SM Energy Faces Challenges as Earnings Estimates Decline Amid Falling Oil Prices

SM Energy Co. (SM) is grappling with decreasing energy prices as 2024 approaches, prompting analysts to revise their earnings estimates downward. SM currently holds a Zacks Rank of #5 (Strong Sell).

This independent energy company focuses on exploring and producing crude oil, natural gas, and natural gas liquids (NGLs) primarily in Texas and Utah. With a market capitalization of $5.2 billion, it remains a key player in the energy sector.

Recent Downward Adjustments: Analysts Lower Earnings Estimates

In the energy industry, oil prices significantly influence the earnings of companies engaged in oil exploration and production. Many firms, including SM Energy, are unhedged, meaning they have not locked in prices for their oil, leaving them to navigate the fluctuating market.

Initially, expectations were that oil prices would stay elevated. However, prices have decreased recently from approximately $80 per barrel to a range of $70 to $75.

Consequently, two earnings estimates for SM Energy have been reduced over the past month for 2024, with three estimates also adjusted downward for 2025. Interestingly, despite the current low prices, one estimate has been increased for both 2024 and 2025 in the last week.

Shifts in Zacks Consensus Estimates Reflect Market Conditions

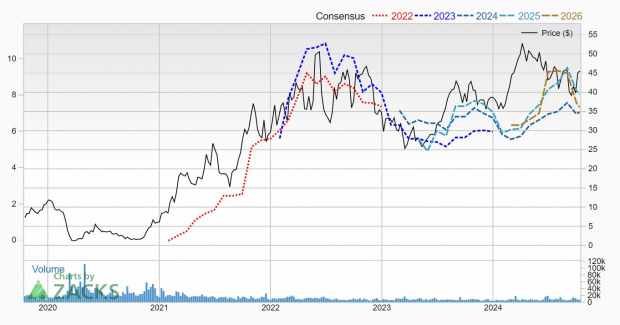

In the past 30 days, the Zacks Consensus Estimate for 2024 has dropped from $7.57 to $7.06 due to these lowered earnings projections. Despite this adjustment, the new estimate represents a 19.9% increase compared to the $5.89 earnings from last year.

Similarly, the 2025 Zacks Consensus Estimate fell from $9.50 to $8.03 over the same period. This still suggests a potential growth of 13.8%, assuming 2024 earnings align with the revised consensus.

The accompanying price and consensus chart indicates a decline, but it remains relatively stable compared to prior years.

Image Source: Zacks Investment Research

Stock Performance: SM Energy Struggles but Remains Undervalued

In 2024, SM Energy shares have lagged behind the S&P 500, reflecting the broader struggles of energy stocks this year, although they have still managed to post yearly gains.

Image Source: Zacks Investment Research

Despite these challenges, SM Energy appears undervalued, boasting a forward P/E ratio of 6.5. Stocks priced under 10 times earnings are generally considered value investments.

Additionally, the company has a price-to-book (P/B) ratio of 1.4, where a ratio below 3.0 also signals value potential. SM Energy remains committed to shareholder value, as evidenced by its 11% increase in the fixed quarterly dividend announced in June 2024, with a current yield of 1.6%. A $500 million share repurchase program has also been authorized, intended to last until the end of 2027.

Investors should note that SM Energy is set to release its third-quarter earnings on October 31, 2024, after market close. Considering the current environment, it might be wise to wait for a rebound in crude oil prices before making investment decisions. Monitoring SM Energy as it adjusts to these market dynamics could be beneficial.

Explore the 7 Best Stocks for the Upcoming Month

Recently, experts have identified 7 standout stocks from a list of 220 Zacks Rank #1 Strong Buys, which they believe are likely to experience significant price increases soon.

Historically, this selected group has consistently outperformed the market since 1988, achieving an average annual gain of +23.7%. These picks are worthy of immediate investor attention.

For more investment insights, consider downloading the report on 5 Stocks Set to Double.

SM Energy Company (SM): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.