RBC Capital Lowers Alexandria Real Estate Equities Rating: What to Expect Next

Investment Outlook Shifted

On October 24, 2024, RBC Capital updated its view on Alexandria Real Estate Equities (LSE:0HCH), downgrading it from Outperform to Sector Perform.

Analysts See Potential for Growth

As of October 22, 2024, analysts set a one-year price target for Alexandria Real Estate Equities at 133.37 GBX/share. Estimates range between a low of 120.97 GBX and a high of 148.82 GBX. This average target suggests a possible increase of 13.51% from the company’s recent closing price of 117.50 GBX/share.

For those interested, you might want to check our list of companies with the highest price target upsides.

Revenue and Earnings Projections

Forecasts indicate that Alexandria Real Estate Equities will generate an annual revenue of 2,743MM, reflecting a decline of 11.10%. The expected annual non-GAAP earnings per share (EPS) stand at 3.82.

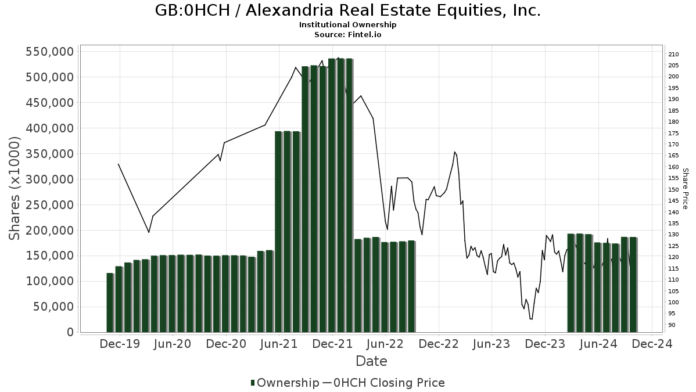

Institutional Ownership Trends

Currently, 1,386 funds or institutions have reported their holdings in Alexandria Real Estate Equities. This marks an increase of 18 owners, or 1.32%, over the last quarter. The average portfolio weight across all funds for 0HCH is 0.37%, up by 12.18%. Total institutional shares rose by 7.39% in the past three months, totaling 186,572K shares.

Changes Among Major Shareholders

Norges Bank increased its stake, now holding 16,457K shares, which is 9.42% ownership. This reflects a prior report of 0K shares, indicating a significant increase of 100.00%.

APG Asset Management US currently owns 7,147K shares, representing 4.09% ownership. Previously, it reported 7,257K shares, showing a slight reduction of 1.54%. The firm has decreased its allocation in 0HCH by 10.10% in the last quarter.

Vanguard Real Estate Index Fund Investor Shares (VGSIX) now holds 6,306K shares, or 3.61% ownership. It has seen its stake decrease from 6,740K shares by 6.88%. Hence, its portfolio allocation in 0HCH decreased by 15.62% during the last quarter.

Additionally, Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) shows a holding of 5,509K shares, which is 3.15% ownership. This is a slight decrease from its previous holding of 5,527K shares, totaling a drop of 0.33% in its allocation, down by 12.05% over the last quarter.

Finally, Principal Financial Group maintains a stake of 5,420K shares, accounting for 3.10% ownership. Previously, it owned 5,458K shares, indicating a decrease of 0.69% and a significant reduction of 50.27% in its allocation in 0HCH over the last quarter.

Fintel provides comprehensive investment research for individual investors, traders, financial advisors, and small hedge funds, covering a wide range of financial data.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.