Economy

Top Two Heating and Air Conditioning Stocks to Monitor Amidst Market Challenges

The Zacks Building Products – Air Conditioner & Heating industry, currently ranked #223 out of over 250 industries, faces challenges from housing market softness, ...

Market Correction Driven by Declining Valuations Rather Than Earnings

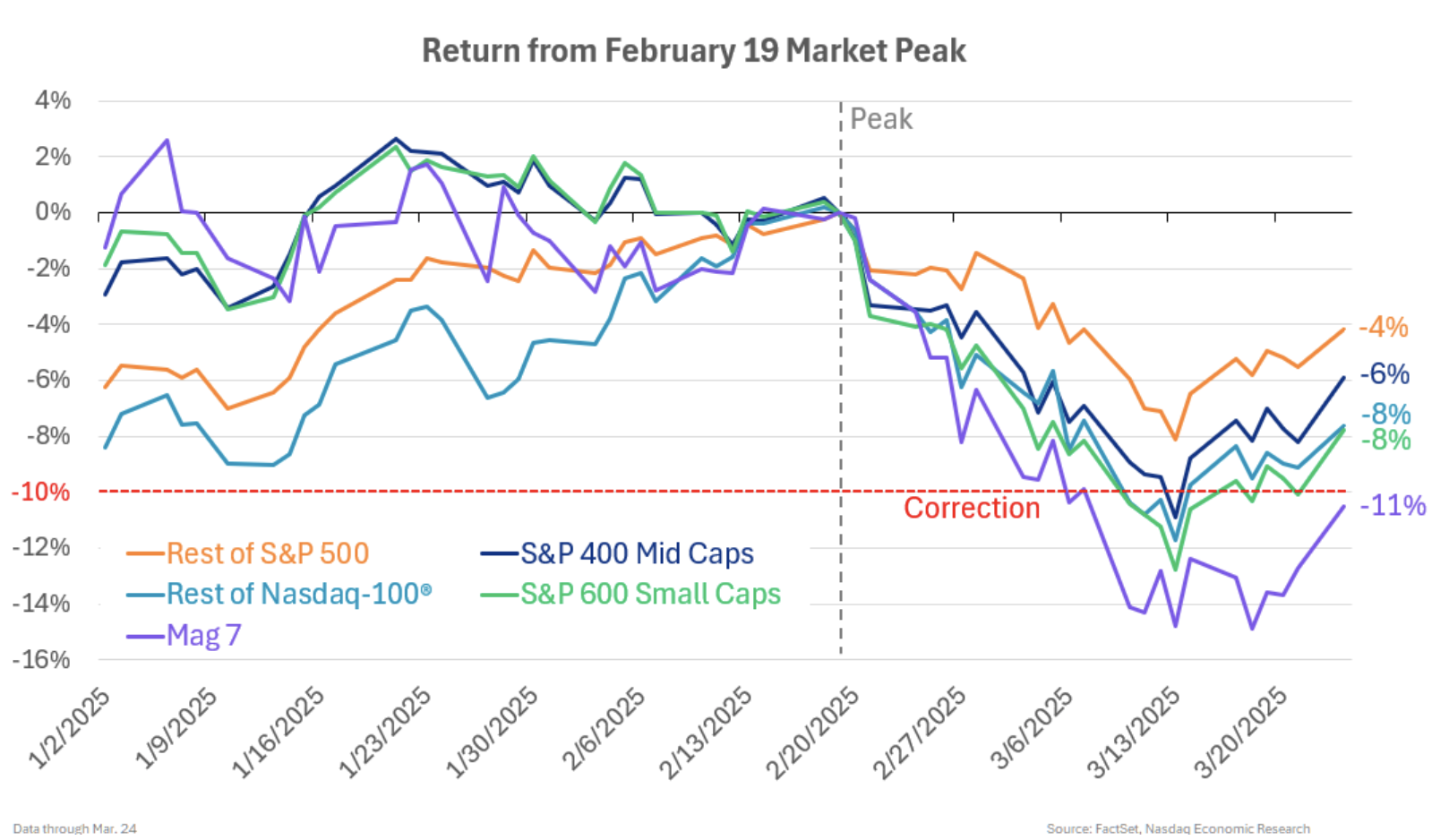

Market Selloff Drives Mag 7 Down Amidst Earnings Resilience Mag 7 Led Selloff in Q1 as All Caps Indexes Enter Correction Last week, we ...

Nasdaq Q4 Earnings Forecast: What to Expect

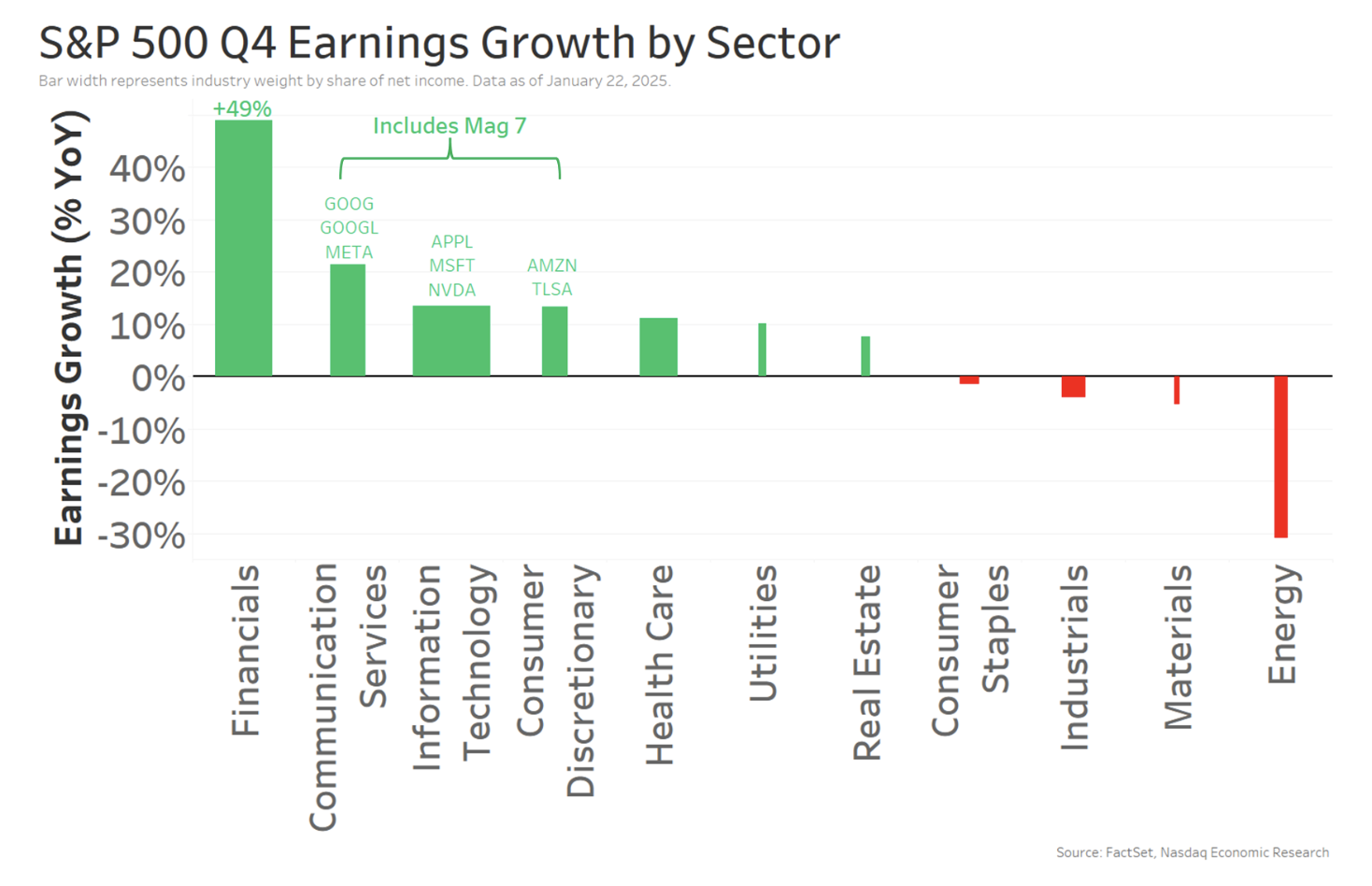

Financial Sector Leads Q4 Earnings Surge for S&P 500 Strong Start for Q4 Earnings Season The Q4 earnings season began last week, highlighted by ...

“Navigating the 2024 Goldilocks Economy: Opportunities and Insights”

2024: A Year of Economic Recovery and Steady Growth As we approach the end of 2024, economies—especially in the US—are displaying a strong recovery. ...

“Q3 Earnings Fueled by the Magnificent Seven”

The Mag 7 Dominates Q3 Earnings Once Again The unofficial close of Q3 earnings season featured the last report from a Mag 7 company, ...

Hiring Plans Diverging for Big & Small Companies

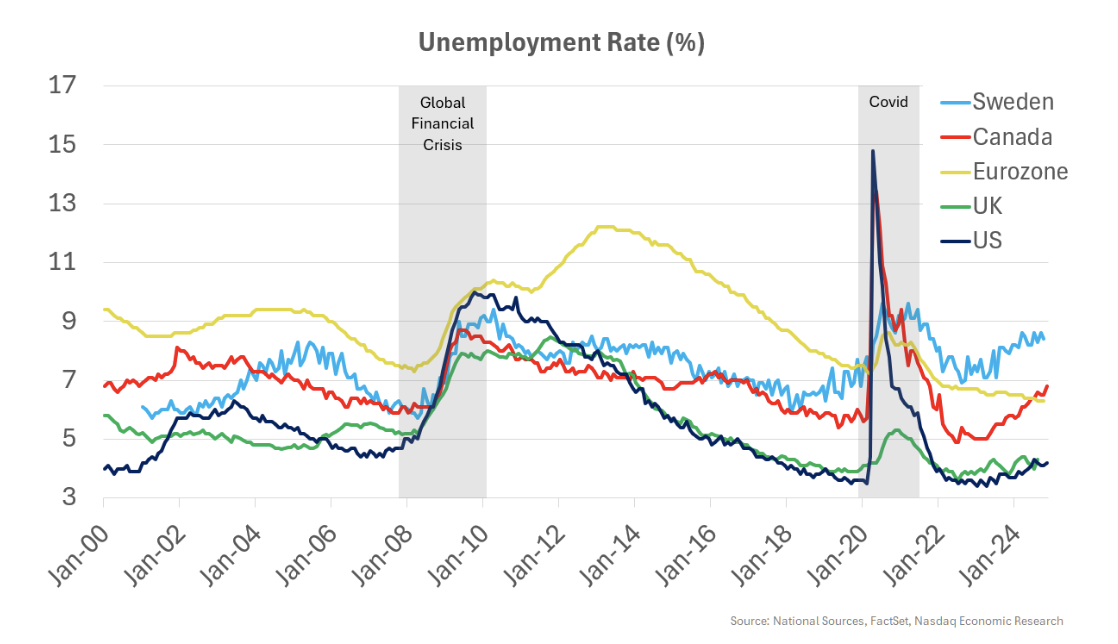

Layoffs lower than their entire pre-Covid history We got data showing that initial claims for unemployment insurance dipped, and they’ve been hovering in the same ...

Covid Distortions Still Impacting Inflation

Inflation has risen from 3.1% YoY to 3.5% this year It’s been a tough start to the year for inflation. Headline CPI inflation was ...

‘Fab Five’ Makes Q1 Earnings Top Heavy

Large cap earnings growth stays positive in Q1 We’re in the thick of Q1 earnings season, with 45% of S&P 500 firms having reported. ...

Striking Disparity in Earnings Performance: Big vs Small Caps

A Glimpse Into Earnings Season Trends As the curtain nears on Q4 earnings season, a tale of two sectors unfolds. With 95% of S&P ...

Market Reacts to CPI Data | Nasdaq

Investor Panic Grips Market as CPI Data Drives Selloff

Market Meltdown Wednesday’s CPI report triggered a market selloff, particularly hitting small caps. Both the Nasdaq-100 ETF and Nasdaq Mid-Caps ETF fell nearly 2% ...