Starboard Value Critiques Pfizer’s Leadership Amid Declining Stock

Investor Frustration Grows Over Pfizer’s Performance

Activist investor Starboard Value has intensified its critique of Pfizer Inc. PFE, holding the pharmaceutical company’s management accountable for not delivering on its promises of innovation and growth.

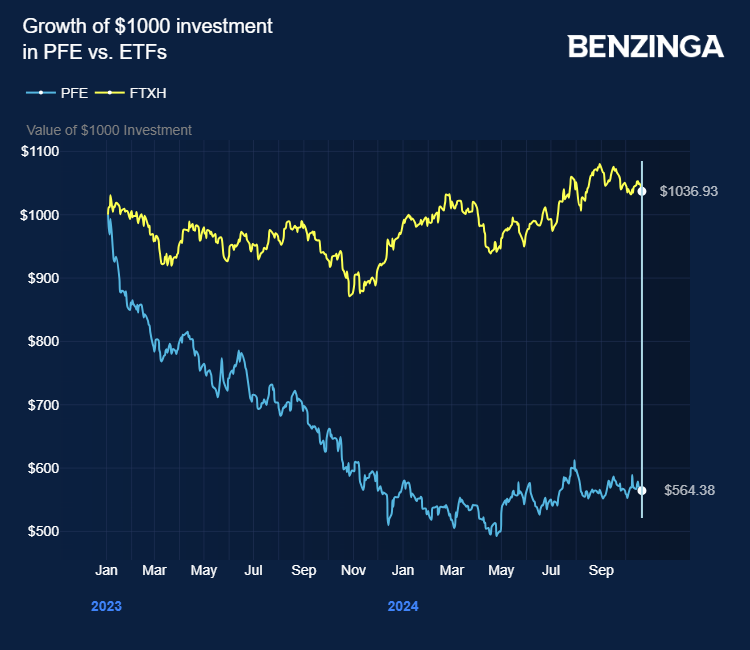

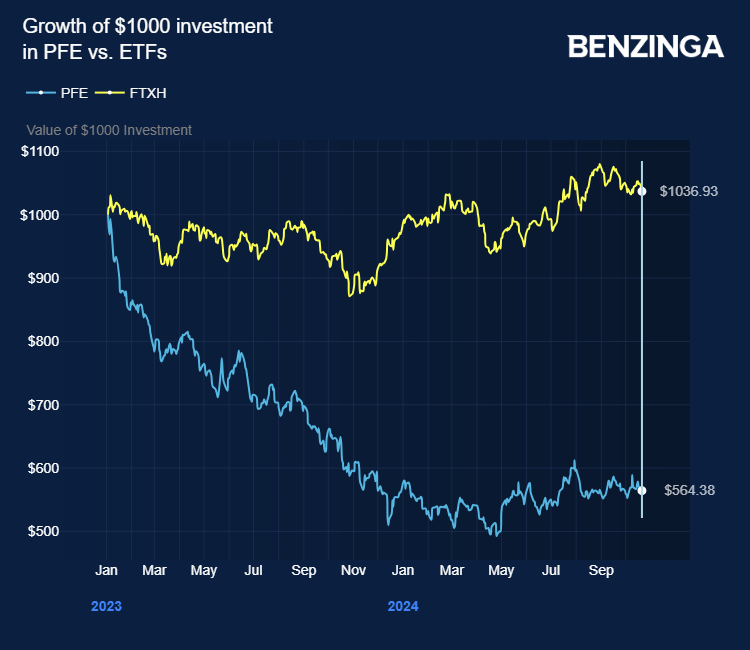

Starboard’s criticism comes in light of a 50% decline in Pfizer’s stock since 2021, despite the firm’s relatively small investment in the company. This reflects widespread dissatisfaction among investors regarding Pfizer’s current performance.

At the Active-Passive Investor Summit, Starboard highlighted that under CEO Albert Bourla, Pfizer has not fully harnessed the momentum gained from the COVID-19 pandemic. They claim this oversight has led to poor performance in research and development (R&D) and mergers and acquisitions (M&A).

Starboard’s presentation notes that since 2019, Pfizer has seen a market value drop of $20 billion, even after gaining $40 billion from its COVID-19-related products.

The investor expressed concerns that Pfizer’s high debt levels could hinder future acquisitions, limiting the company’s growth potential.

Starboard also emphasized Pfizer’s failure to meet bold goals set by Bourla, including developing 15 potential blockbuster drugs by 2022, a target declared when he took over as CEO in 2019.

A key element of Starboard’s critique is Pfizer’s strategy of external investment. The company has spent nearly $70 billion on M&A since 2022, including a significant $43 billion deal for Seagen, yet the returns on these investments have been disappointing.

The investor highlighted that Pfizer has used most of its cash gains from COVID-19 for these acquisitions over the last five years.

In September, Pfizer made the decision to withdraw Oxbryta (voxelotor), a medication for sickle cell disease that was part of the $5.4 billion acquisition of Global Blood Therapeutics in 2022.

Starboard asserts that Pfizer overpaid for its acquisitions post-COVID, pointing out that analysts predict sales from these deals will be $7 billion lower than Pfizer’s own goal of $20.5 billion by 2030.

Challenges persist for Pfizer’s internal innovation efforts as well, particularly with their GLP-1 program, danuglipron. Starboard’s analysis shows a sharp decline in projected sales for danuglipron by 2030, now expected to be just $592 million instead of the earlier forecast of $1.73 billion made by Wall Street in March 2023.

The firm claims Pfizer’s anticipated return on its R&D and M&A investments is merely 15% from 2023 to 2030, significantly lower than the industry median of 38%.

Starboard believes Pfizer will need an additional $29 billion in revenue by 2030 to align with industry standards. They note, “We believe it is unlikely that Pfizer will be able to achieve $79 billion in revenue by 2030; thus, making Pfizer’s return on R&D and M&A insufficient.”

They further asserted, “The board needs to actively hold management accountable for earning appropriate returns on R&D and M&A moving forward. Pfizer deserves to be best in class.”

Price Action: PFE stock declined by 0.12% to $28.90 during Tuesday’s trading.

Read Next:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs