PepsiCo Thrives as a Dividend King with Recent Quarterly Results

Many investors recognize Dividend Aristocrats, which are S&P 500 companies that have consistently raised dividends for at least 25 years. But among the elite is the Dividend Kings group, featuring companies that have increased payouts for a staggering 50 consecutive years.

These companies demonstrate remarkable resilience, having weathered numerous economic storms while rewarding their shareholders over time. It’s important to note that not all Dividend Kings belong to the S&P 500. One member to consider for those seeking a reliable income stream is PepsiCo (PEP), which recently released its quarterly results. Let’s delve into the details.

PepsiCo’s Impressive Quarterly Performance

Following its latest quarterly report, PEP shares reacted positively. The company exceeded earnings per share (EPS) estimates, although it fell short of sales expectations. Notably, cost-cutting strategies highlighted the report, contributing to increased profitability.

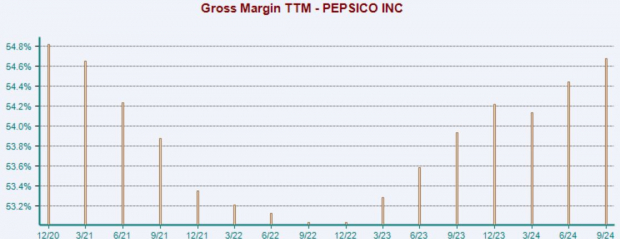

Below is a chart of PepsiCo’s gross margin on a trailing twelve-month basis.

Image Source: Zacks Investment Research

“Our businesses remained resilient in the third quarter, despite subdued category performance trends in North America, ongoing impacts from certain recalls at Quaker Foods North America, and business disruptions due to rising geopolitical tensions in some international markets. Strong cost controls aided our profitability, as we made incremental investments to improve our marketplace competitiveness,” stated Chairman and CEO Ramon Laguarta.

Throughout the quarter, PepsiCo paid out an impressive $7.2 billion in dividends, showcasing its commitment to shareholders. Below is a chart illustrating the dividends paid annually, calculated on a trailing twelve-month basis.

Image Source: Zacks Investment Research

The company’s valuation remains reasonable, with a current forward 12-month earnings multiple of 20.6X, below the five-year median of 23.6X. Although the PEG ratio sits at a steep 3.1X, it is still lower than the five-year highs of 4.9X and aligns with the five-year median.

Final Thoughts

PepsiCo (PEP), a leader in the consumer staples sector and a proud Dividend King, recently reported its quarterly results, which pleased investors with a strong stock response.

The company’s focus on cost-cutting measures has led to improved profitability, making its shares an appealing option for those seeking consistent quarterly dividends.

Massive Infrastructure Investment Looms Ahead

A significant initiative to rejuvenate the aging U.S. infrastructure is on the horizon. With bipartisan support, this urgent endeavor will involve trillions in spending and present substantial opportunities for investors.

The pressing question is: “Will you invest in the right stocks early when their growth potential is at its peak?”

Zacks has prepared a Special Report to assist you in this venture—available for free. It identifies five key companies likely to benefit the most from the extensive construction and repair of roads, bridges, buildings, as well as cargo hauling and energy transformation on a monumental scale.

Download FREE: How To Profit From Trillions On Infrastructure Spending >>

Interested in the latest recommendations from Zacks Investment Research? Download the report “5 Stocks Set to Double” today at no cost.

PepsiCo, Inc. (PEP): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.