Amazon’s Ongoing Legal Challenges and Risk Management Insights

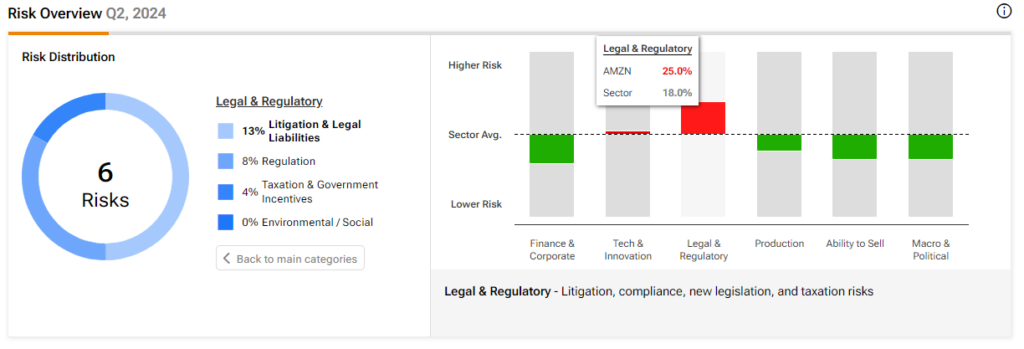

Amazon (AMZN) faces a landscape filled with legal investigations and lawsuits, typical for a company of its size. As outlined in the TipRanks Risk Factors tool, the company’s legal and regulatory issues represent 25% of its total identified risks. This figure exceeds the industry average of 18%, raising alerts among investors.

Insights on Amazon’s Legal Risks

Within the legal and regulatory sector, litigation and liabilities contribute to 13% of the risks, with regulations and taxation & government incentives accounting for 8% and 4%, respectively. Being a global leader in technology, Amazon encounters numerous challenges that concern patents, labor practices, antitrust issues, and data protection. These legal obstacles have the potential to influence the company’s performance significantly.

Another notable risk arises from ambiguous laws regarding the liability of online service providers. Despite Amazon’s robust policies designed to thwart fraudulent seller activities, any lapse in these safeguards could endanger its business and potentially lead to civil or even criminal penalties related to unlawful actions by its sellers.

Amazon’s Broader Risk Landscape

In addition to legal issues, Amazon’s Finance and Corporate risks also comprise 25% of total risks, yet they remain lower than the industry average of 38.9%, reflecting effective management. Production risks follow closely behind, making up 17% of the total. Furthermore, Technology and Innovation, along with Sales Ability, account for 13% each, while Macro and Political risks contribute 8% to Amazon’s overall risk assessment.

Even amidst multiple complex risks, Amazon has proven its capacity to navigate these challenges effectively. The company’s well-developed risk management strategies put it in a position for sustained long-term success.

Current Outlook: Is AMZN Worth Buying?

Wall Street analysts regard AMZN favorably, assigning it a Strong Buy consensus rating based on 45 Buys and two Holds over the past three months. The current average price target for Amazon stands at $224.38, indicating approximately 20% upside potential. Thus far, the company’s shares have risen by 23.4% in 2023.

See more AMZN analyst ratings

Disclosure

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.