Toast: A Rising Star in Restaurant Technology (NYSE: TOST) is revolutionizing how restaurants manage payments, orders, and more. Looking ahead, Toast stock is expected to trade higher in the coming year.

With revenue growing at over 20% annually, management has effectively balanced profitability alongside its expansion efforts. However, there’s an additional factor that signals promise for the future of this company.

Record Growth in Restaurant Adoption

In the second quarter, approximately 8,000 new restaurant locations adopted Toast’s technology. While the second quarter tends to be strong for the company, this figure marks a record number of new clients and addresses concerns from shareholders.

This year, Toast faced backlash after introducing a new fee, which led to a quick reversal by management. This incident left many shareholders questioning the company’s strategy and its impact on user loyalty.

However, the record growth in Q2 suggests that Toast has maintained its strong reputation. This positions the company to potentially accelerate its growth rate moving forward.

Toast identifies markets where it captures 20% market share as “flywheel markets,” indicating that satisfied customers in these areas help the company gain further traction. In these regions, Toast has reported increased adoption rates, lower costs, and improved profitability.

In 2021, Toast held a 20% or greater market share in only 5% of U.S. markets. By 2023, this number increased to 31%, with expectations for continued growth in 2024.

Overall, although Toast commands only 13% of the broader U.S. market currently, many areas show signs of reaching a critical point that could facilitate greater market penetration.

From a broader viewpoint, this suggests that Toast has significant growth opportunities ahead in the U.S. restaurant industry.

Profitability Gains Alongside Growth

My confidence in Toast’s growth potential has remained steady, and the company’s bottom line is proving doubters, including myself, wrong.

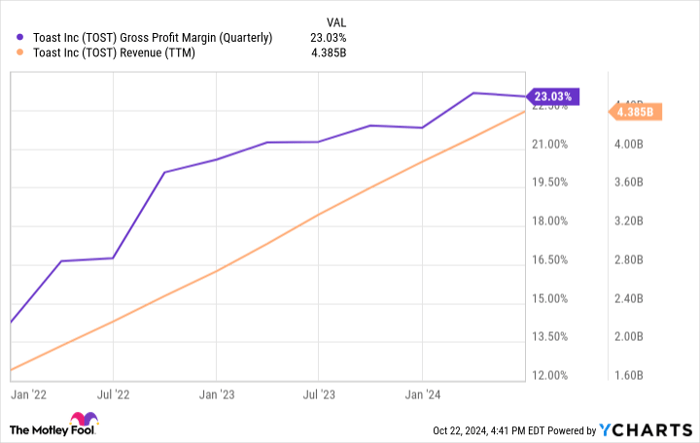

Toast sells hardware at a loss while processing payments at low margins. However, its software subscription services yield high margins. It takes time for the software profits to surpass losses incurred elsewhere. Nevertheless, recent data indicates Toast’s gross profit margin is on the rise alongside surging revenue.

Data by YCharts.

Additionally, the aforementioned flywheel effect is reducing Toast’s sales and marketing expenses. This trend contributes to increasing profitability in conjunction with its overall growth.

On one hand, Toast’s profitability improvements are a natural result of its expansion, while management is also implementing effective cost-control measures. Notably, general and administrative expenses decreased by 22% year-over-year in Q2.

Recently, Toast reported its first quarterly operating profit as a public company. With Q2 operating income at $5 million, though modest, it signals progress.

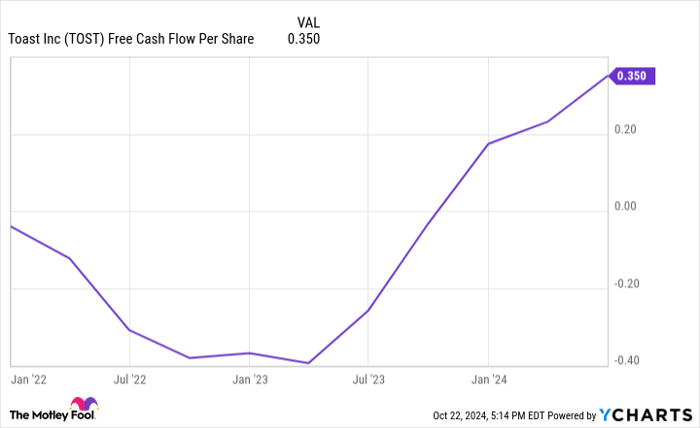

Furthermore, Toast’s free cash flow per share is rising impressively, as shown in the graph below.

Data by YCharts.

Anticipating Growth Beyond 2025

Investors in Toast are looking at a profitable growth opportunity that may gain momentum in the upcoming year. The stock is trading at a reasonable valuation of under four times sales, setting the stage for potential gains as business activity accelerates.

Prospective investors considering buying Toast stock should note that while there is upside potential over the next year, longer timelines may yield more favorable results.

A long-term study by the Boston Consulting Group in 2006 found that stock prices are most influenced by a company’s valuation in the short term. Yet over three years, growth becomes the primary driver of stock price increases.

Given that valuation is significantly influenced by investor sentiment—which can be volatile—it’s uncertain if Toast stock will see immediate gains. If growth continues steadily over the next three years or more, patient investors should reap rewards.

Seize This Opportunity in the Market

If you’ve ever thought you missed out on investing in top-performing stocks, you’ll want to consider this chance.

Occasionally, investment analysts identify what they term “Double Down” stock recommendations, suggesting specific companies poised for significant growth. If you’re concerned you’ve lost your opportunity to invest in something great, now may be an ideal time to act before the moment passes.

- Amazon: Investing $1,000 when we doubled down in 2010 would be worth $21,154!*

- Apple: A $1,000 investment when we doubled down in 2008 would have grown to $43,777!*

- Netflix: If you had invested $1,000 in 2004 based on our recommendation, you’re now looking at $406,992!*

Currently, we are issuing “Double Down” alerts for three remarkable companies, and this opportunity might not come around again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Toast. The Motley Fool has a disclosure policy.

The views expressed here are those of the author and do not necessarily reflect the views of Nasdaq, Inc.