Sempra Energy Set to Announce Q3 Earnings: What to Expect

Sempra (SRE), based in San Diego, California, is a major player in the energy sector, handling the sale, distribution, storage, and transportation of electricity and natural gas. With a market capitalization of about $54 billion, it operates through several segments, including Sempra California, Sempra Texas Utilities, and Sempra Infrastructure. Investors are looking forward to the company’s Q3 earnings report, scheduled for Friday, November 1.

Quarterly Earnings Forecast: A Small Increase Expected

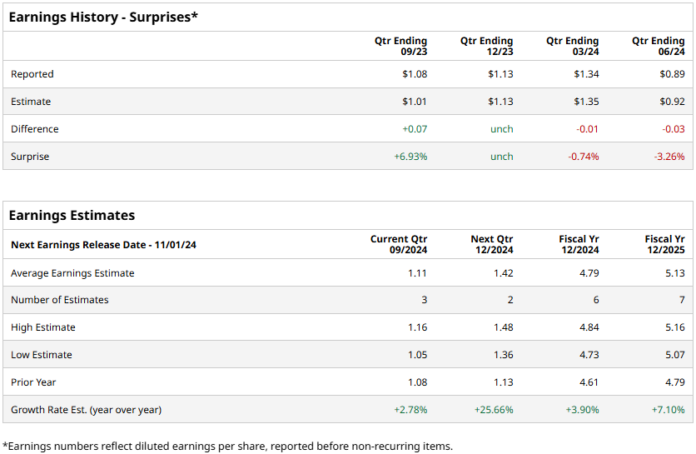

As the announcement approaches, analysts predict that Sempra will report earnings of $1.11 per share, reflecting a 2.8% increase from the $1.08 per share it reported in the same quarter last year. Over the past four quarters, the company has either surpassed or met Wall Street estimates twice but fell short on two occasions. In Q2, the adjusted earnings per share dropped 5.3% year-over-year to $0.89, missing analyst estimates by 3.3%.

Future Projections: Steady Growth in EPS

Looking ahead to fiscal 2024, analysts forecast an adjusted EPS of $4.79, which is a 3.9% rise from $4.61 in fiscal 2023. Expectations for fiscal 2025 predict a further increase of 7.1%, bringing the adjusted EPS to $5.13.

Year-to-Date Performance: Underperforming Compared to Peers

Year-to-date, Sempra shares have risen by 14.6%. However, this lags behind the S&P 500 Index’s 22.5% gain and the Utilities Select Sector SPDR Fund’s (XLU) returns of 29.8% during the same period.

Q2 Disappointment: Revenue Decline and Market Reaction

After a disappointing Q2 earnings release on August 6, when shares dropped 2.1%, Sempra faced challenges with its total revenue falling 9.7% year-over-year to $3 billion. This decline was largely due to a 10% drop in natural gas sales, which amounted to $1.5 billion, and a notable 39.9% decrease in revenues from energy-related businesses, which totaled $373 million. Despite an increase in net income from a $130 million tax benefit and higher equity earnings, the company’s operating margin fell by 5.5% to 10.2%, contributing to a significant 41.1% decrease in operating income to $308 million.

Analysts Remain Optimistic: A “Strong Buy” Consensus

In spite of these challenges, the outlook for Sempra stock remains positive. The consensus rating is a “Strong Buy,” with 12 out of 17 analysts recommending this option, while one analyst advises a “Moderate Buy” and four suggest a “Hold.” The average price target of $90.14 indicates a potential upside of 5.2% from current trading levels.

More Stock Market News from Barchart

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.