“`html

In the early hours following Donald Trump’s 2016 presidential election win, renowned screenwriter Aaron Sorkin shared an emotional letter to his daughters. He expressed feelings of despair and uncertainty about the future.

But that fear, while palpable, did not play out as expected.

Here’s an excerpt from Sorkin’s message:

Sorkin Girls,

Well, the world changed late last night in a way I couldn’t protect us from. That’s a terrible feeling for a father. I won’t sugarcoat it—this is truly horrible.

It’s hardly the first time my candidate didn’t win (this is actually the sixth time), but it is the first time that a thoroughly incompetent individual with dangerous ideas and no real world understanding has been elected…

The world reacted quickly to the election results. Dow futures plummeted by 700 points overnight, and economists braced for a deep recession.

However, the anticipated downturn never materialized.

In fact, after that initial drop, the S&P index skyrocketed in the following days. By the end of 2016, it had increased nearly 5%, and by the conclusion of 2017, it was up 25%. Fast forward to the end of 2020, and the S&P was 76% higher than at the time of Sorkin’s letter.

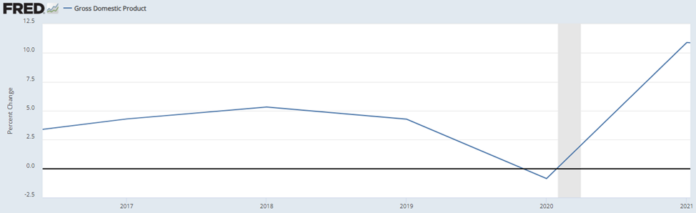

As for the predicted recession? It never happened. Though the pandemic did bring economic challenges, the economy was thriving beforehand with GDP growth consistently between 3% and just over 5%. After the pandemic, growth surged once again.

Source: Federal Reserve data

I’m not endorsing Donald Trump, rather, I’m highlighting a pattern.

Each election cycle brings intense emotions, often leading to dire economic predictions and regretful investment choices.

Back in 2008, Wall Street was similarly rattled after Barack Obama secured the presidency. The stock market tumbled the next day. Here are some historical reactions:

- “Wall Street Reacts to Obama Win: A 5% Plunge” – Forbes (November 5, 2008)

- “Obama Faces Recession, Market Panic” – Bloomberg (November 5, 2008)

- “Dow Sinks After Obama Election; Concerns Over Economic Policies” – ABC News (November 5, 2008)

- “Investors Fear Obama’s Policies Could Worsen Crisis” – Barron’s (November 7, 2008)

- “Obama’s Economic Challenges Could Lead to Further Financial Chaos” – The Wall Street Journal (November 2008)

Despite initial fears, the Dow skyrocketed 148% during Obama’s presidency, demonstrating that the economy can bounce back.

Current Anxiety Levels Are Reaching New Heights

As the 2024 presidential election approaches, people are increasingly stressed and uncertain. According to a recent Forbes survey of 2,000 U.S. adults, over 60% reported that their mental health has been negatively affected by the election, with 46% feeling anxious, 37% stressed, and 31% scared.

The American Psychological Association corroborated these findings, revealing that over 69% of Americans feel stressed due to political tensions. This anxiety stems from numerous alarming headlines in the media:

- “I Study Political Violence. I’m Worried About the Election” – New York Times (October 10, 2024)

- “Harris v. Trump poll: Americans trust the count but worry about violence” – USA Today (October 23, 2024)

- “Still Tense from Jan. 6 Riot, D.C. Braces for What This Election May Bring” – The Washington Post (October 20, 2024)

The fears are not limited to social unrest. Economists are making alarming predictions about potential market responses. Speculations include the negative impacts of Trump’s tariff plan, and concerns that Harris’ policies could inflate corporate taxes and stifle growth.

Anticipating Market Volatility Around the Election

Investor Louis Navellier is curious about this escalating tension. He stated:

“The enemy within…”

Trump describes his opponents this way, while Harris warns that a second Trump term poses significant risks for the country. Both parties perceive each other as threats to American values.

Navellier anticipates a challenging election period, suggesting that market fluctuations could double or triple the VIX, Wall Street’s fear gauge, in the wake of contentious results.

While volatility may seem alarming, investors who remain level-headed could find opportunities for substantial gains. These moments might offer the chance to achieve significant returns in a few days or weeks, akin to a trading “Super Bowl” spurred by fear-driven reactions.

In light of the upcoming volatility, Navellier is actively adjusting his investments, stating:

I’m already making moves to prepare myself with millions of dollars of my own money.

If you’re intrigued by potential investment strategies during such uncertain times, stay tuned for more insights.

“`

Prepare for Market Movements: Insights from Louis and Charles Sizemore

Mark your calendars: next Tuesday at 7 PM ET, Louis will engage in a discussion with Charles Sizemore, Chief Investment Strategist at The Freeport Society.

The focus will be on the potential risks and opportunities arising from the upcoming election’s uncertainty, and how you might benefit. To reserve your spot for this event, click here.

Here’s what Louis has to say:

I’ll guide participants on how to manage the expected volatility and transform it into profits using my proprietary investment system.

Additionally, he’ll offer a free post-election trading strategy, designed to yield returns regardless of the election’s outcome.

Importantly, Louis clarifies he isn’t forecasting a severe, prolonged market downturn that would threaten your investments. He suggests that if your portfolio consists of strong stocks, it’s wise to hold through any turbulence:

As long as you avoid panic selling during market fluctuations, your investments will be fine.

However, there are two critical points to consider:

First, if you’re invested in high-risk assets that deeply depend on the election results, exercise caution—it’s akin to gambling. It might be more prudent to visit a casino and bet on red or black instead.

Secondly, if you’re looking to strategically navigate rather than simply endure election-induced volatility, consider joining Louis and Charles for their upcoming discussion, where they’ll share expert trading strategies.

A Brief Reminder…

No matter the election’s outcome, gold and Bitcoin are expected to perform well over the next four years.

While Trump or Harris might align more with certain policy preferences, neither candidate represents prudent fiscal strategy. In a previous Digest, billionaire investor Stanley Druckenmiller remarked:

I will not vote for Kamala Harris, and I will not vote for Donald Trump. Bipartisan fiscal recklessness is on the horizon.

As more national debt accumulates, the dollar’s value is likely to decline, leading to diminished purchasing power for consumers. In such an environment, assets like Bitcoin and gold that can withstand inflation become key to preserving wealth.

Over the last year, gold has surged by 38%, and Bitcoin has doubled in value.

Source: TradingView.com

While volatility and dips can be expected, the long-term outlook for both assets is positive. Investing in cash over time carries more risk regarding wealth preservation compared to investing in gold or Bitcoin.

As We Conclude…

Anticipate significant market fluctuations surrounding the election, as history indicates that many investors struggle with emotional decision-making. Such responses to market changes can amplify volatility.

Yet, this uncertainty presents an opportunity.

The day after November 6th, life and the market will continue. While substantial price shifts may occur—even in solid stocks—skillful investors can capitalize on these movements, benefiting from wealth transfers away from less informed traders.

Prepare for the upcoming market volatility.

Best wishes,

Jeff Remsburg