Tesla Prepares to Unveil Q3 Earnings: What to Expect

Tesla (TSLA) will announce its third-quarter 2024 results this Wednesday after the market closes. Currently, the Zacks Consensus Estimate for this quarter’s earnings stands at 58 cents per share, with expected revenues of $25.6 billion.

Stay updated with quarterly releases: Check out Zacks Earnings Calendar.

Recent Adjustments to Earnings Projections

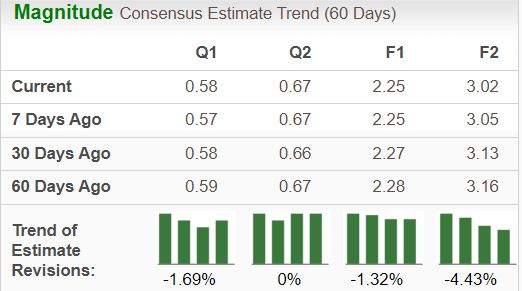

Over the past week, analysts have slightly increased their earnings estimate by 1 cent for the upcoming quarter; nonetheless, this figure reflects a year-over-year decrease of 12.12%. The revenue estimate of $25.6 billion suggests a 9.5% increase compared to last year.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Looking at the wider picture, the Zacks Consensus Estimate for TSLA’s annual revenue is currently $98.7 billion, indicating a modest rise of 2% year-over-year. However, the EPS estimate for 2024 reflects a more significant contraction of around 28%, projected at $2.25 per share.

Historically, Tesla has struggled with earnings estimates, missing expectations in all four previous quarters, resulting in an average negative surprise of 8%.

Tesla’s Price and Earnings Surprises

Tesla, Inc. price-eps-surprise | Tesla, Inc. Quote

Assessment of Tesla’s Earnings Outlook

Tesla’s earnings prediction for this quarter is unclear based on our model. Usually, a favorable Earnings ESP combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold) boosts the chances of a positive earnings result. However, current conditions do not meet this requirement. Notably, TSLA has an Earnings ESP of -1.28% and a Zacks Rank of #2.

Key Factors Influencing Q3 Performance

During the third quarter, Tesla produced 469,796 vehicles, including 443,668 of the Model 3 and Model Y. The company delivered 462,890 vehicles globally, slightly falling short of the Zacks Consensus Estimate of 471,599 vehicles. This was, however, the first year-over-year increase in deliveries in 2024, marking a 4.3% growth from the prior quarter.

Estimated automotive revenues for this quarter are $22.2 billion, up 13% compared to last year. To enhance sales, the company has implemented several price cuts and incentives, which may have affected profit margins. The expected gross margin in the automotive sector is now 18.3%, a decrease from 18.7% last year.

Despite the pressure on automotive margins, Tesla’s energy generation and storage business continues to thrive, largely driven by demand for its Megapack and Powerwall products. Revenue from this segment is projected to be $2.16 billion, a 39% increase compared to the previous year, with gross profit expected to rise over 45%.

The Services and Other unit is also set to generate $2.3 billion in revenues, up from $2.16 billion last year, primarily due to an expanding supercharging network. Notably, major automakers like General Motors (GM), Ford (F), and Stellantis (STLA) are adopting Tesla’s NACS charging standard, which should improve this segment’s future prospects.

Tesla’s Stock Performance and Valuation

Thus far in 2024, Tesla shares have dipped around 11%. Although this is an improvement over the performance of the industry and sector, it still lags behind the S&P 500’s growth.

Year-to-Date Price Comparison

Image Source: Zacks Investment Research

From a valuation standpoint, Tesla appears slightly overvalued. Its price-to-sales ratio is currently at 6.38, significantly higher than the industry average of 1.57, although it is below its own five-year average.

Image Source: Zacks Investment Research

Strategizing for TSLA Ahead of Q3 Earnings

Tesla is grappling with the challenge of narrowing automotive margins. Recent developments, such as the Robotaxi event held on October 10, have raised investor concerns due to a lack of specific details about scaling its ridesharing platform. CEO Elon Musk did not address vital issues, including the timeline for Robotaxi production and potential regulatory hurdles.

Despite these challenges, Tesla is pushing forward with technological advancements. The launch of its humanoid robot project, Optimus, alongside the rollout of the Full Self-Driving (FSD) Beta software (V12.5) signifies its commitment to innovation. Moreover, the company aims to produce new, affordable EV models, which could fuel future growth. The Energy Generation and Storage division remains the most profitable, while the expanding NACS charging network shows promise for additional revenue streams. With solid liquidity and low debt, Tesla is well-positioned to pursue new growth opportunities.

As investors await the third-quarter earnings release, attention will be on Tesla’s revenue growth, profitability, and cash flow performance to assess the company’s overall financial health.

Following the Robotaxi event, Tesla’s stock experienced a notable decline, giving caution to some investors. In contrast, Cathie Wood’s Ark Invest seized the opportunity, purchasing nearly $3 million worth of Tesla shares. Known for capitalizing on stock pullbacks, Ark Invest’s move illustrates that some long-term investors view this dip as a potential buying chance, regardless of the forthcoming earnings results.

Zacks Highlights Top Semiconductor Stock

While this stock is just a fraction of NVIDIA, which has gained over 800% since our recommendation, it holds great potential for future growth.

With robust earnings growth and a broadening customer base, this stock is positioned to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. The global semiconductor manufacturing market is expected to surge from $452 billion in 2021 to $803 billion by 2028. See This Stock Now for Free >>

Would you like the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Ford Motor Company (F): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Stellantis N.V. (STLA): Free Stock Analysis Report

To read the full article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.