Susquehanna Adjusts Enphase Energy Outlook Amid Shifts in Fund Ownership

Latest Downgrade Signals Caution for Investors

Fintel reports that on October 16, 2024, Susquehanna downgraded their outlook for Enphase Energy (WBAG:ENPH) from Positive to Neutral.

Trends in Fund Sentiment

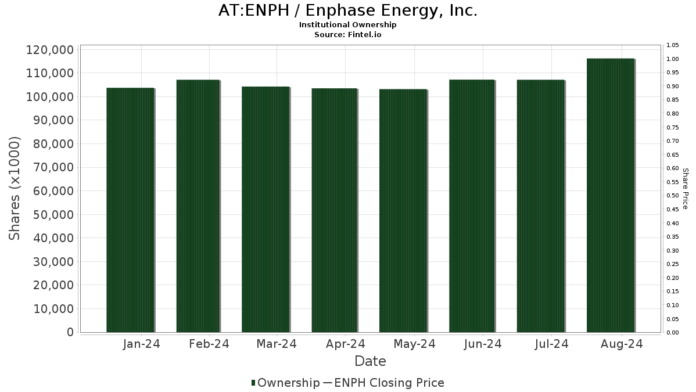

Currently, 1,415 funds or institutions report holding positions in Enphase Energy, representing a decline of 12 owners or 0.84% in the previous quarter. The average portfolio weight allocated to ENPH stands at 0.23%, a rise of 6.17%. Notably, total shares owned by institutions increased by 11.62% over the last three months, totaling 117,697K shares.

Institutional Ownership Changes

Baillie Gifford currently holds 6,285K shares, equating to 4.64% ownership of Enphase Energy. This reflects an increase of 36.66% from their prior holding of 3,981K shares; however, they have reduced their portfolio allocation in ENPH by 49.28% in the last quarter.

VTSMX, Vanguard Total Stock Market Index Fund Investor Shares, owns 4,077K shares, representing 3.01% of the company. This is a slight increase of 0.86% from the previous report of 4,042K shares, though their portfolio allocation in ENPH has decreased by 19.16% over the last quarter.

VFINX, Vanguard 500 Index Fund Investor Shares, holds 3,492K shares, about 2.58% ownership. This reflects a 2.07% rise from their prior holding of 3,420K shares. Similarly, they reduced their portfolio allocation in ENPH by 20.33% last quarter.

Swedbank AB maintains 3,463K shares, or 2.56% of Enphase Energy, marking a 0.34% increase from their earlier holding of 3,452K shares. Their portfolio allocation in ENPH has decreased by 38.48% in the last quarter.

Wellington Management Group LLP owns 3,375K shares, which accounts for 2.49% of the company. Their holdings rose by 39.82% from 2,031K shares; however, they have cut their portfolio allocation in ENPH by 80.55% over the previous quarter.

Fintel is recognized as a leading investment research platform for individual investors, traders, financial advisors, and small hedge funds.

Our extensive data collection includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, and unusual options trades, among other resources. Additionally, our stock picks benefit from advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.