Albany International Faces Troubling Times as Earnings Estimates Decline

Albany International (AIN) is a prominent advanced textiles and materials processing company. It serves the paper and aerospace industries, operating through two divisions: Machine Clothing and Albany Engineered Composites. The Machine Clothing segment specializes in custom-designed fabrics for paper production, while Albany Engineered Composites provides advanced materials for aerospace applications, including both commercial and defense sectors.

Based in Rochester, New Hampshire, Albany International has a presence in North America, Europe, and Asia, and the company is recognized for its innovations in material technology and manufacturing.

Recently, Albany International’s stock performance has been concerning, with earnings growth stagnant over the past five years. The stock recently dipped below a significant support level, leading to negative market sentiment. Analysts have responded by downgrading the stock to a Zacks Rank #5 (Strong Sell). Given these circumstances, investing in AIN may not be advisable at this time.

Image Source: Zacks Investment Research

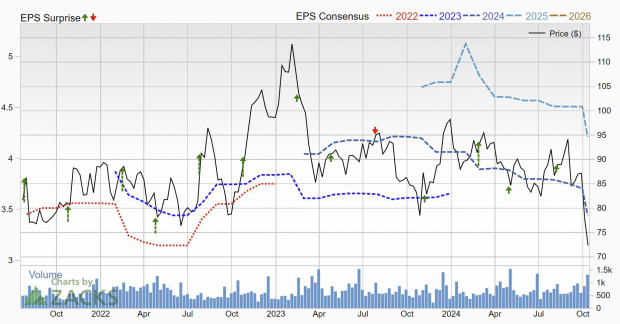

Earnings Estimates Show Significant Declines

In the past two months, earnings estimates for Albany International have been revised sharply downward. Current quarter estimates have dropped by 34%, while those for FY24 have decreased by 8.2% and by 6.7% for FY25.

The forecast indicates a 39% year-over-year decline in earnings for the current quarter, with a 15% drop anticipated for the whole year. However, analysts predict a recovery, expecting earnings to grow by 22.3% in FY25. Sales forecasts remain positive, with a projected growth of 7.7% this year and 7.8% next year.

Image Source: Zacks Investment Research

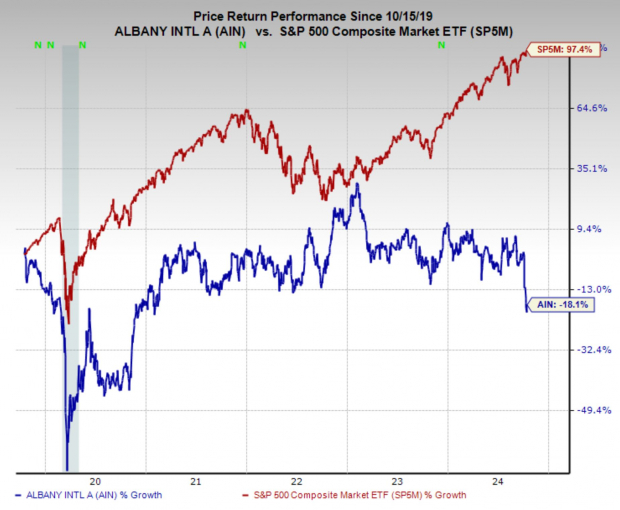

Technical Analysis Reveals Weakness in AIN Stock

The stock chart depicts a concerning trend; after nearly four years of stagnation, Albany International’s stock price has fallen below a crucial support level. This indicates ongoing weakness, and recent downgrades from analysts are likely contributing to added selling pressure.

Until Albany International can demonstrate tangible upward momentum, experts anticipate further declines as the stock approaches a more attractive valuation.

Image Source: TradingView

Is AIN Stock a Poor Choice for Investors?

Albany International finds itself grappling with significant obstacles that have lowered its rating to “Strong Sell.” Despite predictions of revenue growth this year and next, the sharp declines in earnings have created valid concerns among investors.

Furthermore, the recent deterioration in stock performance reflects a generally bearish market sentiment. Until evidence emerges of a consistent recovery in earnings growth and general market improvement, it may be wise for investors to steer clear of Albany International’s stock.

Potential Infrastructure Stock Surge in the U.S.

A considerable effort to enhance aging U.S. infrastructure is on the horizon, which is both bipartisan and urgent. Trillions of dollars will be allocated, creating opportunities for significant financial gains.

The key question remains: “Will you invest in the right stocks early, as their growth potential peaks?”

Zacks has released a Special Report to guide investors in this endeavor, and it is available for free. Explore five companies poised to benefit the most from the upcoming construction and repair projects across roads, bridges, buildings, and energy transformation.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Interested in the latest stock recommendations from Zacks Investment Research? You can download 5 Stocks Set to Double for free. Access the report here: Albany International Corporation (AIN): Free Stock Analysis Report.

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.