Analysts See Growth Ahead for Vanguard Russell 1000 Growth ETF

In-depth analysis from ETF Channel reveals potential upside for the Vanguard Russell 1000 Growth ETF (Symbol: VONG). By assessing the average analyst 12-month forward target prices of its underlying holdings, the implied analyst target price for VONG is calculated to be $108.29 per unit.

Current Trading Status and Analyst Predictions

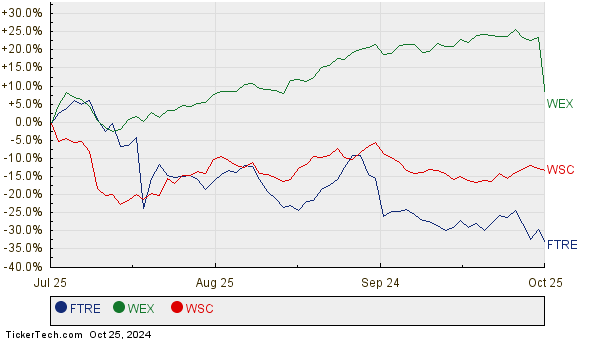

VONG recently traded at approximately $98.12 per unit, indicating a potential gain of 10.37% based on analysts’ target estimates. Notably, three holdings within VONG show significant upside potential relative to their analyst targets: Fortrea Holdings Inc (Symbol: FTRE), Wex Inc (Symbol: WEX), and WillScot Holdings Corp (Symbol: WSC). FTRE, currently priced at $17.37 per share, has a target price suggesting a 28.38% increase to $22.30. Meanwhile, WEX shares, priced at $181.13, could rise by 26.78% to reach the target of $229.64. Lastly, analysts forecast WSC to hit $45.25 per share, a 20.44% rise from its recent price of $37.57. Below is a chart showcasing the twelve-month price performance for FTRE, WEX, and WSC:

Summary of Analyst Targets

Here’s a summary table highlighting the current analyst target prices for these stocks:

| Name | Symbol | Recent Price | Avg. Analyst 12-Mo. Target | % Upside to Target |

|---|---|---|---|---|

| Vanguard Russell 1000 Growth ETF | VONG | $98.12 | $108.29 | 10.37% |

| Fortrea Holdings Inc | FTRE | $17.37 | $22.30 | 28.38% |

| Wex Inc | WEX | $181.13 | $229.64 | 26.78% |

| WillScot Holdings Corp | WSC | $37.57 | $45.25 | 20.44% |

Further Considerations for Investors

Are these forecasts justified, or do they reflect over-optimism regarding stock prices in the coming year? Investors may want to examine whether analysts have valid reasons for their projections or if they are lagging behind recent trends in companies and industries. A high target price can indicate hope for future growth but may also lead to adjustments if the market conditions change. These considerations warrant careful research by investors.

![]() 10 ETFs With Most Upside To Analyst Targets »

10 ETFs With Most Upside To Analyst Targets »

Also see:

• DS Split History

• ETFs Holding AMKR

• Funds Holding GNW

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.