“`html

Scotiabank Adjusts Newmont’s Outlook Amid Mixed Fund Activity

Fintel reports that on October 25, 2024, Scotiabank downgraded their outlook for Newmont (LSE:0R28) from Sector Outperform to Sector Perform.

As of October 22, 2024, the average one-year price target for Newmont is 61.37 GBX/share. Predictions vary, with estimates ranging from a low of 46.96 GBX to a high of 83.10 GBX. This average price target indicates a potential increase of 15.51% from the most recent closing price of 53.14 GBX/share.

Check out our leaderboards to see which companies have the largest price target upside.

Projected Revenue Decline

The anticipated annual revenue for Newmont is 12,365 MM, reflecting a significant decrease of 27.21%. Meanwhile, the expected non-GAAP EPS stands at 2.41.

Positive Fund Sentiment Despite Downgrade

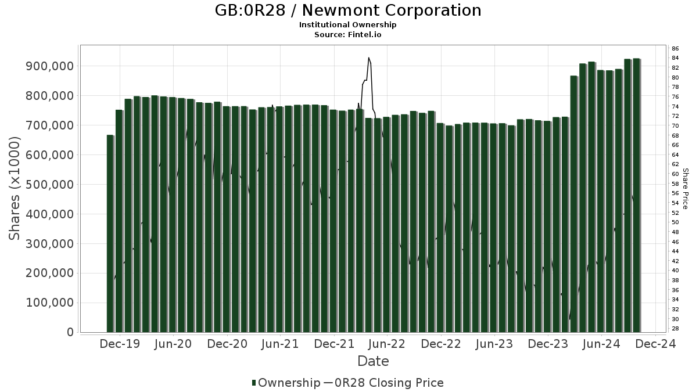

Currently, there are 1,875 funds or institutions reporting positions in Newmont, which marks an increase of 34 owners or 1.85% from the previous quarter. The average portfolio weight of all funds invested in 0R28 is 0.44%, up by 15.57%. Over the past three months, institutional share ownership climbed 5.86% to 930,250K shares.

Van Eck Associates currently holds 50,918K shares, a 4.45% ownership stake in the company. Their recent filing indicates an increase from 49,629K shares, representing an increase of 2.53%. The firm raised its portfolio allocation in 0R28 by 12.67% over the last quarter.

The GDX – VanEck Vectors Gold Miners ETF has increased its shares to 43,624K, which reflects a 3.81% ownership stake. The prior count was 42,864K shares, translating to an increase of 1.74%, along with a 21.08% rise in portfolio allocation in 0R28 during the last quarter.

The VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 36,485K shares, amounting to 3.19% ownership. This is slightly up from 36,275K shares, an increase of 0.58%, with a 14.26% increase in portfolio allocation in 0R28.

Additionally, VFINX – Vanguard 500 Index Fund Investor Shares now owns 29,595K shares at 2.59% ownership, having grown from 29,044K shares, a rise of 1.86%, with a 12.69% increase in allocation. Lastly, VIMSX – Vanguard Mid-Cap Index Fund Investor Shares holds 24,702K shares representing 2.16% ownership, down from 25,041K shares, a decrease of 1.37%. The portfolio allocation in 0R28 was increased by 18.97% over the last quarter.

Fintel provides a thorough investing research platform tailored for individual investors, traders, financial advisors, and smaller hedge funds.

The data we supply is extensive and includes fundamentals, analyst reports, ownership statistics, fund sentiment, options sentiment, insider trading, unusual options trades, and numerous additional resources. Our unique stock picks enhance profitability through advanced, backtested quantitative models.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.

“`