The Potential for Prosperity

Fighting through cost increases and currency challenges, Cintas Corporation (CTAS) remains steadfast in its path to success. Let’s delve into the reasons why sticking with this stock is a prudent move at this juncture.

Drivers of Expansion

A Solid Foundation: Cintas’ success story is fueled by robust performances across its different segments. Particularly, the Uniform Rental and Facility Services segment thrives on the energy sector’s vitality. Moreover, the company’s investments in technology and efficiency enhancement programs like Six Sigma are pushing the segment to new heights. The First Aid and Safety Services segment is also benefiting from escalating demand for products like AED Rentals, eyewash stations, and WaterBreak.

Cintas’ optimistic forecast for fiscal 2024 is a testament to its profitability. The company anticipates revenues between $9.57 billion and $9.60 billion for the year, with a midpoint of $9.585 billion indicating an 8.7% year-over-year increase. Earnings per share are expected to range between $14.80 and $15.00, with a midpoint of $14.90 indicating a 14.7% year-over-year growth.

Strategic Acquisitions: Cintas’ acquisition strategy is a cornerstone of its growth plan. The recent purchase of Paris Uniform Services and SITEX bolsters the company’s capacity to deliver services efficiently and strengthens its market position in the central Midwest region of the United States.

Ongoing Innovation: The company’s commitment to enhancing its product lineup, coupled with investments in technology and infrastructure, continues to drive its performance. Initiatives like the SmartTruck technology amplify route efficiencies and enhance existing routes’ density. Additionally, focus on operational excellence and strategic pricing actions have resulted in a healthy gross margin performance, which rose by 150 basis points to 48.7% in the first nine months of fiscal 2024.

Investor Rewards: Cintas’ dedication to rewarding its shareholders through dividends and share repurchases stands out. In the first nine months of fiscal 2024, dividend disbursements amounted to $393.3 million, marking an 18.3% increase from the previous year. Share buybacks totaled $468.1 million during the same period, a 26.2% year-over-year surge. The company’s dividend received a 17.4% bump to $1.35 per share in July 2023, marking 40 consecutive years of dividend hikes.

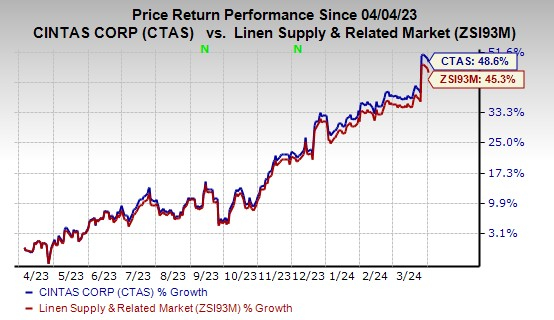

The company presently holds a Zacks Rank #3 (Hold). CTAS shares have outpaced the industry’s growth, climbing 48.6% compared to the sector’s 45.3% over the same period.

Exploring Alternatives

If you’re looking for other options within the Industrial Products sector, consider the following:

Belden Inc. (BDC), currently sporting a Zacks Rank #2 (Buy) and boasting an average earnings surprise of 12.3% over the past four quarters. BDC’s stock has shown a 5.6% increase in the last year.

A. O. Smith Corporation (AOS), bearing a Zacks Rank of 2 and an average earnings surprise of 12% in the trailing four quarters. AOS’ 2023 earnings estimate has risen by 0.7% in the past 60 days, with the stock climbing 34.5% over the past year.

Applied Industrial Technologies, Inc. (AIT), presently holding a Zacks Rank of 2 and an average earnings surprise of 10.4% over the past four quarters. AIT’s fiscal 2024 earnings estimate has seen a 1.7% uptick in the past 60 days, and the stock has gained 41.9% over the past year.

Seizing the Opportunity

Are you on the hunt for the next big thing in the semiconductor industry? Discover a hidden gem that’s a fraction of the size of NVIDIA, yet brimming with potential. This stock, with its rapid earnings growth and expanding customer base, is well-positioned to cater to the skyrocketing demand for Artificial Intelligence, Machine Learning, and Internet of Things. Semiconductor market projections enrich the narrative, forecasting global manufacturing values to increase from $452 billion in 2021 to $803 billion by 2028. Interested in uncovering this gem for free? Take a look here.

The opinions and forecasts expressed herein are solely those of the author and do not reflect the opinions of Nasdaq, Inc.