Roku Gears Up for Q3 2024 Results Amid Growing Streaming Landscape

Roku (ROKU) is scheduled to disclose its financial results for the third quarter of 2024 on October 30.

Key Financial Projections

For this quarter, Roku forecasts total net revenues of $1.01 billion, alongside a gross profit of approximately $440 million and an adjusted EBITDA of $45 million. The Zacks Consensus Estimate for revenues stands at $1.02 billion, reflecting an anticipated 11.52% increase compared to the same quarter last year.

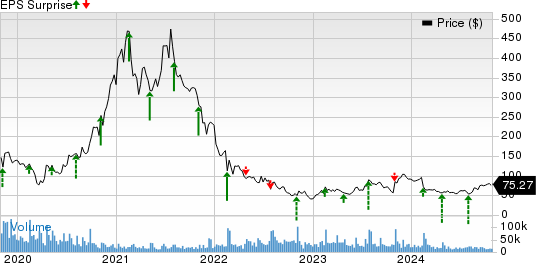

The consensus estimate for the loss per share in Q3 is set at 35 cents, a notable improvement from the loss of $2.33 per share recorded in the previous year. Over the past month, this earnings estimate has remained stable.

Historically, Roku’s earnings have exceeded the Zacks Consensus Estimate in three of the past four quarters, with an average surprise of 24.87%.

Looking Ahead: What to Expect

Several factors likely boosted Roku’s revenue heading into the upcoming announcement. The number of Streaming Households surged to 83.6 million in Q2 2024, up 14% year-over-year, and this positive trend is expected to persist.

During the quarter, Roku forged key partnerships, including a streaming agreement with PEOPLE & Entertainment Weekly for the 76th Emmy Awards and a collaboration with Sony to feature NFL’s GMFB: Overtime series. Such initiatives are anticipated to enhance Roku’s financial performance.

The company’s expanding revenue sources, including Roku-billed subscriptions and diverse advertising solutions, are projected to counter market fluctuations, contributing positively to its earnings. In Q2 2024, platform revenues climbed to $824 million, reflecting an 11% year-over-year increase, a trend expected to continue.

Roku’s strategic approach to maximizing ad revenue through its home screen may also play a role in its financial success during this quarter. An increase in ad units and advertiser inventory is likely to have attracted new clients, further consolidating its market position. Additionally, the integration of UID2 is expected to enhance partnerships and boost platform revenues through improved efficiencies.

Despite the optimistic outlook, Roku faces significant challenges due to fierce competition from major players like Netflix (NFLX), The Walt Disney Company (DIS), and EchoStar’s (SATS) Sling Media. Enhanced ad-supported tiers from Netflix and Disney, alongside new offerings from Sling Media, might hinder Roku’s growth in active users this quarter.

Weakness in Roku’s Media and Entertainment segment, compounded by lower advertising spend in certain areas, could pose additional risks to its financial results for Q3 2024.

Explore Zacks’ Recommendations

We are offering access to all Zacks picks for just $1 for 30 days—no further obligation. Many have taken this chance, while others were skeptical. Our goal is to familiarize you with our services like Surprise Trader, Stocks Under $10, Technology Innovators, and more, which recorded 228 positions with double- and triple-digit gains in 2023.

For the latest stock recommendations from Zacks Investment Research, consider downloading our report titled “5 Stocks Set to Double.” Click here for your free report.

Netflix, Inc. (NFLX): Free Stock Analysis Report

The Walt Disney Company (DIS): Free Stock Analysis Report

EchoStar Corporation (SATS): Free Stock Analysis Report

Roku, Inc. (ROKU): Free Stock Analysis Report

For the complete article, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.