Federal Realty Investment Trust Set to Release Q3 Earnings Amid Changing Retail Landscape

Federal Realty Investment Trust (FRT), located in North Bethesda, Maryland, operates as a self-administered real estate investment trust (REIT), focusing on the management and acquisition of community shopping centers. With a market value of $9.4 billion, FRT will announce its fiscal third-quarter earnings for 2024 after market hours on Wednesday, Oct. 30.

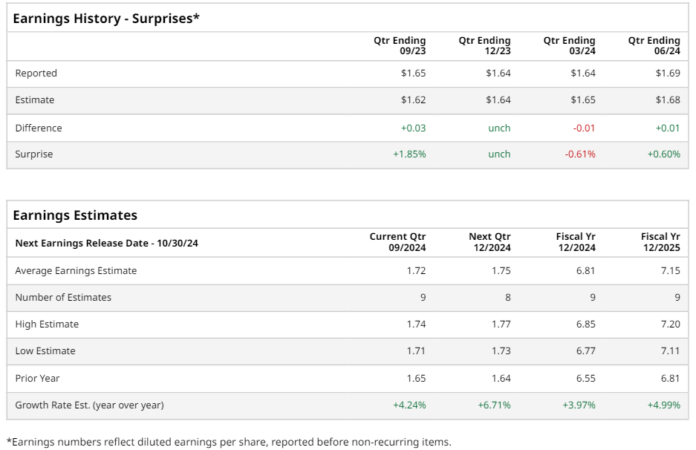

Analysts Project Earnings Growth

Preliminary estimates indicate FRT could report a profit of $1.72 per share on a diluted basis, reflecting a 4.2% increase from $1.65 in the same quarter last year. In the last four quarters, the company has met or surpassed consensus estimates three times, with one quarter falling short.

Expected Full-Year Financial Figures

For the entire fiscal year, analysts predict FRT will achieve funds from operations (FFO) of $6.81, marking a 4% increase from $6.55 in 2023. Looking ahead, the FFO is anticipated to rise by 5% to $7.15 in fiscal 2025.

Stock Performance Compared to Major Indices

Over the past 52 weeks, FRT stock has fallen short of the S&P 500’s overall gains of 33.6%, rising only by 26.7% during that span. The Real Estate Select Sector SPDR Fund (XLRE) outperformed FRT with a gain of 28.9% in the same timeframe.

Challenges Facing Retail Properties

The company’s underperformance can be attributed to economic uncertainty and changing consumer habits that have adversely affected leasing activity and foot traffic in retail spaces. As more consumers turn to e-commerce and the job market remains unstable, concerns grow about potential shifts from physical stores to online shopping. Ongoing economic challenges and the risk of tenant bankruptcies may also impact consumer spending, thereby threatening the company’s profitability and occupancy rates.

Recent Earnings and Analyst Outlook

On August 1, shares of FRT experienced a more than 1% increase following the release of its Q2 earnings. The reported FFO of $1.69 surpassed analyst expectations of $1.68, with revenue reaching $296.1 million compared to the forecasted $292.9 million. The company projects its full-year FFO will fall between $6.70 and $6.88.

Analyst Sentiments Remain Positive

Overall, analysts maintain a reasonably optimistic view on FRT stock, assigning it a “Moderate Buy” rating. Out of 16 analysts covering the stock, 10 recommend a “Strong Buy,” one advises a “Moderate Buy,” and five suggest a “Hold.” The average price target set by analysts is $122.97, suggesting a potential upside of 8.3% from current levels.

More Stock Market News from Barchart

On the date of publication, Neha Panjwani did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are for informational purposes only. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.