Sun Life Financial Shows Strong Momentum, But Valuation Raises Concerns

Shares of Sun Life Financial Inc. (SLF) closed at $57.44 on Monday, just shy of its 52-week high of $58.51. This close proximity indicates robust investor confidence and suggests potential for further price growth. Currently, the stock trades above both the 50-day and 200-day simple moving averages (SMA) of $54.61 and $52.24, respectively. These indicators are often used in technical analysis to forecast future price movements based on historical data.

Over the past five years, earnings for the life insurer have grown by 5.4%, outpacing the industry average of 4.6%. Notably, SLF has a commendable surprise history, having exceeded earnings estimates in three of the last four quarters and missing once, with an average surprise of 1.76%.

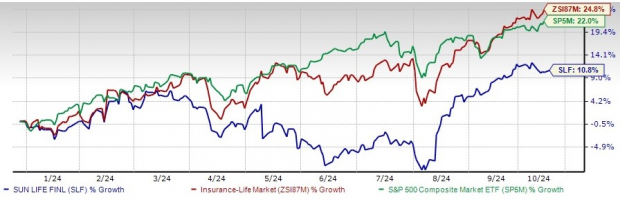

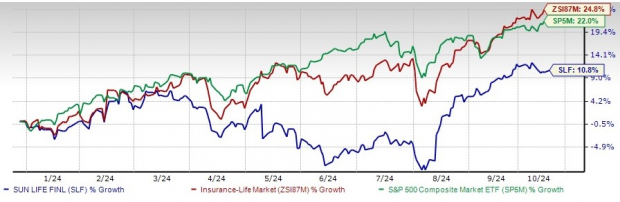

Year-to-date, SLF shares have risen by 10.8%, compared to the industry’s growth of 24.8% and the Zacks S&P 500 composite return of 22%.

Year-to-Date Performance

Image Source: Zacks Investment Research

Analysts Have Mixed Views on SLF

Among the six analysts covering SLF, three have increased their earnings estimates for 2024 and four have done so for 2025 over the last 60 days. However, two analysts have reduced estimates for 2024 and another has lowered the 2025 projections.

In the same period, the Zacks Consensus Estimate for 2024 and 2025 earnings has increased by 1.2% and 1.5%, respectively, signaling a degree of optimism from analysts.

The 2024 estimate suggests a year-over-year growth of 3.6%.

Strong Return on Capital

Sun Life boasts a return on equity of 17.4% over the trailing 12 months, exceeding the industry average of 15.5%. This highlights the company’s effectiveness in using shareholders’ funds.

Additionally, its return on invested capital (ROIC) has been on the rise as capital investments have increased, indicating the firm’s ability to efficiently generate income. The 12-month ROIC stands at 0.7%, again above the industry average of 0.6%.

Growth Factors Supporting SLF

Sun Life’s strategic focus on rapidly emerging Asian economies positions it well for future growth. The company has established a significant presence in China, the Philippines, India, Hong Kong, and Indonesia, while also expanding into Malaysia and Vietnam. Contributions from its Asia operations have climbed to 21% of overall earnings in recent years.

As Canada’s third-largest insurer, Sun Life is aiming to become one of the top five players in the industry, particularly by enhancing its voluntary benefits business. The company is also refining its business mix by shifting toward offerings that require less capital but provide steadier earnings.

Moreover, Sun Life Investment Management focuses on investing in private fixed-income mortgages and real estate, as well as institutional investors’ pension plans. These initiatives reflect SLF’s aim to bolster its Asset Management sector, which typically offers higher returns on equity, requires less capital, and experiences lower volatility.

Operational efficiency has played a key role in Sun Life’s robust capital position, which includes a planned dividend payout of 40-50% over the medium term.

Valuation Concerns

Currently, SLF’s stock appears overvalued relative to its peers, trading at a price-to-earnings multiple of 10.9, higher than the industry average of 8.7.

Other insurance companies, including Reinsurance Group of America, Incorporated (RGA), Primerica, Inc. (PRI), and Manulife Financial Corp (MFC), also trade at multiples exceeding the industry mean.

Final Thoughts

In conclusion, Sun Life’s positive growth projections, strategic focus on Asia, solid financial health, and strong return on capital position it as an attractive hold for current investors.

The company has a VGM Score of B, indicating a favorable assessment compared to its peers in terms of value, growth, and momentum. Coupled with its expanding asset management operations and the integration of U.S. efforts, this Zacks Rank #2 (Buy) insurer seems poised for potential investor interest. A complete list of today’s Zacks #1 Rank (Strong Buy) stocks can be accessed here.

Massive Infrastructure Investments Loom

A significant initiative to rebuild the aging U.S. infrastructure is set to commence soon. This movement has garnered bipartisan support and is seen as urgent and inevitable. With trillions at stake, substantial profits await savvy investors.

The question remains: will you position yourself in the most promising stocks at the onset of this growth potential?

Zacks has put together a Special Report to guide investors through this opportunity. Discover five companies poised to benefit the most from the massive infrastructure spending in the coming years. Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

For the latest recommendations from Zacks Investment Research, you can download “5 Stocks Set to Double.” Click to access this free report.

Manulife Financial Corp (MFC): Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA): Free Stock Analysis Report

Primerica, Inc. (PRI): Free Stock Analysis Report

Sun Life Financial Inc. (SLF): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.