Understanding Wall Street Ratings: A Closer Look at AMD

Investors often rely on Wall Street analysts’ recommendations when deciding whether to Buy, Sell, or Hold a stock. While these ratings can influence stock prices, how much should investors actually rely on them?

Before diving into the reliability of these brokerage recommendations, let’s examine what analysts currently say about Advanced Micro Devices (AMD).

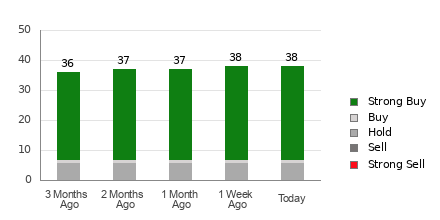

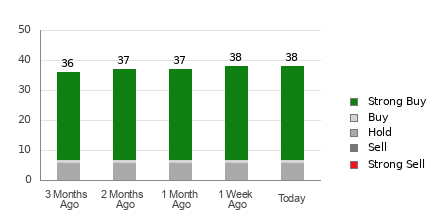

Currently, AMD has an average brokerage recommendation (ABR) of 1.34 on a scale from 1 to 5 (with 1 being Strong Buy and 5 being Strong Sell). This rating is based on recommendations from 38 brokerage firms. An ABR of 1.34 falls between Strong Buy and Buy.

Among the 38 brokerage recommendations, 31 are Strong Buy and one is Buy, representing 81.6% and 2.6% of the total recommendations, respectively.

Trends in Analyst Recommendations for AMD

Check price target & stock forecast for Advanced Micro here>>>

While the ABR suggests that investors should consider buying AMD, making investment decisions based solely on this information may not be prudent. Research has indicated that brokerage recommendations often fail to guide investors toward the stocks with the greatest potential for price increases.

What’s behind this? Brokerage firms often have vested interests in the stocks they cover, which can lead their analysts to display a biased perspective. For every “Strong Sell” recommendation, there are typically five “Strong Buy” ratings issued.

This discrepancy reveals that analysts’ interests do not always align with those of retail investors, frequently obscuring actual stock price trends. Thus, the best strategy may involve using this information to complement your own research or to support another reliable predictive tool.

The Zacks Rank is one such tool that holds a strong track record in predicting performance. The Zacks Rank categorizes stocks from #1 (Strong Buy) to #5 (Strong Sell) based on a robust, externally audited methodology. Pairing your insights with the Zacks Rank could enhance your decision-making process.

Distinguishing Between Zacks Rank and ABR

While both the ABR and the Zacks Rank use a scale from 1 to 5, they measure different factors.

The ABR is solely based on analyst recommendations and typically includes decimal points (for instance, 1.28). On the other hand, the Zacks Rank utilizes earnings estimate revisions to provide a clear, whole-number rating.

Brokerage analysts tend to adopt an overly optimistic view in their recommendations due to the interests of their firms, often misleading investors instead of guiding them accurately.

Conversely, the Zacks Rank is influenced by actual earnings estimate changes, which have been shown to correlate strongly with stock price movements in the short term according to research.

Another key point involves the timeliness of the ratings. The ABR may not always be up-to-date, while the Zacks Rank quickly reflects changes based on analysts’ updated earnings estimates, offering a more current outlook on stock performance.

Is AMD a Good Investment?

The Zacks Consensus Estimate for AMD’s current-year earnings has remained flat at $3.36 over the past month. However, analysts are increasingly pessimistic, as indicated by a consensus on lower EPS estimates, raising concerns about a potential decline in the stock’s value in the near future.

The recent changes in the consensus estimate, along with additional related factors, have led to a Zacks Rank of #4 (Sell) for AMD. For those interested in alternatives, you can view a list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Thus, while the ABR suggests a Buy for Advanced Micro, it is wise to consider this recommendation critically.

A Boom in Infrastructure Spending

A significant initiative to upgrade the aging infrastructure in the U.S. is on the horizon. This bipartisan effort is urgent and critical, with trillions expected to be spent. As a result, immense opportunities for profit could arise.

The crucial question is, “Will you invest early in the right stocks that have the highest growth potential?”

Zacks has put together a Special Report to assist investors, available for free. It outlines five companies poised to benefit significantly from the investment in infrastructure such as repairs to roads, bridges, and energy systems.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

For the latest insights from Zacks Investment Research, you can download “5 Stocks Set to Double” at no cost.

Advanced Micro Devices, Inc. (AMD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.