The Wall Street story of 2023 was the mega-cap tech-heavy Nasdaq 100 Index (QQQ), which rose a robust 50% and was buoyed by members of the “Magnificent 7” stocks such as Microsoft (MSFT) and Meta Platforms (META). Bolstered by the AI revolution, tech stocks such as Nvidia (NVDA) and Advanced Micro Devices (AMD) have displayed little signs of slowing as each hit fresh 52-week highs Tuesday. However, because the best performers rarely achieve back-to-back top performances, investors looking at historical data may want to keep an open mind to other market areas. For example, growth stocks led the way in 2023, commodities in 2022, and large-cap stocks in 2021. This begs the question, is it time to take a closer look at small-cap stocks in 2024?

Reversion to the Mean Potential

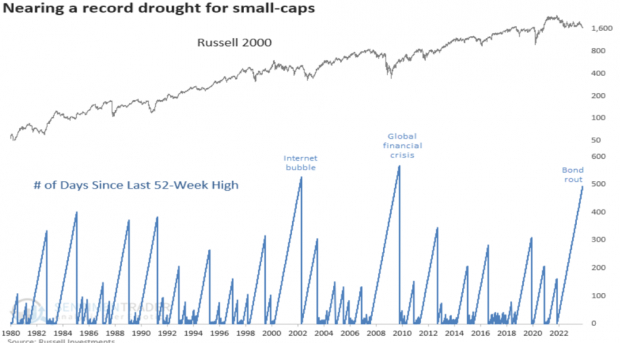

Until the Russell 200 Index notched fresh 52-week highs late last year, the index went more than 500 days without making a 52-week high – its worst drought ever (longer than the Internet Bubble and the Global Financial Crisis!). The significant underperformance sets up a potential reversion to the mean trade, that is, a trade placed with the strategy of anticipating that an asset’s price, which has deviated significantly from its historical average, will revert back to that average.

Image Source: SentimenTrader, Russell Investments

Strength Begets Strength

The Russell 2000 gained 21.9% in the two months ending 2023 – some of its most robust two-month gains ever. Since 1982, the Russell 2000 has gained more than 18.5% in 11 instances. In 100% of the cases, the Russell was higher six months later for an average gain of 19.2%. In other words, historical data supports the trade.

Image Source: Ryan Detrick, Carson Research

Technical Set Up

After three straight weeks of pulling back, the Russell 2000 Index ETF (IWM) is approaching an attractive reward-to-risk zone (the 1st pullback to its 10-week moving average).

Image Source: TradingView

Dovish Fed Favors Small Caps

The CME Group’s FedWatch tool indicates that market participants anticipate six interest rate cuts in 2024. Lower interest rates are generally considered better for small-cap stocks because they reduce the cost of borrowing for businesses. Small-cap companies often rely on loans to fund their operations and expansion. When interest rates are lower, these companies can access capital at a more affordable rate, leading to lower interest expenses and improved profit margins.

Bottom Line

Mega-cap tech stocks enjoyed a positive outlier year in 2024. However, investors may want to explore other market areas in 2024, particularly small-cap stocks. Evidence to the long side is mounting, including reversion to the mean potential, momentum signals, and a high reward-to-risk technical zone.

Just Released: Zacks Top 10 Stocks for 2024

Hurry – you can still get in early on our 10 top tickers for 2024. Hand-picked by Zacks Director of Research, Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2023, the Zacks Top 10 Stocks gained +974.1%, nearly TRIPLING the S&P 500’s +340.1%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2024. You can still be among the first to see these just-released stocks with enormous potential.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.