Apple’s Financial Outlook: Analyzing Earnings and Growth Potential

Apple (AAPL) has made waves on Zacks.com’s most searched stock list. Exploring key factors impacting the stock’s performance can provide valuable insights as we look ahead.

In the last month, shares of Apple, known for its iPhones and iPads, have increased by +1.3%. This is slightly behind the Zacks S&P 500 composite’s +1.4% gain. The Zacks Computer – Micro Computers industry, which includes Apple, has also posted a +1.4% increase during the same timeframe. A major question remains: What direction will the stock take next?

Earnings Estimates: A Key Indicator

At Zacks, assessing changes in a company’s future earnings estimates is our top priority. We believe that the present value of future earnings is crucial to determining a stock’s fair value.

We examine how sell-side analysts are adjusting their earnings estimates based on current business trends. If estimates rise, the stock’s fair value often increases, encouraging more investors to buy. Historical data demonstrates a strong link between earnings estimate revisions and near-term price movements.

For the current quarter, Apple is projected to earn $1.54 per share, a +5.5% increase from the same period last year. However, the Zacks Consensus Estimate has slightly decreased by -0.9% over the last month.

For the current fiscal year, the consensus earnings estimate stands at $6.65, signaling an +8.5% year-over-year change. This figure has seen a marginal reduction of -0.2% in the past 30 days.

Looking to the next fiscal year, analysts expect earnings of $7.53, reflecting a +13.3% increase from last year. This estimate has also fallen by -0.2% recently.

Our proprietary stock rating tool, the Zacks Rank, combines the size of recent consensus estimate changes with other earnings-related factors, leading to a Zacks Rank #3 (Hold) for Apple.

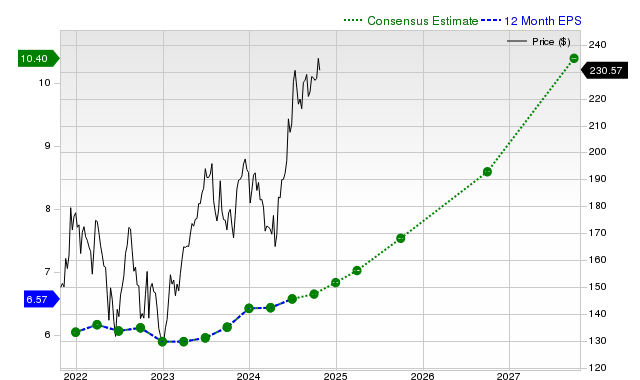

The chart below illustrates the changes to the company’s forward 12-month consensus EPS estimate:

12 Month EPS

Revenue Growth Predictions

While earnings growth is a significant indicator of financial health, sustained earnings increases are tied to revenue growth. Understanding a company’s revenue potential is essential for evaluating future performance.

Apple’s consensus sales estimate for the current quarter is $94.43 billion, reflecting a +5.5% year-over-year increase. The estimates for the current and next fiscal years stand at $390.54 billion and $421.48 billion, indicating +1.9% and +7.9% changes, respectively.

Recent Performance and History of Surprises

In its last reported quarter, Apple announced revenues of $85.78 billion, marking a +4.9% year-over-year growth. For this quarter, earnings per share (EPS) were $1.40, up from $1.26 a year prior.

When compared to the Zacks Consensus Estimate of $84.43 billion, reported revenues exceeded expectations by +1.59%. The EPS also surprised by +4.48%.

Notably, Apple has consistently outperformed consensus EPS estimates in the last four quarters and has exceeded revenue expectations each time.

Valuation Analysis

Understanding a stock’s valuation is vital to making informed investment decisions. It’s essential to determine if a stock’s current price accurately reflects its intrinsic value and future growth prospects.

By comparing present valuation multiples like price-to-earnings (P/E), price-to-sales (P/S), and price-to-cash flow (P/CF) to historical figures, investors can ascertain whether a stock is appropriately valued. Relative comparisons to peers also provide context on the stock’s valuation.

The Zacks Value Style Score evaluates both traditional and unconventional metrics to grade stocks from A to F, with a grade of D for Apple indicating it is trading at a premium compared to its competitors. Click here to review valuation metrics affecting this grade.

Final Thoughts

The insights above, along with other information available on Zacks.com, may help you decide how much credence to give to the current market buzz surrounding Apple. With a Zacks Rank #3, Apple is likely to perform in line with the overall market in the near term.

7 Top Stocks for the Next Month

Experts have identified 7 standout stocks from a list of 220 Zacks Rank #1 Strong Buys, anticipating “Most Likely for Early Price Pops.”

Since 1988, this full list has consistently outperformed the market, boasting an average gain of +23.7% per year. Therefore, these carefully selected stocks merit your immediate attention.

See them now >>

For the latest recommendations from Zacks Investment Research, download 5 Stocks Set to Double. Click here for your free report.

Apple Inc. (AAPL): Free Stock Analysis Report

To read the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.