TSMC’s Remarkable Rise: A Semiconductor Titan Reaches New Heights in 2024

Plenty of notable companies have had a good 2024, but few have had as good a year as Taiwan Semiconductor Manufacturing Company (NYSE: TSM) (TSMC). The world’s leading semiconductor company has seen its stock price double this year, with plenty of momentum on its side.

Transitioning from a $500 billion company to a $1 trillion company is no small feat, but that’s exactly what TSMC has achieved this year. It now belongs to an exclusive group of only eight other companies.

With TSMC’s impressive performance, investors might wonder if they have missed their window of opportunity or if a market correction is on the horizon. However, for those considering an investment in TSMC, now could be the perfect time. Let’s explore the reasons why.

TSMC: A Key Player in the AI Revolution

Artificial intelligence (AI) has been a hot topic in the business world for the last couple of years. The rise of ChatGPT and other generative AI tools has made AI a focal point, compelling businesses across various sectors to integrate this technology.

While TSMC may not be the first company that comes to mind in the AI sector, it is crucial for the AI ecosystem. Its semiconductors are essential components in graphics processing units (GPUs), data centers, and AI accelerators, which are necessary for developing and sustaining AI applications.

This dependence is evident as companies like Nvidia, the leading GPU manufacturer, heavily rely on TSMC for its top-tier chip-making capabilities and extensive production capacity.

Impressive Financial Growth Supported by Demand

In its third quarter, TSMC reported that the hype surrounding AI is translating into significant financial success. The company recorded a 36% year-over-year revenue increase, totaling $23.5 billion, while its operating income rose by over 47% to $11.1 billion.

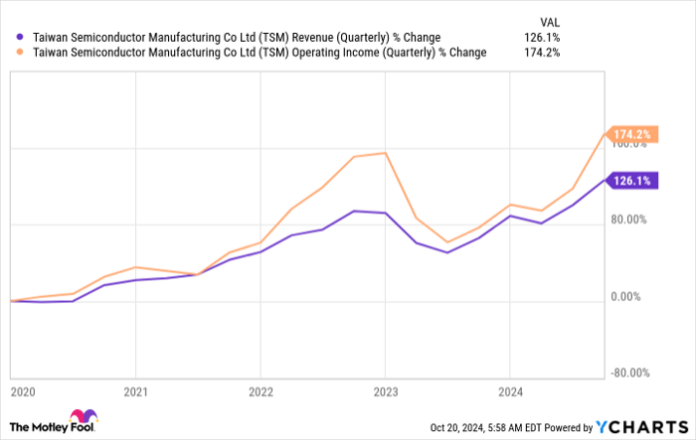

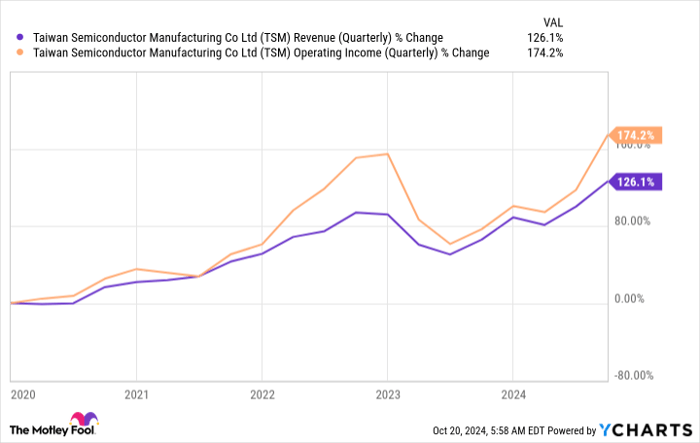

These achievements cap off an extraordinary five-year stretch during which revenues and operating income have both more than doubled.

TSM Revenue (Quarterly) data by YCharts.

More than half of TSMC’s third-quarter revenue came from its high-performance computing segment, which includes AI chips. The company anticipates that revenue from its semiconductors used in AI processors and servers will triple this year, contributing approximately “mid-teen percent” of its total revenue.

TSMC is not just making more money; it is also operating more efficiently. Its gross margin reached 57.8%, an increase of 3.5% from 54.3% in the third quarter of 2023. According to the company’s chief financial officer, this improvement results from a “higher capacity utilization rate and cost improvement efforts,” underscoring its enhanced production capabilities.

For the fourth quarter, TSMC projects revenue between $26.1 billion and $26.9 billion, with gross profit margins ranging from 57% to 59%.

Valuation Reflects Quality in the Market

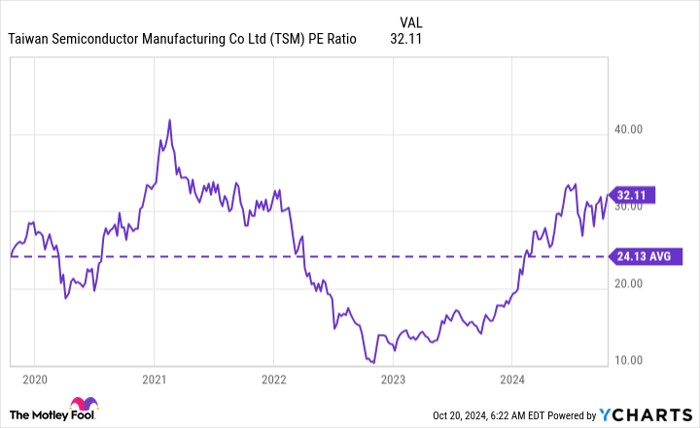

Given TSMC’s stock growth this year, it’s unsurprising that the company now trades at a premium valuation. It is currently trading at slightly more than 32 times earnings, a significant increase compared to its five-year average.

TSM PE Ratio data by YCharts.

While not as high as the 41 times earnings it reached in early 2021, TSMC’s current valuation is still far from being low.

Investors should not let high valuation deter them. Leading companies like TSMC often carry premium pricing due to their strong market positions, especially in today’s spotlight of innovation. Although this may limit short-term growth potential, TSMC is poised for long-term success.

Holding approximately a 90% share of the advanced semiconductor market, TSMC stands alone and is unlikely to face meaningful competition anytime soon. For those apprehensive about investing at this all-time high, dollar-cost averaging could be a prudent strategy.

A New Opportunity Awaits Investors

Have you ever felt like you missed out on investing in top-performing stocks? Now’s your chance to catch a potential upswing.

Our expert analysts occasionally issue a “Double Down” stock recommendation for companies poised for significant growth. If you’re concerned about having missed your opportunity, now might be the ideal moment to invest.

- Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,294!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,736!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $416,371!*

Currently, we are offering “Double Down” alerts for three exceptional companies—don’t let this opportunity pass by.

See 3 “Double Down” stocks »

*Stock Advisor returns as of October 21, 2024

Stefon Walters has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.