Three High-Yield Dividend Stocks to Watch

Finding stocks that pay good dividends is relatively easy. However, identifying stocks with sustainable, above-average yields can be challenging. Often, high yields signal investor concern, hinting at potential issues ahead. Here, we explore three high-yield stocks with dividends that appear secure for the long haul.

1. British American Tobacco

You’re likely aware that the global push to quit smoking poses challenges for British American Tobacco (NYSE: BTI). While the company is diversifying into vaping and heated tobacco, traditional cigarette sales still make up over 80% of its revenue. Despite its declining trend, the smoking rate has not fallen as sharply as one might think.

According to the World Health Organization, about 1.3 billion people still smoke today, down from 33% of the global population in 2000. Their forecasts suggest that by 2030, around 18% of the world will be daily smokers. While the trend is concerning, British American Tobacco is committed to transitioning to a “smokeless world” through its investments in alternative products.

Despite facing a shrinking top line, the company remains profitable enough to sustain its dividend, which has been growing steadily. Investors today can secure a forward yield of 8.4%.

2. Verizon

Most people are familiar with Verizon Communications (NYSE: VZ). However, its growth potential is limited given the decline in landline phones and the fact that 97% of U.S. adults own mobile phones, according to Pew Research. This leaves Verizon to compete for market share while maintaining its existing customer base.

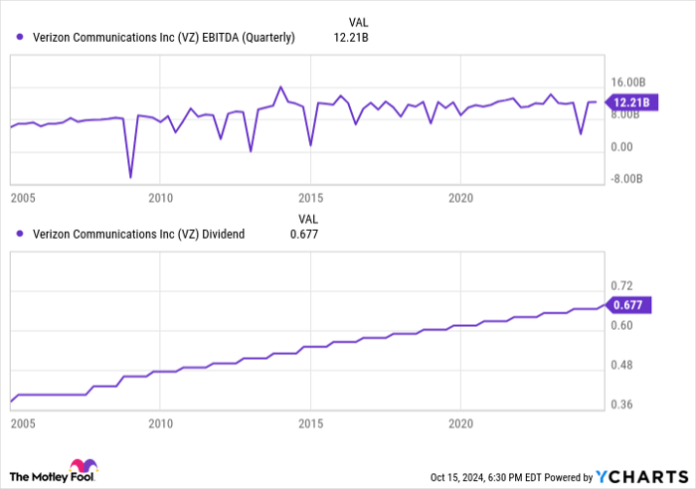

Despite these challenges, Verizon consistently demonstrates profitability that supports its reliable dividend payments. Americans are deeply attached to their mobile devices, spending hours checking their phones each day. This dependence ensures consumers are willing to pay for connectivity, and Verizon’s size allows it to offer competitive prices.

For investors, Verizon is appealing for its stability; the company has maintained quarterly dividends since its formation in 2000 and has raised its annual dividend every year since 2005. Currently, the stock offers a forward-looking yield of 6.3%.

3. Ambev

Finally, consider Ambev S.A. (NYSE: ABEV), which provides an attractive forward yield of almost 6.5%. Comprised of several beer companies, Ambev emerged from notable mergers, including the 2004 merger with Belgium’s Interbrew and the 2008 acquisition of Anheuser-Busch, which produces popular brands like Budweiser and Michelob.

While beer consumption has remained steady outside the U.S., inflation is impacting demand. The first half of this year saw Ambev’s beer sales slightly improving compared to last year, though growth remains tepid.

Nonetheless, the demand for premium beers is holding strong. Research shows that sales of premium beers are increasing faster than non-premium options. Additionally, Ambev is well-positioned to benefit from a cyclical recovery in beer consumption, as consumers often return to classic beverages over time.

Though its dividend payments can be inconsistent due to international operations, the company’s solid yield and long-term growth potential merit consideration.

Explore a Potentially Profitable Opportunity

Feeling like you missed out on investing in successful stocks? There are rare occasions when analysts recommend “Double Down” stocks, which they believe are about to rise significantly. If you’re concerned about missing your chance, now may be the perfect time to invest.

- Amazon: If you invested $1,000 when we doubled down in 2010, you’d have $21,121!

- Apple: Investing $1,000 when we doubled down in 2008 would yield $43,917!

- Netflix: A $1,000 investment from 2004 would now be worth $370,844!

Currently, we are issuing “Double Down” alerts for three exceptional companies, and this may be one of your last chances.

Discover 3 “Double Down” stocks »

*Stock Advisor returns as of October 14, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool recommends British American Tobacco P.l.c. and Verizon Communications and recommends the following options: long January 2026 $40 calls on British American Tobacco and short January 2026 $40 puts on British American Tobacco. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.