Microsoft: Navigating Challenges and Embracing AI for Future Growth

Shares of Microsoft (NASDAQ: MSFT) have seen consistent gains of 41% over the past three years. This slight edge over the S&P 500 index’s increase of 34% marks Microsoft’s stable performance. Yet, 2024 has posed challenges, with the company struggling to gain traction.

This year, Microsoft stock has only managed an 11% increase, significantly trailing the S&P 500 index. This underperformance may seem unexpected, particularly as Microsoft continues to report impressive growth each quarter. In the following sections, we’ll delve into Microsoft’s prospects over the next three years and explore whether the tech leader can recover from a disappointing 2024 and position itself as a long-term winner.

AI: A Catalyst for Microsoft’s Growth

In the fiscal year 2024, which concluded on June 30, Microsoft achieved a 15% year-over-year revenue increase in constant-currency terms, totaling $245 billion. This robust growth stemmed from a rising demand for Microsoft 365 office collaboration tools, a significant surge in Azure revenue, and a 9% growth in search and news-advertising revenue.

Microsoft’s Azure division has played a pivotal role in driving growth, reflecting a 33% rise in year-over-year revenue attributable to Azure and other cloud services. AI contributed nine percentage points to that growth, with its influence expanding from five percentage points in the fiscal first quarter to 11 percentage points in fiscal Q4.

The surge in demand for cloud-based AI services is remarkable. According to Goldman Sachs, the global cloud-computing market is projected to generate $2 trillion in revenue by 2030, a significant jump from $496 billion in 2023. Importantly, generative AI alone is expected to represent 10% to 15% of global cloud spending by the decade’s end.

Microsoft is poised to capitalize on this trend by offering customers access to a comprehensive array of large language models (LLMs) through its cloud platform for developing and deploying AI models. As CEO Satya Nadella noted during the July earnings call:

“With Azure AI, we are building out the app server for the AI wave providing access to the most diverse selection of models to meet customers’ unique cost, latency, and design considerations. All up, we now have over 60,000 Azure AI customers, up nearly 60% year over year, and average spend per customer continues to grow.”

Additionally, Microsoft’s models-as-a-service offering is gaining momentum, with the number of paid customers doubling quarter over quarter in fiscal Q4. As demand for AI services in the cloud is expected to soar, Microsoft should likely see acceleration in its Azure revenue.

Meanwhile, the Office 365 segment is also experiencing growth thanks to AI. Nadella mentioned that “the number of people who use Copilot daily at work nearly doubled quarter over quarter” in fiscal Q4, with customer usage soaring by 60% sequentially. Microsoft Copilot serves as a generative AI assistant, enabling users to work more efficiently and automate processes.

The market for AI-powered productivity tools is predicted to expand significantly, growing at nearly 27% annually through the end of the decade. It was valued at approximately $6.9 billion last year and could reach $36 billion in annual revenue by 2030, presenting a lucrative opportunity for Microsoft.

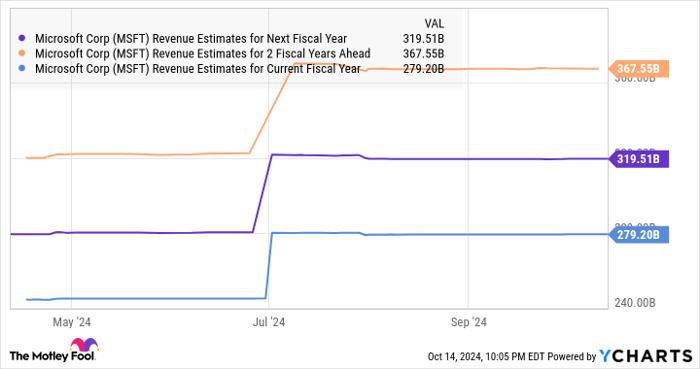

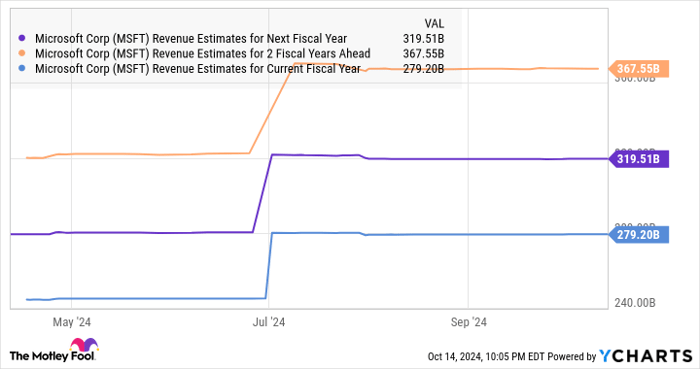

Overall, the rise of AI-related growth avenues should enable Microsoft to sustain its robust growth trajectory in the coming three years. This sentiment aligns with what consensus forecasts indicate, as displayed in the chart below.

MSFT Revenue Estimates for Next Fiscal Year data by YCharts.

Potential for Earnings Growth Driving Stock Performance

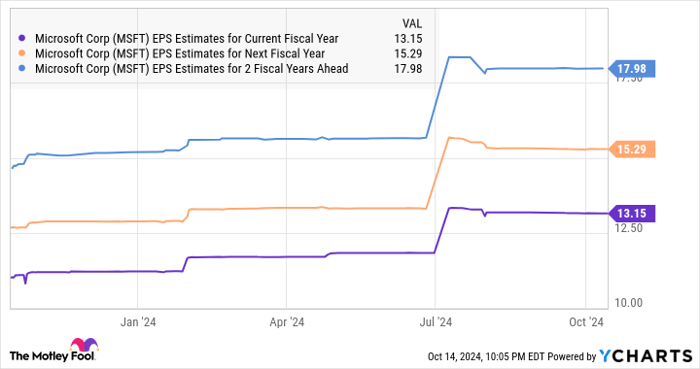

In fiscal 2024, Microsoft reported a 20% year-over-year increase in non-GAAP earnings, reaching $11.80 per share. While analysts predict a smaller earnings jump for the current fiscal year, they expect growth to accelerate in fiscal years 2026 and 2027.

MSFT EPS Estimates for Current Fiscal Year data by YCharts.

The anticipated moderation in Microsoft’s fiscal 2025 earnings increase can be traced back to the company’s aggressive capital expenditure strategy. Last year, capital spending surged 75% to $55.7 billion, and it is poised to rise again in fiscal 2025 as Microsoft focuses on expanding its cloud and AI infrastructure.

This heightened expenditure may pressure earnings growth in the short term, but the company believes it will enable them to meet the growing AI demand over the next 15 years and beyond. Therefore, it is vital for investors to consider the larger picture.

Moreover, forecasts indicate that Microsoft’s earnings growth may ramp up in the next few years. Should earnings rise to $17.98 per share in fiscal 2027 and the stock trades at a multiple of 30 times earnings—comparable to the Nasdaq-100 index’s price-to-earnings ratio—its stock price might reach $540, marking a 29% increase from present levels.

However, if Microsoft achieves even more robust growth and the market responds accordingly with a higher earnings multiple, significantly stronger returns could occur over the next three years. Thus, investors should consider adding this tech giant to their portfolios, notwithstanding its sluggish performance in 2024, as its AI-driven growth may fuel an acceleration in its performance.

A Second Chance at a Promising Investment

Ever had the feeling that you missed out on buying a high-performing stock? If so, here’s some encouraging news.

Rarely, our team of expert analysts issues a strong “Double Down” stock recommendation for companies poised for growth. If you think you’ve missed your chance, now could be an excellent time to invest before the opportunity slips away. The statistics support this sentiment:

- Amazon: Investing $1,000 when we doubled down in 2010 would now be worth $21,121!

- Apple: A $1,000 investment following our recommendation in 2008 would have grown to $43,917!

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d now have $370,844!

Currently, we’re issuing “Double Down” alerts for three exceptional companies, and this opportunity may not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.