Bearish Signals Emerge Despite Strong Gold Performance

Trade Activity Highlights SPDR Gold Trust Sentiment

The SPDR Gold Trust GLD—an exchange-traded fund that mirrors the price of physical gold—has recently captured attention due to unusual options activity noted by Benzinga. Surprisingly, the overall sentiment surrounding this activity was classified as “bearish,” which contrasts with the current trading environment.

More specifically, this issue involved trading 125 contracts of the $193 call option set to expire on January 15, 2027. At the time of writing, the premium for this option was priced at $73.60. This suggests that those buying calls would need the GLD ETF’s price to reach $266.60 (the strike price plus the premium) just to break even.

According to data from the options screener, this bearish sentiment indicates that institutional and professional traders are selling calls, implying they believe the gold fund could struggle to reach profitable levels. This assessment may contradict popular market beliefs.

Year-to-date, the SPDR Gold Trust has seen a remarkable increase of nearly 32% in market value. Over the last five trading sessions, it rose by about 3%, showcasing a steady resilience. Economists like Mohamed El-Erian have emphasized that western countries should not underestimate the significance of gold in uncertain economic times.

However, the pessimistic viewpoint might stem from signs of easing inflation. Many Americans still face high prices compared to pre-pandemic levels, but these potential trends toward disinflation could reduce inflationary fears over time. If this occurs, gold—which typically thrives in inflationary environments—may find itself under pressure.

Direxion ETFs: Opportunities and Risks

There remains a chance that investors misinterpret market signals. Unexpected fluctuations in the precious metals sector could invigorate Direxion’s leveraged gold funds. Specifically, trading activities related to gold can influence sentiment surrounding the mining sector.

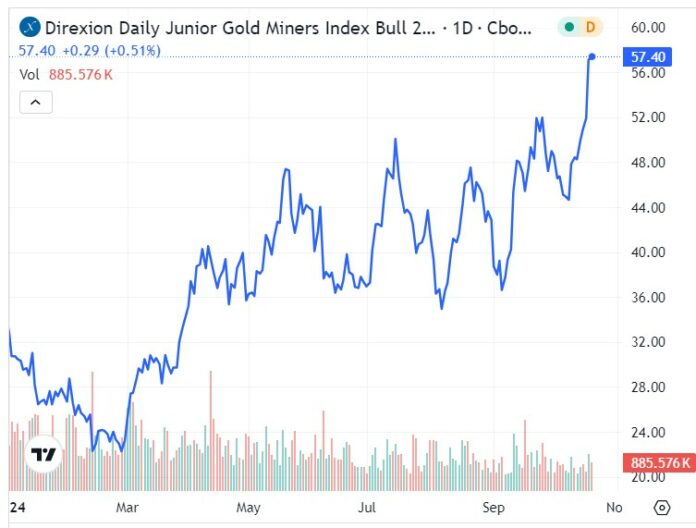

For those optimistic about the gold market, the Direxion Daily Junior Gold Miners Index Bull 2X Shares JNUG aims to achieve daily investment results that reflect 200% of the performance of the MVIS Global Junior Gold Miners Index. Conversely, the Direxion Daily Junior Gold Miners Index Bear 2X Shares JDST seeks to achieve the same 200% outcome but in the opposite direction.

Investors should note that both JNUG and JDST are designed for short-term exposure, ideally no longer than one day. Exceeding this timeframe could lead to performance decay due to the effects of daily compounding volatility.

The JNUG ETF: Riding High on Positive Sentiment

Guided by robust sentiment for gold, the JNUG ETF has thrived this year with an impressive gain of over 75%.

- Notably, the 2X bull fund has received solid backing, illustrated by its position above the 200-day moving average, which can signify strength.

- Furthermore, JNUG recently climbed beyond its 50-day moving average, indicating that the gold market may still have upward potential.

- Despite this, the bearish options activity in the GLD fund is a development requiring close monitoring.

The JDST ETF: Challenges Persist Amidst Adversity

Persistent inflation issues following the COVID-19 pandemic have significantly impacted JDST, which has endured a decline of over 62% in value this year.

- Currently, the gold bear fund is trading below its 200-day moving average, and the 50-day moving average appears to be acting as near-term resistance.

- In the past five sessions, JDST has dropped about 16%. For bearish investors, stabilizing this trend is crucial.

- Encouragingly, selling volume has tapered off since August, potentially signaling an early turnaround.

Featured image by Csaba Nagy from Pixabay.

Market News and Data brought to you by Benzinga APIs