAPL) at $0.37, and Nvidia Corp. (NVDA) for less than a quarter—companies that eventually saw significant growth.

However, my recent successes are just as impressive. In the past year, I’ve realized gains in the following stocks:

- Rambus (RMBS) for 133% gains in 17 months.

- Super Micro Computer (SMCI) for a 593% gain from one-third of my holdings.

- Gatos Silver (GATO) for 45.6% gains in just one month.

- e.l.f. Beauty (ELF) for 68.5% gains over 16 months.

While many investors may panic after the election as stock market fluctuations intensify, I will be leveraging my models to identify profitable opportunities amid the turmoil.

From my four decades of professional experience, I can confidently say that having a system is crucial—especially with the volatility I anticipate.

Currently, I’m particularly enthusiastic about a specific model that took hundreds of thousands of dollars to develop. Until recently, it has only been available to major institutional investors and wealth managers.

However, I’m now offering this model to everyday investors like you before Election Day, helping you target profit opportunities that are often overlooked.

While I won’t reveal all the details just yet, I will share comprehensive insights during my “Day After Summit” on Tuesday, October 29, at 7 p.m. Eastern Time.

At this event, I’ll demonstrate how to navigate the upcoming market volatility and transform it into profits using the same system. Additionally, I plan to offer a free post-election trade designed to be beneficial regardless of the election outcome.

Be sure to register for the summit at this link.

If you can’t attend next week, there’s no need to worry.

As long as you resist the urge to panic sell your long-term investments during market swings, you’ll likely emerge unscathed.

In time…

Sincerely,

Louis Navellier

Editor, Market360

The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owns the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

e.l.f. Beauty, Inc. (ELF), Microsoft Corp. (MSFT), Nvidia Corp. (NVDA) and Super Micro Computer, Inc. (SMCI)

“`