Investing in AI: Profitable Companies Rewarding Shareholders with Dividends

Many companies typically reinvest all their profits to support growth. However, some generate so much money that they can afford to share their earnings with investors through methods like share repurchases and dividend payments.

Despite pouring billions into artificial intelligence (AI), leading firms such as Broadcom (NASDAQ: AVGO), Microsoft (NASDAQ: MSFT), and Meta Platforms (NASDAQ: META) continue to pay dividends. This allows investors to receive income while they benefit from the ongoing AI trend. Although the current income stream may be modest, it has the potential to grow significantly as these companies leverage AI for increased profits.

Broadcom: A Reliable Dividend Champion

Broadcom offers a quarterly dividend of $0.53 per share. With its recent stock price around $180, the company has a 1.2% dividend yield, aligning closely with the S&P 500 average. An investment of $1,000 in Broadcom would yield about $12 in dividends per year, underscoring the benefits of increased investment.

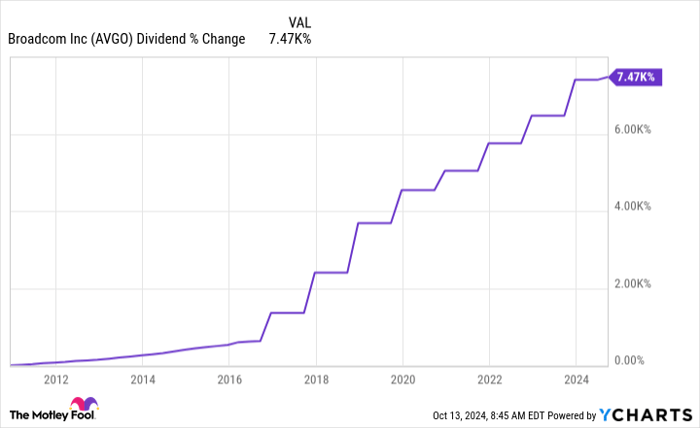

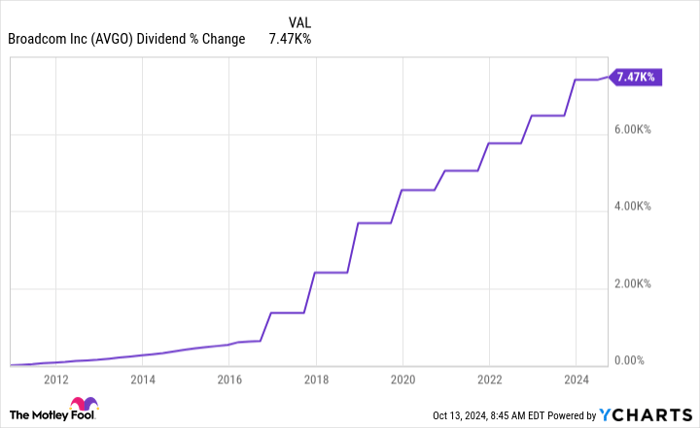

Broadcom’s dividend is particularly impressive because it has been consistently increasing. The company raised its dividend for the 13th consecutive time late last year, marking a 14% increase. Over time, it has shown significant dividend growth:

AVGO Dividend data by YCharts

The future looks bright for Broadcom’s dividends, with a 43% surge in revenue year-over-year in Q2 and an 18% rise in free cash flow, largely thanks to its acquisition of VMware. Excluding VMware, revenue still grew by 12%, driven by $3.1 billion from AI products. This momentum suggests that Broadcom is well positioned to continue growing its dividends at an impressive pace.

Microsoft: Steady Growth Ahead

Microsoft announced a 10% increase in its quarterly dividend, now set at $0.83 per share. This puts its yield at approximately 0.8% based on its current share price.

Although Microsoft offers a lower yield, it boasts a robust history of dividend growth, having increased its payouts for 19 consecutive years, with a 10% average annual growth rate over the last decade.

The company is positioned well for continued dividend payments, maintaining a low payout ratio, which allows for reinvestment and share repurchases. Recently, its board authorized a share buyback plan worth up to $60 billion. Moreover, Microsoft has made significant investments in AI, including partnerships with OpenAI, setting the stage for growth in cash flow and dividends.

Meta Platforms: Growing Potential

In 2023, Meta Platforms began paying dividends, introducing a quarterly payment of $0.50 per share in February, which translates to a 0.3% dividend yield based on current stock prices.

Though Meta’s yield is relatively low and its dividend is new, the company has ample room for growth. Meta plans to invest heavily in AI advancements and has already launched its AI assistant, Meta AI, which it anticipates will lead the industry by year-end. Additionally, it is developing AI tools for advertisers, which CEO Mark Zuckerberg believes could be a significant opportunity.

Although monetizing these AI products may take time, Meta has shown a strong ability to scale successful projects. This capacity positions the company to enhance its dividend payouts meaningfully in the coming years as it profits from its investments.

Capitalize on the AI Revolution

While many emerging AI companies opt to reinvest their profits to further develop technology, companies like Broadcom, Microsoft, and Meta Platforms generate sufficient profits to invest in AI while also rewarding their shareholders with dividends. These stocks present a compelling opportunity for investors looking to benefit from the current wave of AI growth.

Consider This Next Investment Opportunity

Ever wished you could get in on a rising stock before it takes off? Here’s your chance.

Our analysts sometimes produce a “Double Down” stock recommendation for companies they believe are poised for significant growth. If you think you missed previous investment opportunities, now may be the last moment to act. The figures are telling:

- Amazon: if you invested $1,000 when we first recommended it in 2010, you’d have $21,266!*

- Apple: if you invested $1,000 from our 2008 recommendation, you’d have $43,047!*

- Netflix: a $1,000 investment from our 2004 recommendation would be worth $389,794!*

Currently, we have several “Double Down” stocks to watch, and you might not get another opportunity like this soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 7, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Matt DiLallo has positions in Broadcom and Meta Platforms. The Motley Fool has positions in and recommends Meta Platforms and Microsoft. The Motley Fool recommends Broadcom and the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.