Is Broadcom an AI Investment Worth Your Money?

Broadcom (NASDAQ: AVGO) has gained popularity in the realm of artificial intelligence (AI). Yet, choosing Broadcom isn’t as straightforward as investing in giants like Nvidia or Palantir, both of which rely heavily on AI for their revenue.

Broadcom stands out due to its extensive product range, making it a more diversified investment. This broad approach may limit the company’s ability to capitalize on significant tech trends. So, is Broadcom a wise choice for AI investment, or does its diversified portfolio hinder its growth in this crucial area?

Growth Driven by a Non-AI Segment

A visit to Broadcom’s website reveals an overwhelming array of products. The company offers both hardware and software, spanning cybersecurity, mainframe services, and connectivity tools. One of its best-performing software products is VMware, which Broadcom acquired.

Although VMware is instrumental in providing cloud-based virtual desktop services, it isn’t closely linked to AI. Nevertheless, VMware has significantly contributed to Broadcom’s revenue growth.

In the third quarter of fiscal year 2024 (ending August 4), Broadcom reported a 47% increase in revenue, reaching $13 billion. However, excluding VMware’s contributions—which were not factored into Q3 FY 2023—revenue growth dwindled to just 4%. This modest figure appears weak compared to rapidly growing AI-focused competitors.

Delving deeper, one can see that Broadcom’s AI-related products are showing strong performance.

Broadcom’s Stock Price: Is It Too High?

Broadcom’s most significant AI products include its connectivity switches and custom-designed accelerators, such as Alphabet‘s tensor processing unit (TPU). In Q3, custom accelerators saw a remarkable growth of 350% year over year, while ethernet switching devices surged 400%.

This growth is impressive, but it gets overshadowed by underperforming segments within Broadcom’s portfolio. Even so, Wall Street anticipates improvement, with 37 analysts projecting an average revenue growth of 17.5% for FY 2025, expecting AI trends to boost performance. But does that justify purchasing the stock now?

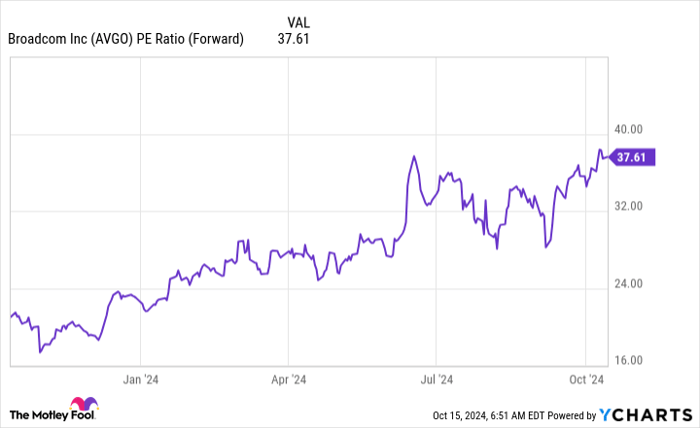

Broadcom’s stock trades at nearly 38 times forward earnings, indicating a substantial premium.

AVGO PE Ratio (Forward) data by YCharts.

The expectations are high, yet Broadcom has fallen short of them when VMware’s impact is excluded.

While Broadcom truly is a solid company with high-quality products, its diverse product offerings make it tough to gauge the specific impact of AI. The prevailing market sentiment suggests that the anticipated benefits from AI will become evident in 2025. Nevertheless, this seems overly optimistic, especially since AI advancements have been notable for about a year and a half.

There appear to be more promising AI stocks available that show faster growth and lower price tags, such as Alphabet or Meta Platforms. Broadcom may eventually prove its worth, but the current stock price seems too risky.

Should $1,000 Go Into Broadcom Now?

Before investing in Broadcom, consider this:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks to buy currently… and Broadcom isn’t one of them. The chosen stocks are projected to yield substantial returns over time.

For instance, when Nvidia made this list on April 15, 2005… if you had invested $1,000 at that recommendation, you’d have $839,122!*

Stock Advisor also guides investors through building successful portfolios, offering regular updates from analysts along with two new stock picks each month. The Stock Advisor service has more than quadrupled the S&P 500’s returns since 2002*.

See the 10 stocks »

*Stock Advisor returns as of October 14, 2024

Suzanne Frey, an executive at Alphabet, and Randi Zuckerberg, a former director of marketing at Facebook and sister to Meta Platforms CEO Mark Zuckerberg, are on The Motley Fool’s board. Keithen Drury holds positions with Alphabet and Meta Platforms, and The Motley Fool has investments in and recommends Alphabet, Meta Platforms, Nvidia, and Palantir Technologies. The Motley Fool also recommends Broadcom. For full disclosure, please see The Motley Fool’s policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.