The compelling case for Huntington Ingalls Industries (HII) extends to its ascendant earnings estimates, resilient Return on Equity (ROE), and robust backlog count. Positioned as a Zacks Rank #3 (Hold) stock in the Aerospace Defense sector, HII is a beacon worth keeping a close eye on.

Delve into the quintessential factors that elevate this company as an investment contender in the current landscape.

Positive Growth Trajectory & Record of Surprises

Recent data shows an upbeat outlook for HII, with the Zacks Consensus Estimate for its first-quarter 2024 earnings per share (EPS) scaling up to $3.49 — a 0.3% increase over the past month. Anticipated total revenues for Q1 are pegged at $2.80 billion, reflecting a 4.7% year-over-year growth.

HII’s long-term earnings growth rate stands at an impressive 6.5%. Notably, the company has maintained a consistent record of surpassing earnings expectations by an average of 20.64% in the past four quarters.

Efficacious Return on Equity

Return on Equity (ROE) serves as a litmus test for a company’s financial acumen in leveraging capital for optimal returns. Currently boasting an ROE of 18.12%, HII surpasses the industry benchmark of 11.11%, indicating superior fund utilization compared to its sector peers.

Steady Dividend Track Record

Huntington Ingalls has carved a niche for itself in rewarding shareholders through dividends. As of February 2024, HII declared a quarterly dividend of $1.30 per share, translating to an annual dividend of $5.20 per share. Notably, HII’s current dividend yield of 1.81% outperforms the Zacks S&P 500 composite yield of 1.30%.

Mounting Backlog

Backed by robust demand for its products, Huntington Ingalls maintains a healthy order book. Securing new contract awards valued at around $12.5 billion in 2023, HII’s backlog soared to $48.12 billion as of December 31, 2023. This bulging backlog portends promising revenue growth for the foreseeable future.

Strong Financial Position

As of the fourth quarter of 2023, HII’s times interest earned ratio (TIE) stood at 10 — indicating the company’s capability to meet interest payment obligations in the near term without strain. Moreover, HII’s total debt to capital ratio, at 37.4%, underscores a prudent debt management strategy, contrasting favorably with the industry average of 53.62%.

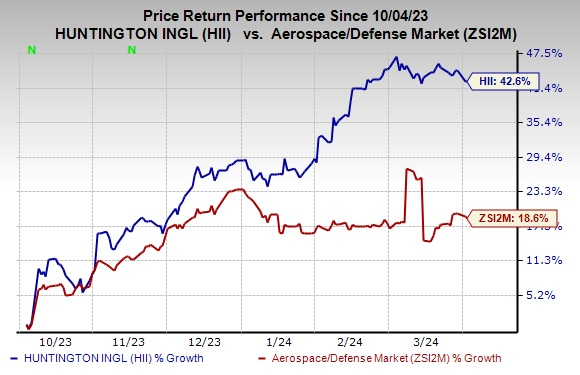

Impressive Price Performance

Marking an upward trajectory, HII shares have surged 42.6% in the past six months, outshining the aerospace defense sector average rise of 18.6%.

Uncover the latest insights at Zacks Investment Research

Promising Alternatives

Amid a backdrop of enticing investment options within the industry, standouts include Textron TXT, Leidos LDOS, and Safran SAFRY, each carrying a Zacks Rank #2 (Buy) currently.

Textron projects a long-term earnings growth rate of 10.1%, with expected 2024 sales of $14.64 billion. Leidos anticipates a 9.3% long-term earnings growth, with 2024 sales forecasted at $15.97 billion. Safran’s long-term earnings growth rate surges ahead at 30.2%, with projected 2024 sales at $29.4 billion, indicating a substantial year-over-year growth potential.

Seeking the Next Big Semiconductor Stock?

Casting a wary eye toward NVIDIA’s phenomenal growth? Now, uncover a prime semiconductor stock with immense growth potential. With escalating earnings and a burgeoning client base, it’s primed to tap into the surging demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor domain is poised for an explosion from $452 billion in 2021 to a projected $803 billion by 2028.

Unlock this Stock’s Potential Now for Free >>

Textron Inc. (TXT) : Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII) : Free Stock Analysis Report

Safran SA (SAFRY) : Free Stock Analysis Report

Leidos Holdings, Inc. (LDOS) : Free Stock Analysis Report

For more insights, consult the original article on Zacks.com at this link

To uncover more strategic investment opportunities, visit Zacks Investment Research

While the perspectives presented reflect the author’s views, they may not necessarily align with those of Nasdaq, Inc.