RBC Capital Initiates Coverage of Oracle with Positive Outlook

On October 23, 2024, RBC Capital began its coverage of Oracle (XTRA:ORC), giving it a Sector Perform rating.

Analyst Predictions Indicate Potential Price Increase

As of October 21, 2024, the average one-year price target for Oracle stands at 172,73 €/share. These predictions vary widely, with the lowest target being 131,61 € and the highest at 205,24 €. Overall, the average target suggests a possible growth of 6.37% from its most recent closing price of 162,38 € / share.

Oracle’s Projected Revenue Growth

The company’s projected annual revenue is estimated at 59,218MM, reflecting a rise of 10.04%. Additionally, the anticipated annual non-GAAP earnings per share (EPS) is 6.49.

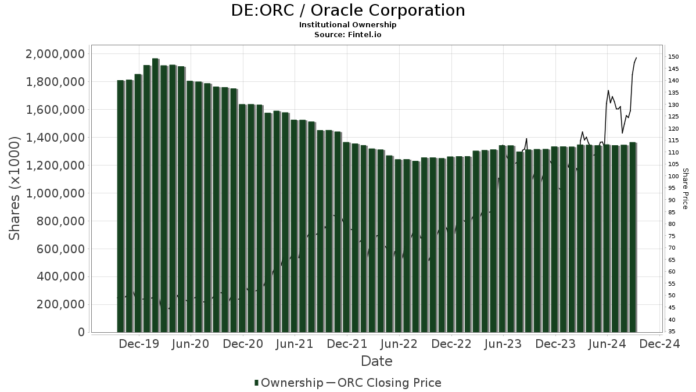

Fund Sentiment Shows Increasing Interest in Oracle

Currently, 4,223 funds or institutions have reported their positions in Oracle. This is a rise of 115 funds, or 2.80%, over the last quarter. The average investment in Oracle among these funds has grown, with an average portfolio weight of 0.64%, up by 7.22%. Institutional ownership has also increased, with total shares held rising by 3.55% to reach 1,367,534K shares in the past three months.

How Major Investors Are Adjusting Their Holdings

Among the significant shareholders, the Vanguard Total Stock Market Index Fund Investor Shares holds 52,079K shares, which constitutes 1.88% of Oracle’s total ownership. This marks a slight increase from the 51,826K shares previously reported, a rise of 0.49%, as the fund boosted its allocation by 9.85% over the last quarter.

The Vanguard 500 Index Fund Investor Shares has 40,915K shares, reflecting a 1.48% stake. This shows an increase from its earlier 40,180K shares, representing a 1.80% growth, with an 8.36% higher allocation.

JPMorgan Chase reported a holding of 39,990K shares, comprising 1.44% ownership. This is an increase from 39,375K shares reported previously, a change of 1.54%. However, there’s been an 82.64% decrease in their portfolio allocation in Oracle over the last quarter.

Geode Capital Management has increased its shares from 33,262K to 34,310K, now holding 1.24% of the company, showing a growth of 3.05%, with their allocation up by 10.03% since last quarter.

The Fidelity 500 Index Fund owns 19,409K shares, indicating a 0.70% stake, an increase from 19,056K shares previously reported. Their allocation has increased by 1.95% over the last quarter.

Fintel provides a comprehensive analysis platform for individual investors, traders, financial advisors, and small hedge funds. Our coverage includes financial fundamentals, analyst reports, ownership data, fund sentiment, insider trading, and more.

Click to Learn More

This article was originally published on Fintel.

The views expressed in this article reflect the author’s opinions and do not necessarily represent those of Nasdaq, Inc.