TSMC Expands Into Europe Amid Growing AI Chip Demand

Semiconductor leader Taiwan Semiconductor Manufacturing Company (TSMC) is gearing up to increase its presence in Europe. Wu Cheng-wen, the Minister of Taiwan’s National Science and Technology Council, announced plans for new chip manufacturing plants in the region. This announcement follows last month’s reveal of TSMC’s intention to build its first chip plant in Europe, targeting the rising demand for artificial intelligence (AI) chips.

Currently, TSMC is in the process of constructing its first fabrication plant in Dresden, Germany, with an investment totaling €10 billion.

Reasons Behind TSMC’s European Move

This expansion is largely influenced by geopolitical concerns. By enhancing its European operations, TSMC aims to mitigate risks from increasing tensions between the U.S. and China, alongside the ongoing challenges between Taiwan and China. Broadening its geographical footprint will help TSMC create a more robust and diverse supply chain, reducing dependence on any single region.

The surge in demand for AI chips is another critical factor driving this expansion. Major U.S. tech companies like NVIDIA (NVDA) and AMD (AMD) heavily rely on TSMC’s advanced production capabilities to manufacture the powerful chips that fuel AI applications. This reliance further solidifies TSMC’s position as a leader in the industry.

Upcoming Q3 Earnings Report

TSMC’s plans for European expansion accompany the anticipation of its Q3 earnings report, which is due to be released on October 17. According to Reuters, analysts expect TSMC to report a 40% increase in Q3 profit, reaching NT$298.2 billion.

In a notable performance, TSMC reported revenue of NT$251.87 billion for September, reflecting a 39% growth compared to the previous year, driven by strong demand for chips.

Investors Weigh Options for TSM

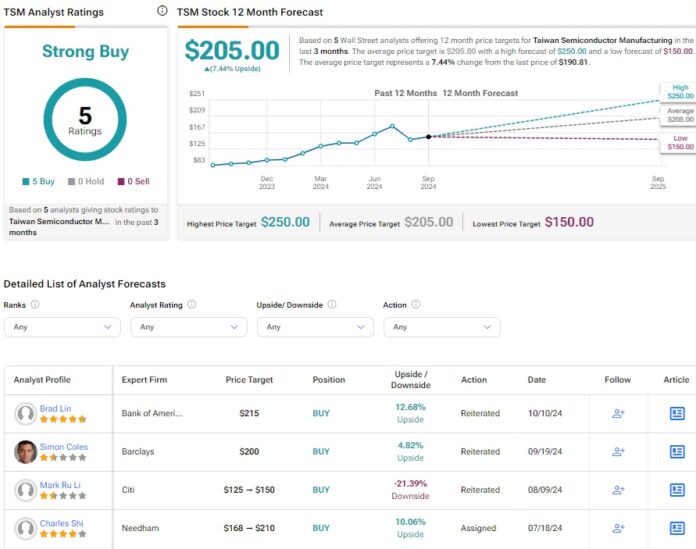

On Wall Street, TSMC boasts a Strong Buy consensus rating, with five Buy recommendations issued in the last three months. The average price target for TSMC shares is $205, suggesting a potential upside of 7.44%. Remarkably, TSMC’s stock has risen over 85% since the start of the year.

See more TSM analyst ratings

Disclosure

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.