Positive Momentum: DexCom, Inc. (DXCM) is poised for substantial growth in the short term. Bolstered by an impressive product lineup, the company closed the fourth quarter of 2023 on a solid note, with several positive coverage decisions boosting investor confidence. Nonetheless, the fierce competition within the market remains a nagging concern.

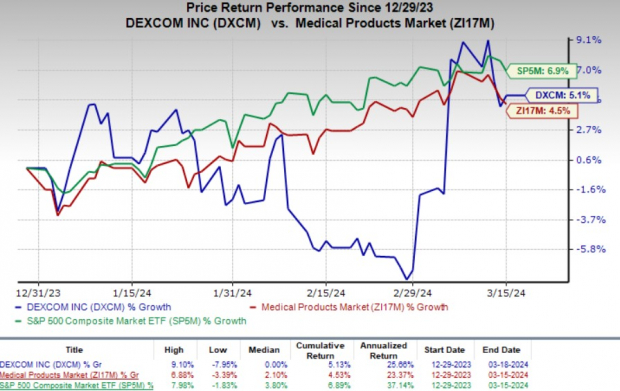

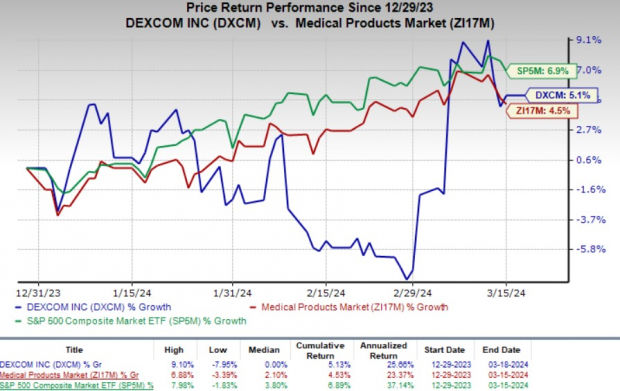

As per recent statistics, DXCM’s stock has seen a modest rise of 5.1% since the beginning of the year – slightly trailing its industry’s growth rate of 7.3%. Meanwhile, the S&P 500 Index has demonstrated a commendable 6.9% uptick over the same timeframe.

With a formidable market capitalization of $50.29 billion, DexCom is anticipating a robust 33.1% growth over the next five years, reaffirming its market position in the years to come.

Image Source: Zacks Investment Research

Over the past four quarters, DexCom has consistently outperformed the Zacks Consensus Estimate, showcasing an average earnings surprise of 32.81%.

Now, let’s explore the reasons behind this optimism.

Robust Demand: DexCom’s continuous glucose monitoring (CGM) products continue to attract strong market demand, underpinning the company’s growth trajectory.

The introduction of new offerings such as DexCom One and G7 Sensor has expanded the product line, accelerating revenue growth. The positive reception to these products since their launch late last year is a testament to their vitality in the market.

Furthermore, the increased coverage for CGM systems during the quarter has provided additional growth impetus. This trend is expected to persist into 2024, with newer sensors like G6 and G7 gaining traction in international markets. The global launch of G7 in over 15 countries in 2023 underscores DexCom’s commitment to expanding its market reach.

DexCom’s strategic focus on integrating CGM sensors with automated insulin delivery systems worldwide is likely to further enhance the demand for its sensors in the future.

In addition, the burgeoning glucose monitoring market offers substantial growth opportunities for DexCom, particularly in niche segments like non-intensive diabetes management, hospitals, gestational diabetes, pre-diabetes, and obesity management.

Innovative Product Launches: DexCom’s recent FDA approval for its new glucose sensor, Stelo, designed for type II diabetes patients not using insulin, marks a significant milestone. The impending U.S. market launch of this sensor in the summer of 2024 is projected to be a key growth driver for the company this year.

Furthermore, the introduction of Dexcom ONE+ – a user-friendly CGM system catering to individuals managing type 1 or type 2 diabetes with insulin therapy – highlights the company’s commitment to enhancing patient experience through advanced technology.

Expanding Coverage: DexCom’s products are witnessing a surge in coverage recognition, fueling positive sentiment among investors. The widespread adoption of the G7 CGM System by major pharmacy benefit managers in the United States reflects the growing acknowledgment of DexCom’s technological prowess.

Moreover, the broadening public coverage for type 1 and type 2 diabetic patients leveraging DXCM’s G6 CGM System underscores the company’s commitment to enhancing patient access to innovative healthcare solutions.

Additionally, DexCom’s strong showing in the fourth quarter of 2023, with impressive revenue figures, indicates a promising outlook. Driven by expanded sensor coverage and robust domestic and international revenue growth, DexCom foresees total revenues ranging from $4.15 to $4.35 billion for 2024 – implying a notable organic growth rate of 16-21% year over year.

The stellar performance of the Sensor segment, coupled with encouraging growth prospects in the glucose monitoring market, bodes well for DXCM in the upcoming quarters.

Challenges Ahead

Cost Pressures: The contraction in DexCom’s gross margin during the fourth quarter of 2023 signals rising cost pressures, with a 290 basis points year-over-year decline to 63.5%. The company’s projected adjusted gross margin of 63-64% for 2023 underscores the persistent challenge of escalating costs.

Intense Competition: The competitive landscape in the blood glucose monitoring devices market remains fierce, with rapid innovations and new product launches. DexCom faces formidable rivals in the single-point finger stick device market, collectively leading the global sales of self-monitored glucose testing systems.

Trend Analysis

DexCom is experiencing a positive trend in estimate revisions for 2024. Over the last 60 days, the Zacks Consensus Estimate for 2024 earnings has risen from $1.70 per share to $1.76.

The consensus revenue estimate for the first quarter of 2024 stands at $911.2 million, reflecting a robust 22.9% year-over-year growth. Similarly, the earnings projection of 27 cents per share signifies a substantial 58.8% increase from the preceding year.

DexCom, Inc. Price

DexCom, Inc. price | DexCom, Inc. Quote

Potential Stocks to Watch

For investors eyeing opportunities in the broader medical sector, stocks like DaVita Inc. DVA, Cardinal Health, Inc. CAH, and Cencora COR present compelling options worth exploring.

DaVita, currently holding a Zacks Rank #1 (Strong Buy), boasts an estimated long-term growth rate of 12.1%. With a track record of consistently beating earnings estimates, DaVita offers a favorable investment proposition. To uncover more top-rated stocks, check out today’s Zacks #1 Rank stocks here.

DaVita’s stock has surged by 67.4% in comparison to the broader market’s performance.

The Unstoppable Surge of Healthcare Stocks

Cardinal Health’s Magnificent Momentum

Recently, the healthcare industry has been ablaze with excitement due to its significant growth of 22.4% over the past year. Among the notable entities is Cardinal Health, boasting a Zacks Rank of 1 and an estimated long-term growth rate of 15.9%. Its earnings consistently exceeded expectations in the last four quarters, with an average positive surprise of 15.6%.

Cardinal Health’s shares have soared by an impressive 51.6%, outshining the industry’s growth of 14% during the same period.

Cencora’s Remarkable Rally

Cencora, currently holding a Zacks Rank of 2 (Buy), has an estimated long-term growth rate of 9.8%. Surpassing earnings expectations in the trailing four quarters, it has delivered an average surprise of 6.7%. The company’s shares have surged by a remarkable 53.2% in the past year, leaving the industry’s meagre 1.1% growth far behind.

Infrastructure Stock Boom Forecasted to Sweeping the Nation

A forthcoming monumental endeavor to revamp the deteriorating U.S. infrastructure is on the horizon. It stands as a bipartisan, pressing, and unavoidable task. Trillions of dollars are set to be injected into this colossal project, opening up avenues for prosperous opportunities.

The paramount question lingering is, “Are you prepared to dive into the right stocks at their inception, when the zenith of their growth beckons?”

In anticipation of this epochal transformation, Zacks has unveiled a Special Report to guide investors through this lucrative terrain—presenting five special companies poised to reap the most benefits from the overhaul of roads, bridges, buildings, as well as advancements in cargo transportation and energy evolution on an astonishing scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

DaVita Inc. (DVA) : Free Stock Analysis Report

Cardinal Health, Inc. (CAH) : Free Stock Analysis Report

DexCom, Inc. (DXCM) : Free Stock Analysis Report

Cencora, Inc. (COR) : Free Stock Analysis Report

For more insightful articles like this, visit Zacks.com by clicking here.

Explore more findings and opinions from Zacks Investment Research here.

The perspectives and viewpoints depicted here solely belong to the author and are not necessarily a reflection of those held by Nasdaq, Inc.