ServiceNow Eyes Strong Q3 Earnings Boost Amid Expanding Clientele

ServiceNow NOW is set to announce its third-quarter 2024 results on July 24.

The Zacks Consensus Estimate indicates second-quarter revenues will reach $2.74 billion, showcasing a 19.78% increase from last year.

Expected earnings for this period stand at $3.46 per share, reflecting an 18.49% rise compared to the same quarter last year. Notably, this earnings projection has remained steady for the past month.

Historically, ServiceNow has consistently outperformed expectations, beating the Zacks Consensus Estimate in each of the last four quarters, with an average surprise of 11.21%.

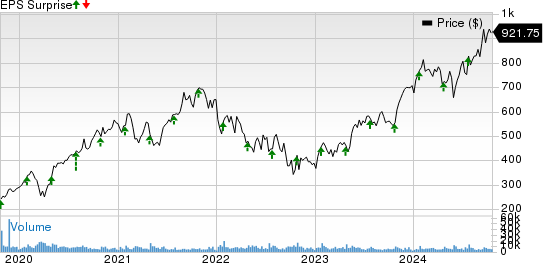

ServiceNow, Inc. Price and EPS Surprise

ServiceNow, Inc. price-eps-surprise | ServiceNow, Inc. Quote

Stay informed with all quarterly releases: Check out Zacks Earnings Calendar.

Let’s explore what to expect leading up to this announcement.

Third-Quarter Revenue Expectations

ServiceNow forecasts third-quarter 2024 subscription revenues between $2.66 billion and $2.67 billion, translating to a year-over-year increase of 20-20.5% based on GAAP. When adjusted for constant currency, subscription revenues are expected to show growth in the 20.5% range.

The Zacks Consensus Estimate for third-quarter 2024 subscription revenues is at $2.663 billion, which represents a 20.2% year-over-year growth.

ServiceNow’s progress is backed by an expanding client base, as businesses continue embracing its digital workflow solutions. As of the second quarter of 2024, the company had 1,988 customers contributing over $1 million in annual contract value (ACV), marking a 15% increase year-over-year.

Additionally, the company secured eight deals worth more than $14 million in new ACV and four deals over $10 million. In total, ServiceNow completed 88 deals greater than $1 million in net new ACV, with a 40% year-over-year rise in customers generating over $20 million.

Moreover, in the second quarter of 2024, Generative AI contracts gained momentum, resulting in net new ACV for Now Assist doubling sequentially and featuring in 11 deals valued at over $1 million.

This positive trajectory is expected to continue into the third quarter of 2024.

Stock Performance Overview

ServiceNow shares have returned 30.5%, outperforming the Zacks Computer & Technology sector, which appreciated 19.7%, and the Zacks Computers – IT Services industry, which grew by 12.5%.

Year-to-Date Performance Chart

Image Source: Zacks Investment Research

Despite this strong performance, ServiceNow is currently viewed as overvalued, with a Value Score of F. The forward 12-month P/S ratio sits at 14.97X, well above the sector’s 6.21X and the industry’s 11.1X averages.

Price/Earnings (P/E) Ratio

Image Source: Zacks Investment Research

Innovations Driving Growth

ServiceNow’s expansion is fueled by its commitment to innovation as businesses navigate digital transformation. Its growing expertise in Generative AI and strong partnerships contribute to favorable prospects.

By integrating artificial intelligence and machine learning into its offerings, ServiceNow enhances its solutions. The recent update, Xanadu, provides AI-enhanced, industry-specific solutions across various sectors such as telecommunications, financial services, and public service.

Additionally, the platform’s Washington, D.C. update introduced advanced features aimed at improving operations and productivity while promoting the use of Generative AI.

The Xanadu update extends AI functionalities to enhance customer adaptability and streamline processes, impacting areas like Security, Sourcing, and Procurement Operations.

ServiceNow intends to implement Agentic AI in its platform, targeting the provision of 24/7 productivity for Customer Service Management and IT Service Management AI Agents, designed to boost efficiency in issue resolution.

Moreover, a solid partner network, including Visa, Microsoft MSFT, NVIDIA NVDA, IBM, Genesys, Fujitsu, Equinix, Boomi, and Infosys, reinforces ServiceNow’s AI capabilities.

Market Outlook

With a robust Generative AI portfolio and a strong partner ecosystem, ServiceNow is well-positioned for long-term revenue growth. Its current Growth Style Score of A makes it an attractive option for investors, even amid elevated valuations.

Holding a Zacks Rank #2 (Buy), it may be an opportune moment for investors to consider accumulating ServiceNow stocks ahead of the upcoming third-quarter report.

Zacks Highlights Top Semiconductor Stock

While NVIDIA has gained over +800% since our recommendation, our latest semiconductor pick presents significant growth potential.

As strong earnings and a growing customer base propel demand for Artificial Intelligence, Machine Learning, and the Internet of Things, the global semiconductor market is projected to leap from $452 billion in 2021 to $803 billion by 2028.

Explore this stock for free now >>

Want the latest recommendations from Zacks Investment Research? Download the report on 5 Stocks Set to Double today.

Microsoft Corporation (MSFT) : Free Stock Analysis Report

International Business Machines Corporation (IBM) : Free Stock Analysis Report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

ServiceNow, Inc. (NOW) : Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.