Stryker Corporation Gears Up for Earnings Report with Strong Profit Expectations

Stryker Corporation (SYK), a prominent player in the medical technology sector based in Portage, Michigan, holds a market capitalization of $140.8 billion. The company offers a diverse array of products, including implants, surgical equipment, biologics, digital imaging systems, and emergency medical devices. All these innovations aim at improving both patient care and healthcare outcomes. Investors are anticipating the fiscal third-quarter earnings announcement for 2024, scheduled for after the market closes on Tuesday, October 29.

Positive Earnings Forecast Ahead of Earnings Announcement

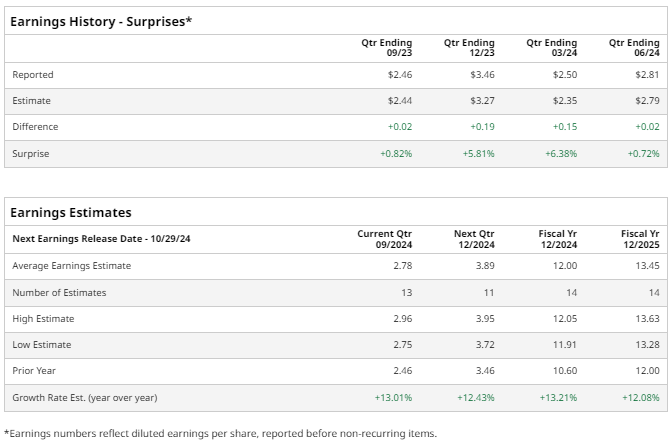

Analysts project that Stryker will report earnings of $2.78 per share on a diluted basis, marking a 13% increase from $2.46 per share reported in the same quarter last year. Notably, Stryker has a solid track record, having consistently beaten Wall Street’s earnings-per-share (EPS) estimates in its last four quarterly reports.

Year-End Earnings Predictions Strengthen Investor Confidence

For the full fiscal year, expectations remain high, with forecasts indicating an EPS of $12—a rise of 13.2% compared to $10.60 in fiscal 2023.

Stryker Performance Compared to Major Indices

Year-to-date, SYK shares have recorded a 22.6% increase, slightly trailing the S&P 500’s (SPX) impressive 22.7% gain. In contrast, Stryker has outperformed the Healthcare Select Sector SPDR Fund (XLV), which posted only 11% returns in the same period.

Strategic Acquisition and Market Reactions

On September 17, Stryker’s stock fell by 2.2% following its announcement to acquire care.ai, a company that specializes in AI-assisted virtual care workflows and smart room technology. Despite the initial drop, Stryker’s stock has shown impressive growth throughout the year, signaling strong confidence from investors.

This acquisition is seen as a strategic move to enhance Stryker’s product offerings and expand its market reach, potentially benefiting its stock performance in the future.

Analyst Ratings and Price Targets Indicate Confidence in SYK

Analysts are generally optimistic about SYK, giving it a “Moderate Buy” rating overall. Out of the 28 analysts covering the stock, 18 recommend a “Strong Buy,” two advocate for a “Moderate Buy,” and eight suggest a “Hold.”

The average price target set by analysts for SYK stands at $382.88, implying a potential upside of 4.3% from current market prices.

More Stock Market News from Barchart

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.