Stocks

Genpact Limited Quarterly Earnings Report

Genpact Limited Exceeds Q4 Earnings Projections, Sees Year-Over-Year Growth

Genpact Limited, a global professional services firm, announced its fourth-quarter 2023 financial results, surpassing market expectations and exhibiting growth. Strong Financial Performance Genpact reported ...

MGM Resorts Anticipated Q4 Earnings Review

MGM Resorts Anticipated Q4 Earnings Review

MGM Resorts International MGM is set to announce fourth-quarter 2023 results on Feb 13, 2024, following the closing bell. The company had previously reported ...

Sunoco: On the Brink of Q4 Earnings

Sunoco: On the Brink of Q4 Earnings

Sunoco LP is anticipated to unveil its much-awaited fourth-quarter 2023 earnings on Feb 14, in the early hours of the trading day. In the ...

Flowers Foods (FLO) Q4 Earnings Match Estimates, Sales Up Y/Y

Flowers Foods: Weathering the Storm with Mild Success

Flowers Foods, Inc. FLO has revealed its fourth-quarter fiscal 2023 results, indicating that while the bottom line aligned with the Zacks Consensus Estimate, it ...

Crocs Anticipates Strong Q4 Earnings: A Detailed Preview

Crocs Anticipates Strong Q4 Earnings: A Detailed Preview

Crocs, Inc. CROX is set to release fourth-quarter 2023 results on Feb 15, before the market opens. Analysts foresee a 1.4% year-over-year revenue growth, ...

The Ongoing Radiance of Nextracker (NXT)

The Solar Power Innovator In the universe of solar power, Nextracker Inc (NXT) stands out like a bright star. By specializing in solar tracking ...

The Dark Clouds Shadowing Archer Daniels Midland (ADM)

Company Overview

Archer Daniels Midland (ADM) is a global food processing and commodities trading company that operates in various segments such as agriculture, nutrition, and transportation. The company is involved in sourcing, processing, and distributing agricultural products, including grains, oilseeds, and other raw materials. ADM’s diverse business encompasses food ingredients, animal feeds, biofuels, and industrial products.

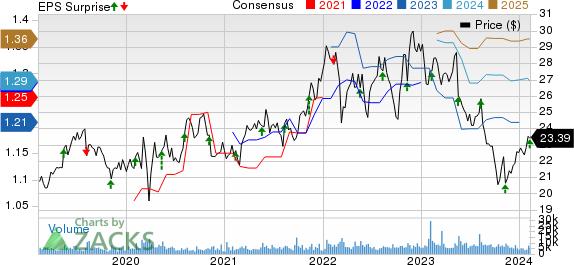

Accounting Investigation is a Potential Red Flag

On January 22nd, shares of Archer Daniels Midland cratered nearly 25% after news broke that the US Attorney’s Office in Manhattan had launched an investigation into the accounting practices at ADM’s nutrition segment.

Image Source: TradingView

The CFO of the company has already been placed on leave and has preemptively lowered earnings guidance. Though the investigation is ongoing, the CFO leave news doesn’t pass the smell test. Furthermore, investors must ask themselves, “With thousands of stocks to invest in, why should I invest in a company under investigation for its accounting practices?”

Are Americans Waking up to the Dangers of Seed Oils?

Seed oils, such as soybean oil, corn oil, and sunflower oil, have been criticized for several reasons regarding their adverse impact on health. These seed oils have an imbalance between omega-6 and omega-3 fatty acids that can contribute to inflammation. Inflammation is linked to various chronic diseases, including heart disease, diabetes, and certain inflammatory conditions. Furthermore, the plant-based protein (or meat alternative) craze appears to be nearing its end. ADM has seen persistently lower demand for its plant-based products. Beyond Meat (BYND), a pure play on the plant-based industry, is down by more than 64%, proving that this macro industry downtrend may have legs and may never recover.

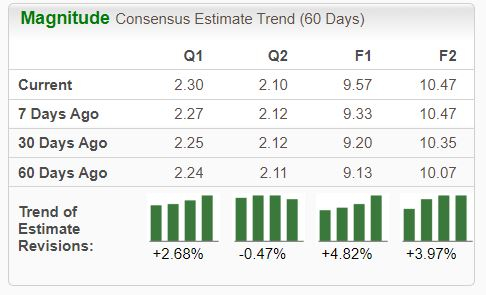

Sales and EPS Growth Rates are Expected to Slow

Competition is heating up in several of ADM’s main segments from companies like Swiss-based Bunge Global (BG) and Cargill. As a result, Zacks Consensus Estimates suggest that ADM will suffer negative earnings and sales growth in 2024.

Image Source: Zacks Investment Research

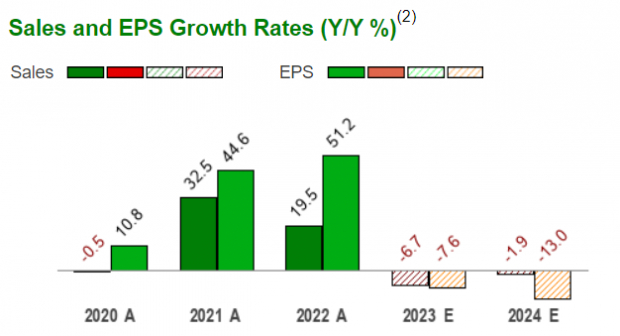

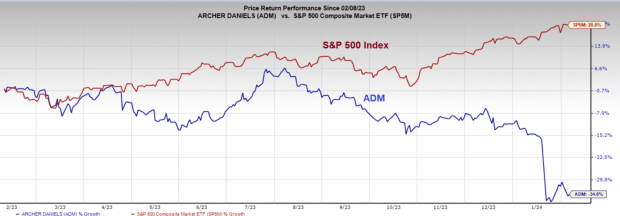

Chronic Relative Underperformance

On Wall Street, the only scoreboard that counts is price performance. Beyond ADM’s many fundamental issues, the company does not perform much better from this perspective. Over the past year, shares have lagged the S&P 500 Index’s 20.8% gain and lost 34.6%.

Image Source: Zacks Investment Research

For investors, few feelings are worse than investing in a chronically underperforming stock. Until ADM exhibits some semblance of a trend reversal, investors should avoid shares.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Company Overview

Archer Daniels Midland (ADM) is a global food processing and commodities trading company that operates in various segments such as agriculture, nutrition, and transportation. The company is involved in sourcing, processing, and distributing agricultural products, including grains, oilseeds, and other raw materials. ADM’s diverse business encompasses food ingredients, animal feeds, biofuels, and industrial products.

Accounting Investigation is a Potential Red Flag

On January 22nd, shares of Archer Daniels Midland cratered nearly 25% after news broke that the US Attorney’s Office in Manhattan had launched an investigation into the accounting practices at ADM’s nutrition segment.

Image Source: TradingView

The CFO of the company has already been placed on leave and has preemptively lowered earnings guidance. Though the investigation is ongoing, the CFO leave news doesn’t pass the smell test. Furthermore, investors must ask themselves, “With thousands of stocks to invest in, why should I invest in a company under investigation for its accounting practices?”

Are Americans Waking up to the Dangers of Seed Oils?

Seed oils, such as soybean oil, corn oil, and sunflower oil, have been criticized for several reasons regarding their adverse impact on health. These seed oils have an imbalance between omega-6 and omega-3 fatty acids that can contribute to inflammation. Inflammation is linked to various chronic diseases, including heart disease, diabetes, and certain inflammatory conditions. Furthermore, the plant-based protein (or meat alternative) craze appears to be nearing its end. ADM has seen persistently lower demand for its plant-based products. Beyond Meat (BYND), a pure play on the plant-based industry, is down by more than 64%, proving that this macro industry downtrend may have legs and may never recover.

Sales and EPS Growth Rates are Expected to Slow

Competition is heating up in several of ADM’s main segments from companies like Swiss-based Bunge Global (BG) and Cargill. As a result, Zacks Consensus Estimates suggest that ADM will suffer negative earnings and sales growth in 2024.

Image Source: Zacks Investment Research

Chronic Relative Underperformance

On Wall Street, the only scoreboard that counts is price performance. Beyond ADM’s many fundamental issues, the company does not perform much better from this perspective. Over the past year, shares have lagged the S&P 500 Index’s 20.8% gain and lost 34.6%.

Image Source: Zacks Investment Research

For investors, few feelings are worse than investing in a chronically underperforming stock. Until ADM exhibits some semblance of a trend reversal, investors should avoid shares.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2023. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Expedia’s Soaring Stock

Expedia’s Stock Shows Remarkable Growth – Is It Sustainable?

Expedia (NASDAQ: EXPE), the renowned travel company offering travel services from airlines, hotels, and car rentals to cruises, is about to unveil its financial ...

Investing in Tech? Buy These Three Stocks Now

Investing in Tech? Buy These Three Stocks Now

It’s no secret that technology stocks are darling assets for investors, offering rapid growth and market momentum. However, many shy away due to the ...

The Semiconductor Market Rebound: Navigating the Complexities

Roadblocks and Optimism for 2024 This year is predicted to bring a much-needed upturn for the semiconductor industry, following a period of dwindling inventories ...