S&P Global SPGI shares have soared by a remarkable 23.6% in the past year, effortlessly outperforming the 20.9% growth of the vast technology services industry to which it belongs.

The recent fourth-quarter figures from SPGI painted a mixed picture – while earnings per share came in at $3.13, missing the Zacks Consensus Estimate by 0.6%, they still managed to surge by an impressive 23.2% compared to the previous year. Revenues of $3.2 billion not only exceeded the consensus estimate by 0.5% but also showed a robust 7.3% year-over-year growth, driven by stellar performances across all divisions.

The Strategic Steps of S&P Global

SPGI’s growth trajectory has been buoyed by the successful launch of innovative services that have significantly bolstered its positioning in the market. The introduction of the Supply Chain Console by S&P Global Market Intelligence and the S&P Global Canada Services Purchasing Managers’ Index have had a positive impact. Additionally, Platts (S&P Global Commodity Insights) inclusion of the daily assessment of Southeast Asia LNG cargo has heightened price transparency.

Strategic acquisitions have also played a pivotal role in S&P Global’s growth narrative. Recent acquisitions of Market Scan Information Systems and ChartIQ in 2023 have ramped up mobility services and fortified S&P Global Market Intelligence, respectively. Furthermore, the acquisition of Shades of Green business in 2022 strengthened second-party opinions. Not to overlook the game-changing merger with IHS Markit, sealing its transformative impact on data and analytics offerings post the completion on Feb 28, 2022.

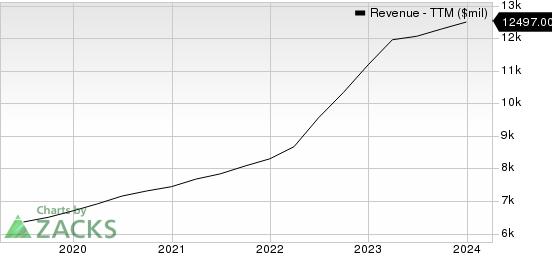

The Revenue Growth of S&P Global Inc.

S&P Global Inc. revenue-ttm | S&P Global Inc. Quote

S&P Global’s commendable practice of rewarding its shareholders via share repurchases and dividend payouts has struck a chord with investors. Noteworthy disbursements totaled $1.1 billion in dividends and $3.3 billion in share repurchases in 2023. The previous year saw dividends and share repurchases amounting to $1 billion and $12 billion respectively. Even in 2021, S&P Global returned $743 million to shareholders through dividend payments. These strategic initiatives have not only bolstered investor confidence but have also had a positive impact on the company’s bottom line, underpinning the impressive 23.6% escalation in S&P Global shares over the last year.

However, S&P Global is noticing an uptick in expenses due to investments in ongoing productivity programs, augmented compensation costs sparked by investments in growth initiatives, and the completion of acquisitions alongside escalated incentive costs. Consequently, the future earnings of the firm are deemed susceptible to pressure.

As of the end of the fourth quarter of 2023, S&P Global’s current ratio, an indicator of its liquidity, stood at 0.84. This marked a decline from the 0.92 recorded at the end of the previous quarter and a dip from the year-ago quarter’s reading of 0.94. A current ratio less than 1 can intimate potential challenges in meeting short-term obligations.

Expert Opinions and Alternative Stocks to Explore

Presently, S&P Global holds a Zacks Rank #3 (Hold).

For investors seeking other options in the broader Zacks Business Services sector, Core & Main CNM and The Hackett Group HCKT are worth considering.

Core & Main currently boasts a Zacks Rank of 1 (Strong Buy) with a long-term earnings growth prognosis of 12%. For more choices, check out the complete list of today’s Zacks #1 Rank stocks here.

Over the past four quarters, Core & Main has exceeded earnings expectations by an average of 1.5%.

The Hackett Group currently holds a Zacks Rank of 2 (Buy). The company has a long-term earnings growth expectation of 13.5%.

HCKT has surpassed earnings estimates by an average of 2.6% over the last four quarters.

Discover Lucrative Opportunities in Oil Stocks

The global thirst for oil is insatiable…and oil producers are grappling to keep up. Despite oil prices retracting from recent peaks, companies in the oil supply chain are poised for substantial gains.

Don’t miss out on the critical insights shared in Oil Market on Fire, highlighting four unanticipated oil and gas stocks well-positioned for significant profits in the imminent weeks and months.

Claim your complimentary report now.

The Hackett Group, Inc. (HCKT) : Free Stock Analysis Report

S&P Global Inc. (SPGI) : Free Stock Analysis Report

Core & Main, Inc. (CNM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.