Raymond James Upgrades Nasdaq Outlook: Analyst Predictions Show Potential Growth

Analysts Forecast Positive Movement for Nasdaq Shares

On October 14, 2024, Raymond James raised its outlook on Nasdaq (LSE:0K4T) from Market Perform to Outperform.

Expected Price Increase of 3.76% from Current Levels

As of September 25, 2024, analysts predict an average one-year price target for Nasdaq at 74.75 GBX per share. Predictions vary, with a low of 54.59 GBX and a high of 94.59 GBX. This average target suggests a potential rise of 3.76% from the latest closing price of 72.04 GBX per share.

For a broader view, check out our leaderboard featuring companies with significant upside potential.

Projected Revenue and Earnings Overview

The anticipated annual revenue for Nasdaq stands at 3,987 MM, reflecting a notable decrease of 39.29%. The projected annual non-GAAP EPS is anticipated to be 2.98.

What is Fund Sentiment Around Nasdaq?

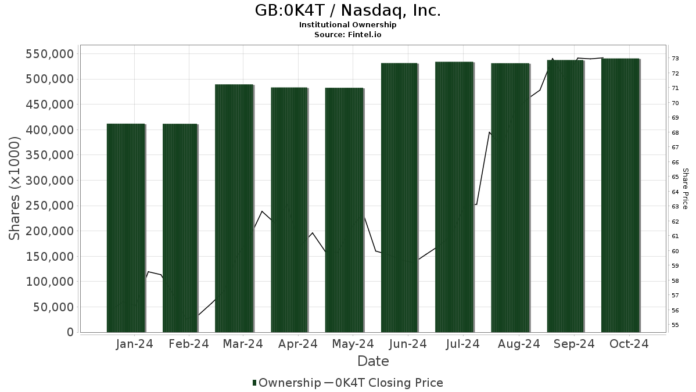

A total of 1,456 funds or institutions currently report holding positions in Nasdaq, marking a decline of 19 entities or 1.29% over the last quarter. The average portfolio allocation of these funds dedicated to 0K4T is now 0.32%, up by 2.13%. In the past three months, institutional ownership increased by 2.17%, totaling 540,890K shares.

Current Actions by Major Shareholders

Thoma Bravo maintains ownership of 85,608K shares, which constitutes 14.86% of the company, with no change over the last quarter.

Investor Ab holds 58,182K shares, representing 10.10% ownership, also remaining unchanged.

Massachusetts Financial Services owns 20,884K shares or 3.63% of the company. This is down from 21,224K shares, a decrease of 1.62%, reflecting an 85.16% reduction in their portfolio allocation in 0K4T over the last quarter.

Wellington Management Group LLP has increased its holdings to 14,749K shares, accounting for 2.56% of the company, up from 10,693K shares—an impressive 27.50% increase, although they reduced their portfolio allocation by 81.30% last quarter.

MEIAX – MFS Value Fund A reports 14,025K shares held, which equals 2.44% ownership, down slightly from 14,319K shares, reflecting a 2.10% decrease while increasing their portfolio allocation by 2.45% in 0K4T over the last quarter.

Fintel provides extensive investment research tools designed for individual investors, traders, financial advisors, and small hedge funds. Our platform encompasses a global data set including fundamentals, analyst reports, ownership data, fund sentiment, insider trading, and much more, alongside exclusive stock picks generated from advanced quantitative models for enhanced profitability.

Click to Learn More

This information was originally published on Fintel.

The views and opinions expressed herein belong to the author and do not necessarily represent those of Nasdaq, Inc.