Nuclear Energy Companies Surge Amid AI Boom

Nuclear energy stocks and uranium companies have seen significant gains over the past month as investors shift their focus to sectors expected to energize the artificial intelligence (AI) era.

Notable names such as NuScale Power, Oklo, Cameco, and Centrus Energy have all experienced substantial increases since Microsoft’s announcement of a significant nuclear energy deal with Constellation on September 20. Following this, both Google and Amazon made high-profile investments in nuclear energy to support their AI initiatives.

Stay Updated with the Zacks Earnings Calendar.

In late 2023, the U.S. led an initiative with other countries to commit to tripling nuclear energy capacity by the year 2050.

Why Nuclear Energy Stocks Are Gaining Attention

Nuclear energy is rapidly becoming a central player in the clean energy movement. According to the U.S. Department of Energy, it is twice as reliable as natural gas and three times more dependable than wind and solar. In 2023, nuclear power accounted for 50% of the nation’s carbon-free electricity, solidifying its role as a major source of clean energy.

Support from the U.S. government is driving the revival of the nuclear industry. Legislation is in place to facilitate the deployment of next-generation small modular reactors and boost uranium production, making it easier for tech giants to invest in nuclear energy to meet their growing power demands.

Recently, Amazon announced a commitment to nuclear energy as part of its strategy to power its AI growth, making a deal with Talen, a nuclear power company, earlier in the year. This step followed Alphabet’s (Google) partnership with Kairos Power, a next-gen nuclear energy startup.

Other major tech players, including Apple, Nvidia, and Meta, are also expected to pursue nuclear energy solutions to ensure consistent and clean power supply for their AI operations.

Since early September, stocks of NuScale Power (SMR), Cameco (CCJ), and Centrus Energy Corp. (LEU) have all surged by at least 50%, with Oklo seeing an almost 200% increase, benefiting from investor interest.

Is NuScale Power Stock a Smart Investment?

NuScale Power CorporationSMR is leading in the development of advanced small modular reactor technology. It is the first small modular nuclear reactor company with its design certified by the U.S. Nuclear Regulatory Commission, allowing energy production in more locations more efficiently.

The company has formed various partnerships across Europe, North America, and Asia to advance small modular reactors.

However, NuScale’s stock can be considered a high-risk option. Currently, it is heavily shorted and facing losses, with anticipated revenue declining by 10% in 2024 to $20.4 million before a projected surge of 954% to $215 million in FY25.

Image Source: Zacks Investment Research

NuScale’s stock price has surged roughly 160% since September 6 and is up 450% year-to-date. On Wednesday, SMR shares reached new record highs, surpassing previous peaks set in August 2022 and July 2024.

Currently, SMR stock is trading at high relative strength index (RSI) levels and above its 21-day moving average, indicating potential volatility. Investors may wish to wait for a pullback to safer levels before acquiring shares.

For those looking to minimize risk, investing in Fluor (FLR) stock could be a better option, as Fluor holds a 51% stake in NuScale Power. Fluor is working towards selling most of its NuScale shares to a strategic investor focused on commercialization. Fluor stock increased by 8% on Wednesday.

There exists potential for a major tech company to acquire a significant position in NuScale Power, with the firm set to release its Q3 financial results on Thursday, November 7.

Centrus Energy: A Reliable Nuclear and Uranium Investment

Centrus Energy Corp.LEU provides a variety of nuclear fuel components and services to commercial nuclear power plants across the U.S.

“`html

Uranium Industry Leaders Shine with New Developments and Promising Projections

Two key players, Centrus Energy and Cameco, are taking the spotlight as they navigate the evolving nuclear energy landscape.

Centrus Energy: A New Era of Uranium Enrichment

The Bethesda, Maryland-based Centrus Energy Corporation has marked a significant milestone by opening the first U.S.-owned uranium enrichment plant to start production since 1954. This facility aims to meet the growing demand for nuclear fuel as the industry looks to the future.

In 2023, Centrus supplied High-Assay Low-Enriched Uranium (HALEU) to the U.S. Department of Energy. While standard nuclear reactors use uranium enriched to 5%, HALEU, which has an enrichment of 5% to 20%, is essential for next-generation Small Modular Reactors (SMRs).

Strategically, Centrus has collaborated with companies pursuing innovations in small modular reactors, such as TerraPower, supported by Bill Gates. Their recent performance was strong; the company reported a ‘beat and raise’ second quarter. CEO Daniel H. Barlow highlighted that the uranium enrichment sector stands to benefit from over $3.4 billion in congressional appropriations, which represent the most significant federal investment in uranium enrichment in decades.

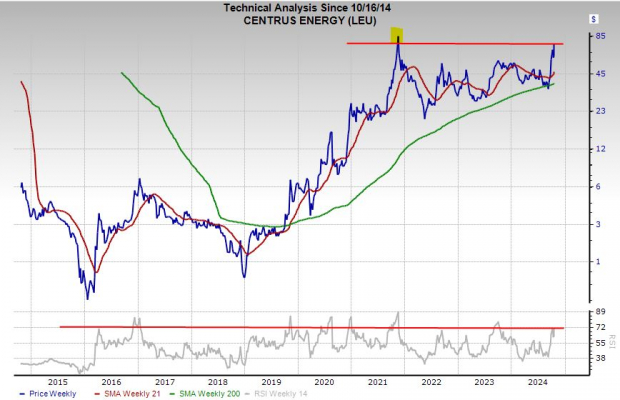

Image Source: Zacks Investment Research

Centrus’ optimistic earnings forecast has earned it a Zacks Rank #1 (Strong Buy) rating. The stock has surged 110% since September 6, bouncing back from its 200-week moving average. To regain its position from late 2021, where it hit a 10-year high, Centrus must surpass these levels before reaching pre-financial crisis figures.

Investors may wish to consider waiting for Centrus stock to stabilize after its rally. However, this could be a worthwhile long-term investment for those looking to capitalize on uranium and the revival of U.S. nuclear energy.

Cameco: The Leading Uranium Producer to Own

Canada’s Cameco Corporation, ticker CCJ, is a major player in the uranium mining sector. This company specializes in uranium refining, conversion, and fuel manufacturing services, positioning itself as one of the few large-scale producers accessible to everyday investors. Notably, Kazakhstan accounts for 43% of global uranium production, which can be compared to OPEC’s approximate 40% in crude oil.

Cameco ranks as the second-largest uranium producer worldwide, according to the World Nuclear Association, and operates two of the highest-grade uranium mines situated in northern Saskatchewan, Canada. The company has maintained its optimistic outlook for 2024, with CEO Tim Gitzel noting growing full-cycle support for nuclear energy.

Image Source: Zacks Investment Research

Projected adjusted earnings for Cameco indicate significant growth heading into 2024 and 2025, driven by double-digit revenue increases. However, recent downturns in uranium prices have led to some downward revisions in earnings forecasts.

Over the past five years, Cameco’s stock has skyrocketed by 500%. Since early September, CCJ has risen 50% after finding support near its 52-week lows and bouncing off its 21-month moving average, nearing its 52-week highs as of Wednesday.

Cameco is on the verge of entering a new trading range as it advances past its 2007 levels. The company is well-positioned to benefit from an emerging era of nuclear energy. Wall Street analysts are notably enthusiastic about Cameco, with 11 out of 13 brokerage recommendations categorized as “Strong Buys,” alongside two “Buys.” Additionally, Cameco offers a dividend with a sustainable payout ratio, further enhancing its appeal to investors.

Exclusive Opportunity: Access Zacks’ Insights for Just $1

In a unique offer, Zacks Investment Research provides 30-day access to its stock recommendations for only $1, allowing new users to sample its portfolio services.

Thousands of investors have taken advantage of this deal, while others remain skeptical, believing there may be a catch. However, Zacks’ motive is simple: to introduce users to various trading services that reported gains of double- and triple-digits in 2023.

For immediate stock recommendations, check out: 5 Stocks Set to Double, available for free. Other reports include Amazon.com, Inc. (AMZN), Cameco Corporation (CCJ), Alphabet Inc. (GOOGL), Centrus Energy Corp. (LEU), NuScale Power Corporation (SMR), and Oklo Inc. (OKLO).

If you’d like to access the full Zacks article, click here.

The views expressed here reflect the author’s opinion and do not necessarily represent those of Nasdaq, Inc.

“`