Banking Sector Optimism

The banking sector is basking in a brighter glow this year than in the turmoil of 2023, thanks to a clearer view of the Federal Reserve’s rate trajectory and the likelihood of a gentle descent for the U.S. economy. This newfound confidence has sparked investor excitement in financial institutions, making it a prudent time for financial enthusiasts to cast their gaze towards resilient banks offering generous dividends.

A Closer Look at Truist Financial

At the forefront of attention is Truist Financial Corporation (TFC), a financial giant headquartered in Charlotte, NC. Formed through the marriage of BB&T Corp and SunTrust Banks in late 2018, Truist stands tall as one of the largest commercial banks in the United States.

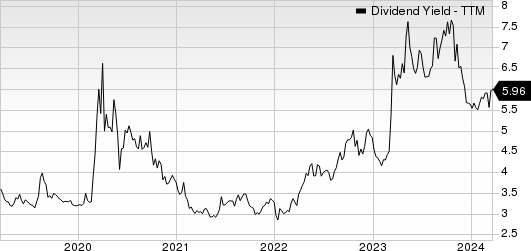

Impressive Dividend Yield

For shareholders eyeing a steady income stream, Truist has been paying a quarterly dividend of 52 cents per share since 2022. Over the past five years, the bank has raised the dividend three times, boasting an annualized growth rate of 5.24%. With a current dividend yield of 5.96%, Truist outshines the industry average of 3.81%, painting an attractive picture for income-seeking investors.

Strategic Financial Moves

Despite the external accolades, Truist is not without its own internal restructuring endeavors. The bank recently made headlines with agreements to sell off its remaining 80% stake in its insurance subsidiary, Truist Insurance Holdings, along with its asset-management arm, Sterling Capital Management LLC. Although such moves triggered reactions from rating agencies like Fitch and Moody’s, signaling a potential shake-up in the bank’s operations, these decisions are part of a larger strategy to sharpen the focus on core banking activities.

Financial Strategy for Stability and Growth

Truist has been actively revamping its financial structure, including a $750-million cost-cutting initiative, a 4% reduction in workforce, and a business consolidation strategy. These adjustments are expected to yield cost savings despite a slight increase in adjusted non-interest expenses projected for the year. The bank’s net interest income saw a significant uptick in 2023, driven by factors such as robust loan demand and the effects of the merger. Looking ahead, while NII may face challenges from declining loan demand and rising deposit costs, Truist remains optimistic about its growth prospects in the coming years.

Upward Trajectory

Despite near-term hurdles, including concerns about asset quality and revenue diversification, Truist Financial showcases resilience in its ability to navigate challenges and sustain profitability. In the last six months, the bank’s shares have soared by 23.2%, underscoring investor confidence in the institution’s trajectory compared to industry peers.

A Potent Investment Opportunity

For investors seeking a blend of stability and growth potential, Truist Financial emerges as a compelling choice. With a Zacks Rank #3 (Hold) designation, the stock holds promise for generating robust returns over time, marking it as a key contender worth monitoring.

As the financial landscape continues to evolve, Truist stands poised to weather the storms and harness opportunities that lie ahead, offering investors a chance to partake in the bank’s journey towards sustained success.